Consumer Affairs: Scams Are On The Rise

The Department of Consumer Affairs is concerned that scammers are preying on consumers’ vulnerability during these challenging economic times.

Consumer Affairs Department education officer Honey Adams yesterday [Mar.22] said scams are becoming a growing problem on the island.

And while most local residents have got smarter when it comes to recognising scams and protecting themselves, fraudsters are becoming more sophisticated as well.

Ms Adams said: “Phishing’ — also called ‘carding’ or ‘brand spoofing’ — is an online fraud scam used to steal your personal and financial information such as credit card numbers, bank account information and passwords.”

These hoax emails can look genuine, using the company’s logo and format, and a link which leads to a website that seems genuine, but isn’t.

“The sole purpose of this scam is to conduct illegal transactions on your account and steal your money,” said Ms Adams. “In addition to stealing personal and financial information, phishers can infect computers with viruses and convince people to participate unsuspectingly in money laundering.”

There are key things to avoid this scam:-

- Never click on a link or open an attachment in an unexpected email – even if it looks like it comes from your bank,

- Your bank will never ask for your details in an email,

- Never reply to an unsolicited email from an overseas or unknown source, even to “unsubscribe”. Do not click on links or call telephone numbers. You could have your money and identity stolen, or you could expose your computer to spyware that can identify your bank details and passwords.

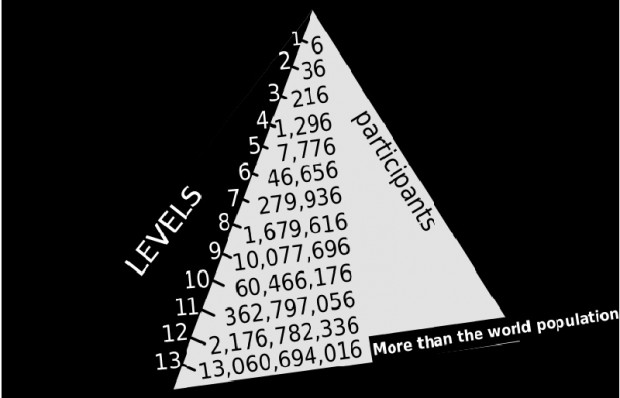

The second popular scam is fraudulent multi-level marketing schemes or pyramid schemes as they are commonly called.

“These scams come in a variety of forms but the main characteristic of a pyramid scheme is that participants only make money by recruiting more members.” said Ms Adams. “The only way for a pyramid scheme to work for everyone is if there is an endless supply of new members and in reality there isn’t.

“It is mathematically impossible and when the business is unable to recruit new investors the money stops coming in and the business collapses.”

The unsustainable exponential progression of a classic pyramid scheme

Ms Adams said if you are considering joining a multi-level marketing business, do your research: investigate the business and its products first.

Get as much information as you can, including copies of their sales literature, and their business and marketing plan.

“Talk to other people who have experience with the multi-level marketing company and the products, to determine whether the products are actually being sold and whether they are making good money,” she said.

The Department of Consumer Affairs has compiled information and tips to help protect consumers from becoming victims of these schemes. These tips are located on its web-site, or you can contact the department’s office for a copy.

“We strongly suggest that all residents take steps to avoid being a victim of a scam,” said Ms Adams. “Knowledge is a strong tool here. Take the time to find out all you can about the various scams and how they work.

“Be prepared to be targeted by scammers and have a plan to protect yourself -– a savvy consumer is our best protection against scams.”

Ms Adams also reminded Bermuda residents that under the Consumer Protection Act 1999, it is illegal to operate a pyramid scheme onthe island.

“It is an unconscionable act and a violation of this Act carries a $15,000 fine and/or imprisonment for up to 12 months,” she said.

Read More About

Category: All

Oh dear. Maybe it is time to get out of my gift club ASAP