US Complaint Seeks Return Of $919 Million

Liquidators from the British Virgin Islands for Fairfield Sentry Ltd. and affiliated funds, which had been the largest feeder funds for Bernard L. Madoff Investment Securities Inc., have filed an amended complaint last week against the funds’ managers, including Fairfield Greenwich Ltd. and its local subsidiary Fairfield Greenwich [Bermuda] Ltd.

Liquidators from the British Virgin Islands for Fairfield Sentry Ltd. and affiliated funds, which had been the largest feeder funds for Bernard L. Madoff Investment Securities Inc., have filed an amended complaint last week against the funds’ managers, including Fairfield Greenwich Ltd. and its local subsidiary Fairfield Greenwich [Bermuda] Ltd.

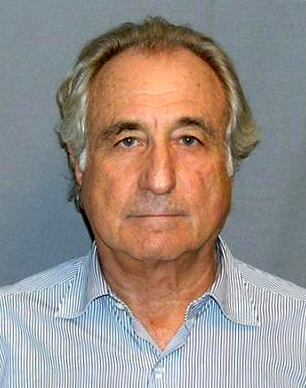

The complaint seeks return of $919 million paid over six years as management and performance fees for supposed profits from investing with Mr. Madoff [pictured], who in 2009 admitted operating the largest Ponzi scheme in US history.

The complaint says the managers were paid 20 percent of realised and unrealised growth in the funds’ net assets.

The complaint, originally filed in New York state court, was transferred to US District Court and from there to the bankruptcy court in Manhattan.

The liquidators were granted relief under Chapter 15 of US bankruptcy laws. Chapter 15 allows courts in the US to assist foreign bankruptcies. Founded in 1983, Fairfield Greenwich provides and manages hedge funds and other investment vehicles for its clients.

At its peak, Fairfielf Greenwich had approximately $16 billion in client and firm assets under management. The company’s Bermuda operation was domiciled here in 2003.