Cato Institute: Bermuda A Non-Issue

A commentator for a conservative Washington think tank says it’s inevitable GOP presidential front-runner Mitt Romney will come under attack by the American media for using off-shore financial centres including Bermuda – though he predicted the press may hold fire until after he gets the Republican nomination.

A commentator for a conservative Washington think tank says it’s inevitable GOP presidential front-runner Mitt Romney will come under attack by the American media for using off-shore financial centres including Bermuda – though he predicted the press may hold fire until after he gets the Republican nomination.

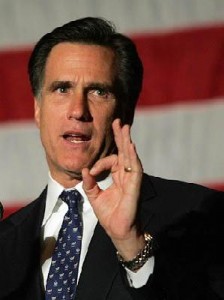

Mr. Romney [pictured] — who eked out a thin victory in last week’s Republican Presidential straw poll in Iowa and is expected to win handily in today’s New Hampshire primary — has come under withering criticism from rival Newt Gingrich in recent days for doing business in Bermuda and the Cayman Islands when he headed the private equity firm Bain Capital in the ’80s and ’90s.

Daniel J. Mitchell, a Cato Institute scholar and a senior commentator at its website, today [Jan. 10] said attacks against Bermuda and other off-shore domiciles by Mr. Romney’s political rivals were misguided. And he suggested that while the “establishment press” in the US had yet to actively pursue these criticisms, it was only a matter of time before this happened.

“But when those attacks occur, I’m extremely confident that the stories will fail to mention that prominent Democrats routinely utilise tax havens for business and investment purposes, including as Bill Clinton, John Kerry, John Edwards, Robert Rubin, Peter Orszag, and Richard Blumenthal,” said Mr. Mitchell. “It’s almost enough to make you think [the] establishment press is biased.”

While describing himself as “not a big fan of Mitt Romney”, Mr. Mitchell nevertheless said the candidate’s use of off-shore funds in Bermuda and Cayman should be a non-issue in the 2012 Presidential campaign.

“In this post, I want to focus on the issue of tax havens,” he said. “Regular readers know that I’m a big defender of these low-tax jurisdictions, for both moral and economic reasons, and I guess that reporters must know that as well because I’ve received a couple of calls from the press in recent weeks. But I suspect I”m not being called because reporters want to understand international tax policy. Instead, based on the questions, it appears that the establishment media wants to hit Romney for utilizing tax havens as part of his work at Bain Capital.

“As far as I can tell, none of these reporters have come out with a story. But I think it’s just a matter of time, so I want to preemptively address this issue. So let’s go back to 2007 and look at some excerpts from a story in the ‘Los Angeles Times’ about the use of so-called tax havens by Romney and Bain Capital.”

Excerpt from “Los Angeles Times” report:

While in private business, Mitt Romney utilized shell companies in two offshore tax havens to help eligible investors avoid paying US taxes, federal and state records show. Romney gained no personal tax benefit from the legal operations in Bermuda and the Cayman Islands. But aides to the Republican presidential hopeful and former colleagues acknowledged that the tax-friendly jurisdictions helped attract billions of additional investment dollars to Romney’s former company, Bain Capital, and thus boosted profits for Romney and his partners. …Romney was listed as a general partner and personally invested in BCIP Associates III Cayman, a private equity fund that is registered at a post office box on Grand Cayman Island and that indirectly buys equity in U.S. companies. The arrangement shields foreign investors from US taxes they would pay for investing in US companies. …In Bermuda, Romney served as president and sole shareholder for four years of Sankaty High Yield Asset Investors Ltd. It funneled money into Bain Capital’s Sankaty family of hedge funds, which invest in bonds and other debt issued by corporations, as well as bank loans. Like thousands of similar financial entities, Sankaty maintains no office or staff in Bermuda. Its only presence consists of a nameplate at a lawyer’s office in downtown Hamilton, capital of the British island territory. … Investing through what’s known as a blocker corporation in Bermuda protects tax-exempt American institutions, such as pension plans, hospitals and university endowments, from paying a 35% tax on what the Internal Revenue Service calls “unrelated business income” from domestic hedge funds that invest in debt, experts say. …Brad Malt, who controls Romney’s financial trust, said Bain Capital organized the Cayman fund to attract money from foreign institutional investors. “This is not Mitt trying to do something strange,” he said. “This is Bain trying to raise some number of billions from investors around the world.”

Mr. Mitchell said it was worth noting:

- Nobody has hinted that former Massachusetts Governor Mr. Romney did anything illegal for the simple reason that using low-tax jurisdictions is normal, appropriate, and intelligent for any business or investor ["Criticising Romney for using tax havens would be akin to attacking me for living in Virginia, which has lower taxes than Maryland," he said].

- Jurisdictions such as Bermuda and the Cayman Islands are good platforms for business activity, which is no different than a state like Delaware being a good platform for business activity. ["Indeed, Delaware has been ranked as the world’s top tax haven by one group though American citizens unfortunately aren’t able to benefit," he said.]

- America’s corporate tax system is hopelessly anti-competitive, so it is quite fortunate that both investors and companies can use tax havens as vehicles to profitably invest in the United States. This helps protect the economy and American workers by attracting trillions of dollars of investment to the US.

Mr. Mitchell concluded: “These three points are just the tip of the iceberg. Watch this video for more information about the economic benefit of tax havens.”

Video: “The Econonomic Case For Tax Havens”