‘Strong Objections’ Raised To Bermuda Bill

The Coalition for Competitive Insurance Rates [CCIR]– the Washington lobby group backed by the island’s re/insurance industry — has strongly objected to legislation aimed at closing what’s been called “The Bermuda Loophole” in the US tax code.

The Coalition for Competitive Insurance Rates [CCIR]– the Washington lobby group backed by the island’s re/insurance industry — has strongly objected to legislation aimed at closing what’s been called “The Bermuda Loophole” in the US tax code.

Massachusetts Congressman Richard Neal has described the loophole that allows US re/insurers to transfer premium income to Bermudian and other offshore affiliates to avoid paying tax on profits as a “sophisticated means of tax avoidance.”

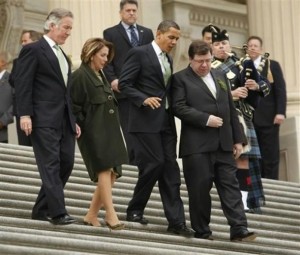

He reintroduced legislation into the US Congress last month to end the practice [Rep. Neal is pictured at left with President Obama, House Minority Leader Nancy Pelosi and former Irish Prime Minister Brian Cowen on the US Capitol steps].

But the CCIR has said the so-called Neal Bill would drive up consumer insurance rates in America by reducing competition and critical US insurance capacity.

CCIR is made up of businesses, consumer advocates and insurance industry groups including the Association of Bermuda Insurers & Reinsurers [ABIR].

The group has outlined its concerns in a letter sent to the chairmen and ranking members of the Senate Finance Committee and House of Representatives Ways & Means Committee detailing the negative consequences of this proposal.

“Consumers in states like Florida rely on a global reinsurance market to protect their homes and businesses,” said Bill Newton, executive director of the Florida Consumer Action Network. “Especially in these challenging economic times, we need to make sure that Americans can afford to conduct business and protect their families.

“Rep. Neal’s legislation chooses to benefit a few large, profitable companies while putting average Americans at risk. Now is certainly not the time to make access to insurance more costly.”

The US insurance market relies on an international network of reinsurance companies to meet the country’s insurance coverage needs.

Nearly two-thirds of all reinsurance coverage required to protect US consumers and businesses is provided by non-US reinsurance companies or their affiliates, many of them based in Bermuda.

A study conducted in 2009 and updated in 2010 by researchers at the Brattle Group, a Cambridge, Massachusetts based economic consulting firm demonstrated that the proposed legislation would cost consumers more than $11 billion per year and would reduce US reinsurance capacity by 20 percent.

The effects of these cost increases would be felt most in disaster-prone states like California, Florida, Louisiana and Texas.

“On the heels of Hurricane Irene’s devastation in my state, anything which has the impact of driving up insurance rates and reducing reinsurance capacity for hurricane-prone states is unacceptable. Accordingly, I must raise my objection to Congressmen Neal’s legislation,” said North Carolina Insurance Commissioner Wayne Goodwin. “Ultimately, anyone in favor of consumer protection must oppose this measure.”

A diverse and wide-ranging group which includes consumer advocates, trade experts, business leaders, and elected officials has vocally opposed the Neal bill.

Over the past year, the state legislatures of Texas, Florida and Louisiana, states who know all too well the value of insurance coverage, have passed memorial resolutions stating their strong opposition to the proposed reinsurance tax.

Additionally, the European Union has stressed their concern that the tax would violate the principles of free trade. In fact, the very companies who are pushing for this legislation in the United States have been fighting against a virtually identical provision in Brazil that would limit their ability to compete in that market.

“The choice to single out foreign-based insurers and reinsurers is a particularly bad one at a time when we are looking to create jobs in the US.” said Nancy McLernon, President & CEO of the Organisation for International Investment [OFII]. “The bill sends an unfortunate, but clear message to global companies that they cannot count on being treated in a fair and equitable fashion when doing business here.

“And, given that the US subsidiaries of foreign companies collectively employ over five million Americans, it should give more than enough reason for our representatives to oppose the bill for the impact it would have on our ability to encourage more global companies to invest in this country and create more jobs.”

Read More About

Comments (2)

Trackback URL | Comments RSS Feed

Articles that link to this one:

- Obama Budget Targets Overseas Tax Benefit | Bernews.com | April 12, 2013

Congressman Neal is an idiot. Its his kind of thinking that has got the US in hot financial water. Idiotic thinking leads to disaster