‘Policy To Shift More Land Tax To Working Class’

[Updated] The OBA are “planning to increase the burden on land tax on Bermuda’s working class while at the same time reducing the burden of land tax for Bermuda’s wealthy,” according to an email sent out by the PLP.

The emails appear to have been sent out to constituents and said, “Minister Bob Richards and the One Bermuda Alliance are planning to increase the burden on land tax on Bermuda’s working class while at the same time reducing the burden of land tax for Bermuda’s wealthy.

“Under the new Land Tax Act that has been proposed by the OBA, Minster Richards will see his land tax bill reduced by 21% while your friends and family on Cedar Hill will see their land tax double!

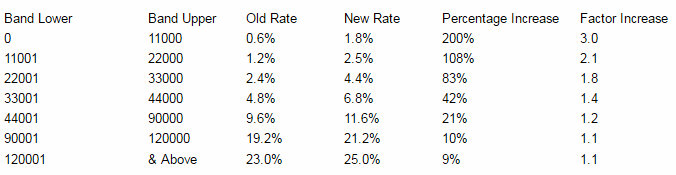

Chart provided:

“When Minister Richards announced the changes to Land Tax he said that, “the rate increases are both equitable and fair”. We do not believe that it is ‘equitable and fair’ for the OBA to raise land tax on the working class, while wealthy homeowners will pay less land tax than they did before.

“Many Bermudians have seen years of wage freezes while taxes, health insurance, and the cost of living continue to rise. We in the PLP think it is wrong for OBA to shift the burden of taxes from the wealthy to the working class.

“If you agree with us that it is wrong for the OBA to raise land taxes on Bermudians who can least afford it, contact your OBA MP Wayne Scott and tell him to vote no on raising land taxes on his working class constituents while the wealthy receive a tax cut.”

The emails were signed by Shadow Minister of Finance David Burt, and so we asked him for comment and he said, “It is our job as the Opposition to hold the Government accountable for their actions.

“The proposed changes to Land Tax will see taxes paid by working class homeowners in many cases double, while those with large houses will see their land tax bills decrease.

“When Minister Richards announced the changes to Land Tax he said that, ‘the rate increases are both equitable and fair’. We do not believe that it is ‘equitable and fair’ for the OBA to raise land tax on the working class, while wealthy homeowners will pay less land tax than they did before.

“As an example, Minister Richard’s ARV has fallen by 18% and his land tax bill will decrease by 21%. However, a resident of Cedar Park Road whose ARV has fallen by 14% will see their land tax bill skyrocket by 99%.

“Many Bermudians have seen years of wage freezes while taxes, health insurance, and the cost of living continue to rise. We in the PLP think it is wrong for OBA to shift the burden of land taxes from the wealthy to the working class.

“We will oppose this bill in Parliament tomorrow and we hope that MPs Bascome, Outerbridge, Roberts-Holshouser, Smith and Scott who have many working class constituents will join with us and vote against this tax increase on their working class constituents,” concluded Mr Burt.

Update 8.26am: We asked the Finance Ministry for a response to this yesterday, and in their response this morning they did not confirm or deny what Mr Burt said, but did say “this is the subject of today’s debate.”

However, unofficial reports suggest that today in the House the Government may bring some form of an amendment which would not see lower priced properties have a higher increase than higher priced properties. What exactly that could be remains to be seen, however the Minister is expected to speak on the land tax policies later today and, as the Ministry noted, debate it – so we will update as able.

Fuzzy mäth for sure!

My Land Tax more than doubled. Can we get these OBA people out of office please! They take care of themselves while regular Bermudians struggle!

The ARV’s are going to be corrected which significantly reduces the increase this produces.

what are you paying in real numbers? Won’t be anything like those in the upper brackets!

But they can afford to pay more!

You’re blaming the wrong party. If the PLP hadn’t racked up so much debt while they were in office these tax hikes wouldn’t be necessary. How else are we going to afford to pay for both the interest on our debt and the civil service? And high value home land tax has gone up significantly under the OBA too so this isn’t just a working class issue. The OBA are just trying to dig us out of a PLP mess to save Bermuda from defaulting on our debt and becoming a third world country… We all have the PLP, and in particular the very smart, very charismatic, but very self-serving Ewart Brown, for the rocky times both now and ahead.

I do not know but I think this finance minister is a joker he keeps giving concessions and breaks and backs loans getting nothing for the people really, and screws the poor on top no mention that he has racked up as much debt in two years as the PLP in 14 I am afraid he is piggy backing on their bad rap. and should they be voted out we will really be in hell. I believe stopping all capital projects until some miracle happens borrowing to give the illusion we are going places is nothing more than a farce! did I not hear yesterday news that, Cuba signed 17 hotel deals in one day? good thing I treat all expatriates with respect don’t know when you might have to call for a hand out.

hey if the arv is going down that means that a great deal of more properties will now fall under rent control? The courts are going to have a field day with landlords that fail to register prior to a tenant questioning the amount charged witch will be almost always well above the arv.

oh and with a lower arv the homes expats can buy decreases?

What was it before and what is it now?

Wow so now you pay 2.5% while others pay 25% and you think that is fair?

And working class Bermudians voted for these Dreamers.

LMFAO

Assuming no ARV change, the lower band would pay $130 per year more.

ARVs have reduced, so this would be lower than $130 per year

The people voted for jobs, not tax increases or immigration reform.

Go look at the jobs board , tonnes of them there.

PLP…making maths work for them again!

Look, one can not control the drop in ARV value. Trying to spin this as an OBA bill against the people is pathetic.

We’re where we are because of the PLP. Let’s remember that.

Here is how to do the percentage change on each of the numbers, try it and see what you get.

http://m.wikihow.com/Calculate-Percentage-Increase

sorry s/b 120,001 for the upper band

Imagine that, OBA taking care of their own.

We should have stayed out until the OBA wad dethroned

Can / could you afford to “stay out”?

What he means is “stay out until the sick pay runs out”.

And your alternative would have been?

why? So you could have a bunch of financially clueless lawyers look after financial operations !!! That worked out well didn’t it… They spent for votes, not for one moment thinking…hey maybe we should keeping funds for times when the boom is over and the bust begins.

Get ready u’lot for more strikes etc. Sad yes but true

Personally, I wouldn’t agree with decreasing Tax on the wealthy while increasing them on the less wealthy

That’s the OBA way dumb knots.

Looks. Like Mike. Has to ask. For. John’s. Help. Again

Or everyone will be. Back. On. The. Hill again

I would like the Minister of Finance to speak to this claim by the Opposition… as soon as possible.

When he finishes looking under the HOOD.

You can either look at it as rates increasing by about 2%, or you can apply some political mathematics and say that 1 to 3 gives a 200 percentage increase and 23 to 25 gives a 9 percentage increase. If you wanted to keep the difference the same the top band would need to jump from 23 to 69!

Sounds like in the medival days, de poor where always over taxed.

I don’t see any decreases?

Looks. Like Mike has to call John again. For help

Some seriously fuzzy math here.

Land tax rates went up but ARV’s went down. I am seeing a 14.3% decrease in my ARV and a 2.9% rise in my annual payment, which would be the first increase in about 5 or 6 years and amounts to less than $50 for the year.

If OBA keeps fooling with us, more and more they’ll be force to get Michael fahy out.

They aren’t planning on doing it, they have already done so. I received mine just over a week ago and it is double.

If I recall correctly, the OBA also said recently that land tax was going to be looked out and apportioned differently in the next couple of years so the burden was not on the lower end of the scale.

Also, I believe some recent calculations were in error and were being revised.

Feel free to correct me if I’m wrong, and someone else may remember details more clearly than I am at this hour.

I just received my March land tax bill. My land tax has doubled & I’m in the 2nd tier, so to speak! 109% to be exact! But get this, there’s also a pamphlet with Q & A on what to do if you disagree with the increase!! Why should I pay a 109% increase on a 1-bedroom condo that is less than 900 square feet?! Someone has lost their mind for real!!

Another reason to believe that this rogue administration is out of touch with the people .

Maybe David Burt would provide what the dollar rates are? Maybe the rates have changed and so what appears as an increase is not. ARV’s have dropped with the house price falls. This is only half a story, and meant to raise emotions if not 100% accurate.

This does not tell the whole story though, does it. For each individual property the ARV was adjusted, so that there was little or no actual change.

It’s just another spew of misleading lies from the PLP.

All tyey ever say is utter s#1t.

We all have to pay for the inept governing we were subject to for 14 years.

How else do we pay for things like the Grand Atlantic?

I think a bit of context over how many properties fall into which bands would allow for clarification as to whether this is or is not a “fair” policy.

the % are increased for all bands yes increased higher on the lower end and i’m one going to have to pay more but my dollar increase will be no where near as much at the other end. the plp are playing number games yes the % are increased but the dollars paid by the so called wealthy are pretty big

A more meaningful table would be to give the actual $ of land tax rather than the %. Also, as David Burt almost certainly knows, the valuations have fallen (not a good thing of course, even though it brings less land tax). Many people will fall into a lower “band” as a result, especially at the lower levels of value. This is electioneering of course by the PLP, but yet again, the OBA PR is lacking. By not explaining, they leave a vacuum for the PLP to fill with misinformation.

Electioneering, you say? Here are my facts for you. Pre this increase: ARV: $21,000 – Tax paid $93 – Post this increase: $19,200 – Tax payable $201.50. So, if the ARV has been reduced, this essentially could mean that my rent may need to be concurrently reduced because I could move from a property which is currently under no rent control to one that is. Who ends up paying even more than the actual tax increase?

a) ARV has no correlation to market rents. It is simply an unfortunate term that shares a similar name which confuses people. Just because ARV goes up or down, your rent does not correlate.

b) The rent control threshold has moved lockstep down to 22,800 from 27,000 so nothing changes in terms of the number of rent control properties on island.

c) Rent control properties are not necessarily ‘cheaper’ than non-rent controlled properties. If the ‘registered rent’ was established at the height of the market, it remains there. The only thing rent control does is control rent increases from the ‘registered rent’.

d) $93 or $201 is a extremely low fee that does not even cover the cost of your twice weekly pickup of garbage, never mind all the other stuff your tax is meant to cover. I know it may be difficult to appreciate that fact, but it is true. Sure the increase is not welcomed, but really, its tough to argue you are not getting good value for money.

Doesn’t this govt get tired of scheming the poor!!!! Black or white we must unite and get this greedy govt out!!!

You seem to forget who really put this on the taxpayer. When the “other” Government left office, the cookie jar was empty. The “new” Government had to borrow money to pay for all the “friends & family” the “other” Government hired, whilst the “others” emptied the cookie jar. Yes, my land taxed tripled and my ARV dropped. But the “other” Government also doubled my land tax in 2010, while increasing my ARV, so it would be rated as in an executive neighborhood, in which I am not. 2 billion in debt and we still have to borrow money to pay for an overburdened Civil Service. How do you purpose we reduce the debt and make this island livable again? Throw the IBC off the island, turn away foreign investment, do not welcome tourists/visitors? Our money is worthless without “foreign investment”. And yet you say this Government is greedy. Sunshine, you are looking at the wrong Government. You had better look back to what was happening before Dec. 2012.

And replace them with who ? The same people who got us into this mess?

Whoever is the government they’re going to have to tackle this crippling and unsustainable debt problem .

Do you really think ‘this greedy government’ is having to raise taxes just so they can put the money in their pockets ?

Remember , the private sector have paid and are still paying . The public sector are all still fully employed with no pay cuts .

The PLP were the greedy Govt you lemming !

It is already in effect. Taxation is the only way to pay for the civil service. There are limits to taxation. Bob gave Morgan’s Point a guarantee – that’s more debt we are responsible for. Projects that are unable to get financing on there own should wither. Gov’t is picking winners and losers.

a guarantee is a guarantee , not debt.

I believe a little to late now I already got mine and is due March 31 Arv decrease about 25 per cent and land tax increase 99 per cent… That’s when I realize that bermuda become a place where you work for government!!!!The richer gets all the poor gets less more and more. I had enough of all this stuff !

And I’m tired of funding a huge civil service for such a small population!

“The OBA are planning to increase the burden on land tax on Bermuda’s working class while at the same time reducing the burden of land tax for Bermuda’s wealthy.”

That is sooooo backwards, smh…

I have already received my land tax bill and found that the INCREASE has already applied. Why is this when it has not been debated in the house. My bill has increased by $200 -300 dollars. Someone please explain.

Must be a LIE if you dont know whether it increased by $ 200 or $ 300.

Which was it?? Another PLP plant.

That would be impossible. In December, all property ARVs were downgraded. This would have meant that, in the interim, everyone would have seen their land tax go down until these amendments are passed.

Rich, while your logic could make some sense, the fact is that we have already received bills for the new increases which have hit extremely hard for us in the lower bands.

Nothing like a little PLP spin on things to rile us in the morning!! No wonder why our funds were mismanaged; poor math skills!!

Try to do the math on each of the numbers and see what you get.

http://m.wikihow.com/Calculate-Percentage-Increase

Stop blaming the PLP the OBA doesn’t have any ideas but tax the hell out of those who can least afford they won’t tax the wealthy lol that would be taxing their friends and themselves get real the one business A@@ SMH

“Richards…decrease by 21%” “Cedar Park…SKYROCKET by 99%”

Come on now, when working with percentages, having a higher increase than someone else, doesn’t mean you have an unfair increase.

Just using stated numbers as examples:

Example 1.

0.6% of 11,000 is 66

Increase 66 by 200% = 198

an actual increase of 132

Example 2.

19.2% of 120,000 is 23,040

Increase 23,040 by 10% = 25,440

an actual increase of 2400

Do you see how the actual increase in ex.1 is still a lot lower than the actual increase in ex.2? In fact, ex.2 is actually 1718% more than ex.1! Percentages…sigh.

Although i disagree with increasing the land tax by those rates stated, with these numbers, the wealthy still carry most of the load (as they should).

PLP, if youre going to vilify the OBA using numbers, dont use percentages, they can muddle the real numbers. 1,000,000% increase on zero is…well, zero.

THE FUNNIEST THING IS HOW YOU ALL BELIEVE MR. BEAN SO EASILY. 21% increase LMFAO WHERE DID YOU GET YOUR MATH FROM!

PEOPLE THIS IS ALL TO RILE YOU UP AND GIVE THE PLP INCENTIVE TO TRY AND GET THE HOUSE DISSOLVED WHICH WILL NEVER HAPPEN! The people that believe this are nothing more than SHEEP! Bahhhhhhhhhhhhhh

First people complain about the cost of living for the lower class in Bermuda.

Government drops the ARV resulting in a lower cost of living for the lower class.

If the ARV goes down taxes have to go up just to maintain the status quo.

People in the lower class complain because they are told to do so.

If the cost of living goes down for the lower classes, the profit from renting goes down as well.

That’s basic IGCSE math……

As usual, the PLP math, while technically correct, is the wrong math

WE NEED TO COME OUT AGAIN , THEY NEED 2 CALL A ISLAND STRIKE & THIS TIME ALL COME OUT . BRING THE RICH UP & OVER OUR LEVEL .

What are they waiting for? Get the police to remove this people from the grounds!!!!! This is ridiculous …. They are destroying all of us including our next generation as they are so concernd about it!!

Oh so now we’re all getting worked up? Where were you people when the PLP was screwing things up? Hoping it would get better eventually???

The OBA are no way perfect and for sure they annoy the hell out of me but really….where were you guys when the PLP was sending ex-pats off the island, raising taxes themselves, making things for free when we didn’t have the money to pay for them, etc etc. HUH?? Where were you?

Go protest Alaska Hall for a change.

We have received our land tax bill, our property is in one of the higher ARV bands, we fully expected and were quite happy to contribute to a progressively higher tax bill, but we were stunned to see that our tax has dropped. This is contrary to what we understood was the intent so can only assume that someone has made a major mistake in implementing this. We support the OBA’s efforts to get Bermuda moving again, but this is inappropriate. Lower ARV bands should get a break, Seniors in the lower bands should pay zero, and ideally, landlords who own multiple ARV units should pay a surcharge which they are not allowed to pass on to the tenant (that may be too complex to administer fairly).

Yea, but you have to realize that the land tax regime is so incredibly progressive in any event.

The lowest band will still 1.8% whereas the highest band will be 25%. This will translate into a few additional dollars for those at the bottom end, whereas those at the top will be forking out thousands more.

We went from having an extremely progressive land tax regime to a slightly-less-than-extremely-but-still-massively progressive land tax regime.

QUESTION: WOULD IT BE POSSIBLE FOR OBA AND PLP TO JOIN TOGETHER AND FORM ONE PARTY?

It wasn’t party politics until the PLP was formed with the aim of a unified voting on the party line, without dissent.

Have the PLP MPs ever voted against of come out and disagreed with the party line publicly??? No, not that I recall …whereas the OBA have…The OBA are a much more inclusive party.

The nice thing about our tax system is that it is a blend of income tax (payroll tax) & consumption tax. You want that big home with a pool etc, you are going to pay a much higher percentage on its ARV than the modest home. You want the fancy SUV wannabe, pay the additional tax then pay much more for licensing too.

Your choice.

Property values plummeted due to policies of the PLP. Bermudians sold out & moved away. IB people left in droves leaving empty upper end dwellings behind them.

The upper end properties took a huge hit in rental value & property value. These few prooperties paid the lions share of land tax collected. The ARV had to be adjusted & more load is now on those who used to get away with paying very little.

Doesn’t mean that I am happy with my increase in tax. I am not. What gets me is that Government is hitting us harder in taxes but making little to no effort to cut its day to day expenses i.e. the payroll of the Civil Service, specifically the size of the civil service.

Actually if you had read recent reports correctly, you would see that Govt has cut its spending as referenced in the Budget and when Moody’s gave it’s most recent report.

So why aren’t you all striking for this. This is absolutely high way robbery. Everything goes up but your wage. So does this mean if you have apartments for rent you now pass this increase onto your tenants?

No, because you would have a lease.

Not necessarily and, unfortunately, properties may now fall under rent control.

I should say above I was applying a simple straight logic but this is not how it is actually applied as it should be banded for the value not straight application but still the lowest level will pay $198 vs the upper tier when applying the bands to each level will pay a minimum of $6,400 if the value is deemed to be 120,000.

If the value is deemed to be 1,000,000 then the tax is $233,400 or 20,000 more than the old rate

Well my tax more than doubled on a property that has absolutely no income…I can’t even afford to renovate a small studio apt underneath my house…my main house is now deteriating because of the fact that once all necessaries are paid there is no money left till the next small paycheck gets issued…I personally feel that if your property has no outside income then your taxes should not be raised or IF you should be taxed at all…I recall paying all govt taxes upon purchasing my property…Do we even OWN what we pay for..?

Consider yourself lucky that the rental income isn’t taxed yet. It soon will be as it is a huge source of taxable income for the Government.

Well someone has to pay for all of the upgrades to the venues and preparation for the AC, Airport Project, bridge repair in St. Georges so that the material for the Airport Project can be moved, bloated salaries for Government Officials, empty seats on all of the multiple commercial flights in and out of Bermuda, someone has to foot the bill for the dignitaries when they are wined and dined for those events and other events to come. If you the Bermys want to appear like a 1st world/class country, you have to spend and be taxed like a 1st world/class country. Your Government will tax and spend regardless of your desires by the way, because want to appear and be recognized as a “perfect and desirable” Island Paradise as you see so often in this publication. Never mind the gang violence, incest, murder, assault, rape, sexual assault, robbery, drug activity, money laundering and tax evasion that the government allows to happen.

All of the pomp and glitter that your Government is showing to the rest of the world isn’t free, someone has to pay, and like everywhere else in the world, the masses pay, not the minority 1 percent. Get ready, there will be more expense put on the back of the majority 99 percent.

Disingenuous at best -

1. Because of the services tax that targets lawyers, accountants, etc

2. Because new taxes are mainly necessary to pay for the vulgar nouveau-riches excesses of former PLP ministers .

Should I continue?

Oh so now we’re all getting worked up? Where were you people when the PLP was screwing things up? Hoping it would get better eventually???

The OBA are no way perfect and for sure they annoy the hell out of me but really….where were you guys when the PLP was sending ex-pats off the island, raising taxes themselves, making things for free when we didn’t have the money to pay for them, etc etc. HUH?? Where were you?

Go protest Alaska Hall for a change. No I don’t suspect you will.

Less people on the island, more demand for social care. This is how it works, get used to it.

Less expats on the Island to pay for the costs of the Civil Service means Bermudians have to pay more. Simple maths, get used to it as it will get worse.

As long as it’s fair across the board and clearly this amendment is not fair. Those who have luxury homes, why shouldn’t they pay for them. Those who have a little family homestead, you’re saying they should pay a significantly larger amount than those who can afford to pay in those much higher tax brackets?

“Fair” means everybody pays more. Get used to it.

so land tax is now Social care….smh !

This is ludicrous. the absolute numbers tell a very different story. If you are in the lowest band, your monthly tax is increasing by 11 dollars. The top is in excess of $250 of month… I don’t see how this is disproportionately hurting the poor.

Really? My lowest bracket property just increased from $33 to $99 per half year – that’s $132 per year. That’s the fact.

yep, which is 11 dollars a month.

Sorry , I’m not renting my apartment anymore. I’ve remove the doors and windows and decided to let it rut away. It’s cheaper.

Hope you paid for planning approval…Would cost you more than the land tax me thinks.

How could they do this to struggling people ?

Cut the BS Coffee. These struggling people I see in the pictures have smart phones, they ain’t cheap.

Are these the people that took a werk off last week and called in sick?

They can afford to do that, they can afford to pay their taxes.