US Budget Targets Insurers, Tax Avoiders

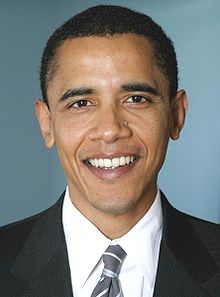

President Obama’s proposed US Budget for 2012 reopens the issue of taxing off-shore insurers and also takes aim at multi-nationals which use off-shore financial jurisdictions for “earnings stripping” to lower or entirely eliminate their American tax bill.

President Obama’s proposed US Budget for 2012 reopens the issue of taxing off-shore insurers and also takes aim at multi-nationals which use off-shore financial jurisdictions for “earnings stripping” to lower or entirely eliminate their American tax bill.

Unveiled yesterday [Feb. 14], the Budget’s insurance tax provision would apply to all carriers who cede premiums to overseas affiliates — but would likely have the most significant impact on those with Bermuda operations.

Specifically, the provision says that the administration seeks to disallow the deduction for excess non-taxed reinsurance premiums ceded to all foreign affiliates. Under the proposal, a US non-life insurance company would be denied a deduction for certain excessive non-taxed reinsurance premiums paid to foreign affiliates.

When a similar measure was included in last year’s US Budget, Bradley Kading, president and executive director of the Association of Bermuda Insurers & Reinsurers, confirmed the proposal was designed with Bermuda in mind. Mr. Kading said the provision — later dropped while the 2011 Budget was being finalised by the White House and Congress — while not specifically citing Bermuda was a “general reference to the issue that affects all non-US insurers that do business with US affiliates.”

The tax advantage exists because current tax law allows the US-based affiliates of offshore insurers to cede a large share of their property casualty premiums to the reinsurance units of their parents, which are based in low-tax or no-tax jurisdictions, such as Bermuda.

Under current tax laws, the US subsidiary deducts the premium and the foreign parent company does not pay US or local tax on the premium while earning investment income subject to low or no tax.

This occurs because related-party reinsurance does not result in a transfer of risk outside the global group. “Thus, it is an efficient way of significantly reducing US tax without transferring risk,” according to a discussion draft on the issue released by the US Senate Finance Committee last year.

The Budget’s “earnings stripping” provision is aimed at global corporations which engage in tax avoidance, channelling profits through off-shore financial centres like Bermuda. It was likely inspired by revelations Internet giant Google had used a network of off-shore jurisdictions – including Bermuda — to slash its US tax bill by $3 billion over three years. Reports of Google’s use of Bermuda in its tax avoidance strategies drew international condemnation.

In December the heads of US-based multinationals held a “Tax Summit” with the White House, asking for a lowered tax bill in exchange for repatriating earnings estimated at $1 trillion currently held in Bermuda and other off-shore domiciles. This week’s Budget provision targeting “earnings stripping” suggests these appeals failed to sway President Obama.

But I thought the general consensus amongst government officials and business Bermuda that we are not a tax haven and the outside tax reform in many countries is not something Bermuda should worried about!