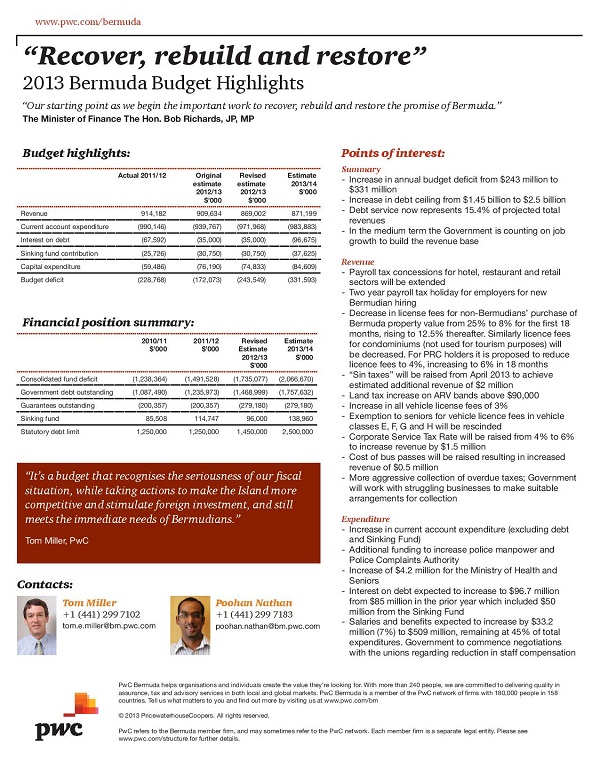

PwC 2013/14 Budget Highlight Summary

Following the delivery of the 2013/14 Budget this morning [Feb 22] by Minister of Finance Bob Richards, PricewaterhouseCoopers Bermuda released a highlights summary.

Tom Miller, PwC Partner, commented on the budget: “It’s a budget that recognises the seriousness of our fiscal situation, while taking actions to make the Island more competitive and stimulate foreign investment, and still meeting the immediate needs of Bermudians.”

The summary below was provided by PwC, click to enlarge:

Mr. Miller also commented about the Government’s plans to manage the deficit: “As presented, the Government’s deficit management plan balances the need to stimulate growth and create jobs while cutting spending and increasing revenue.”

PwC said notable actions within the budget include:

- Starting negotiations with unions regarding a reduction in staff compensation

- Raising the debt ceiling to $2.5 billion

- Keeping public debt at such a level that the net debt/GDP ratio does not exceed 38 %

- Implementing tax policies to promote tax growth and create jobs:

- two year payroll tax policy for new Bermudian hires

- reduce license fees for non-Bermudians purchasing property

- Extending payroll tax concessions to the hotel, restaurant and retail sectors

- Raising duty on cigarettes, tobacco, beer, wines and other spirits

- Increasing vehicle license fees and rescinding senior citizen car licensing exemptions

- Raising the cost of bus passes

- Raising the Corporate Service Tax Rate

- Promising to use all available means to collect overdue taxes

“The Budget addressed all priority areas of the Island’s social economy – health and safety, senior citizens, and education, committing additional funds to police manpower, increasing the budget for the Ministry of Health and Seniors, and the Education Ministry – to help expand its services to special needs students,” said PwC.

“What is clear from this Budget is that the solutions to Bermuda’s challenges also go beyond the Government. It’s up to all of us to do our part to help develop a more attractive Bermuda marketplace, while tightening our belts to get us through this difficult economic climate together,” Mr. Miller concluded.

View all our coverage of the 2013 Budget here.

It is a minor thing but just wondering if the senior vehicle exemption means that seniors pay the difference on a class D to the larger or do they pay the full registration fee for the larger car?

Pretty clear I think above!

Classes E F G and H will be rescinded.

This means if you can afford a bigger car then pay for it – pretty clear.

And it means that grandson cannot license a huge car to grannies house!

TCD now require all owners to register their own cars in person.

And how are we expected to continue to live with this cost of living increase when our paychecks will not support it??? Really????????? Legalize marijuana and tax all that is imported!! Our premier might be able to afford a comfortable life regarding finances… But what about the rest of the population who are already struggling??!