KPMG Responds To 2017/18 Bermuda Budget

“Increasing taxes will help to balance the budget and should see Bermuda’s debt start to reduce in a few years, but there is more to be done in reforming the public sector,” KPMG said, adding that “increasing the cost of doing business in Bermuda may result in businesses moving their staff to lower cost jurisdictions.”

Finance Minister Delivers Budget

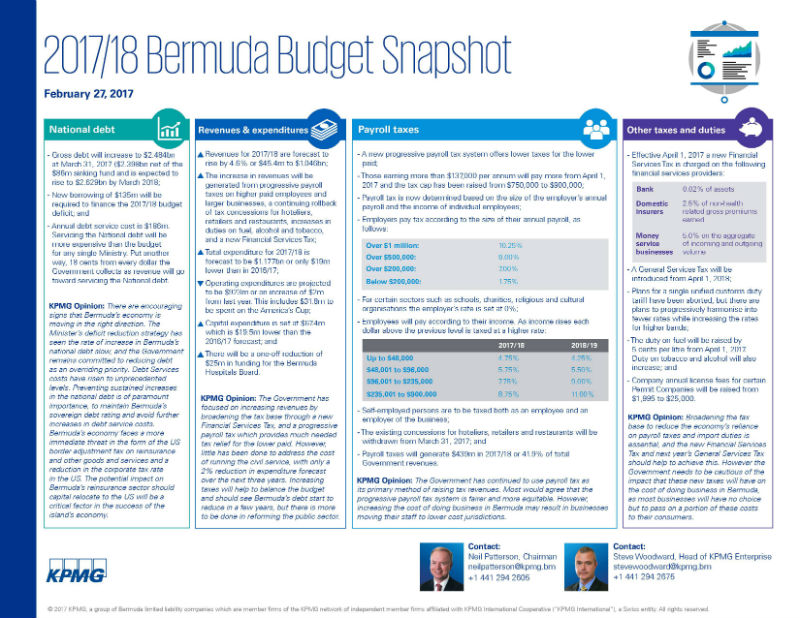

Introducing a new Financial Services Tax, payroll tax changes, and adjustments to customs duties were a few of the financial initiatives revealed by Finance Minister Bob Richards in the 2017 Bermuda Budget.

In addition, the maximum taxable salary level will be raised from $750,000 to $900,000, land taxes for this upcoming year will remain unchanged, while duty on cigarettes, tobacco, beer, wines and spirits will be raised.

In explaining the changes to the payroll tax system, the Minister said, “In the situation where an employer is currently passing on the maximum amount of 6% to an employee, an employee earning in the lowest band [1] will receive a tax cut of up to $600 p.a. in 2017/18.

“The next band [2] provides for a tax cut of $600 – $720. Band three provides for a tax decrease of $720 to an increase of $1,713. The top band provides for an increase of $1,713 to $29,000.”

Speaking on concessions, the Minister said, “In fiscal year 2014/15 non-legislated concessions to hotels, retailers and restaurants totaled approximately $31 million. The roll back of these concessions was started in fiscal year 2015/16 and in this fiscal year Government will fully withdraw all such concessions.”

The Government will also be introducing a new tax to be called the Financial Services Tax which will be for banks, local insurance companies and Money Service Businesses.

“When applied to banks the tax will be calculated as 0.02% of assets,” the Minister said. “The tax as applied to local insurance companies will be a tax on gross premiums earned, excluding premiums from health insurance.

“The rate of tax will be 2.5% of non-health related gross premiums. Finally the rate of tax for the Money Service Businesses will be 5% on their aggregated incoming and outgoing transmission volume.”

KPMG Comments

The company said, “There are encouraging signs that Bermuda’s economy is moving in the right direction.

“The Minister’s deficit reduction strategy has seen the rate of increase in Bermuda’s national debt slow, and the Government remains committed to reducing debt as an overriding priority.

“Debt Services costs have risen to unprecedented levels. Preventing sustained increases in the national debt is of paramount importance, to maintain Bermuda’s sovereign debt rating and avoid further increases in debt service costs.

“Bermuda’s economy faces a more immediate threat in the form of the US border adjustment tax on reinsurance and other goods and services and a reduction in the corporate tax rate in the US.

“The potential impact on Bermuda’s reinsurance sector should capital relocate to the US will be a critical factor in the success of the island’s economy.

“The Government has focused on increasing revenues by broadening the tax base through a new Financial Services Tax, and a progressive payroll tax which provides much needed tax relief for the lower paid.

“However, little has been done to address the cost of running the civil service, with only a 2% reduction in expenditure forecast over the next three years.

“Increasing taxes will help to balance the budget and should see Bermuda’s debt start to reduce in a few years, but there is more to be done in reforming the public sector.”

“The Government has continued to use payroll tax as its primary method of raising tax revenues. Most would agree that the progressive payroll tax system is fairer and more equitable.

“However, increasing the cost of doing business in Bermuda may result in businesses moving their staff to lower cost jurisdictions.

“Broadening the tax base to reduce the economy’s reliance on payroll taxes and import duties is essential, and the new Financial Services Tax and next year’s General Services Tax should help to achieve this.

“However the Government needs to be cautious of the impact that these new taxes will have on the cost of doing business in Bermuda, as most businesses will have no choice but to pass on a portion of these costs to their consumers.”

KPMG’s 2017/18 Bermuda Budget Snapshot [PDF]

I find it amazing that Mr Famous still thinks the debt is acceptable because we got a hospital and a new TCD etc. Until He and other prominent members of our community realise the significance of this debt servicing cost then there will be no political will to sort it out.

Mr Famoussss also doesn’t like facts.

Michael Dunkley told us last night that they’ve cut the civil service jobs by 649 people but this only represents 2% of the total? Methinks there is more to this than meets the eye…

Justin methinks YOUR figures are a bit out. For 649 people to be 2% means they have to have 32,500 people employed in the CS. I know they have too many but not quite that number. Redo your math mate

Say what you want, The PLP is a Labor Party, and Labor spends money . The debt will increase in order to easy the pressure on those on the bottom .To avoid this, Bob must bring some relief to the man in the street . He must start with make the same public presentation that he made to the Chamber of Commerce to our Sport Clubs . Will he? No! Here is the did connect that must be fixed. Only the Premier can bring our two communities together . Will he? Yes.

You must be joking this from the government that ended term limits; that has made it easy to employ non-Bermudians during a time that there is still high levels of unemployment among Bermudians; that has not mention one word about the hundreds of Bermudians who have become economic refugees in another man’s country(England)

Bringing the two Bermuda’s together; not this premier nor his political support base which has no compulsion in throwing other Bermudans under the bus and this is reflected in the constant call to cut the civil service despite the impact that would have on many families.

Ok one more time. So here is the problem with term limits. They force companies to fire someone who may be doing an exceptional job. There may not be a Bermudian qualified to do the job. So the company is forced to source and hire…another foreigner. Here’s the problem, some companies may decide they don’t want to fire their exceptional member of staff, and in fact they may decide they don’t like being told by government who they should fire. So they decide to move the company somewhere else. Guess what happens to any Bermudians who happen to be employed by that company?

Look mate, we aren’t going to need ANY civil servants if IB leaves and takes all of the bermudian jobs with them! Get that through your thick skulls people! You bash IB all the time and say “good riddance,” but just for one minute get your head out of your butts and think about what that means! Hate on them all you want but the fact of the matter is that we cannot survive without the jobs IB provides us. My whole family would be jobless.