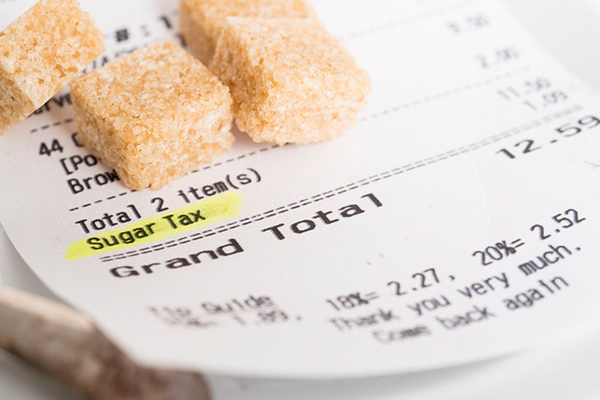

50% – First Phase Of Sugar Tax In Effect Today

If you like certain types of sugary drinks and foods, be prepared to pay a bit more for them as the first phase of the Sugar Tax comes into effect today [Oct 1] with the Government confirming that “the Sugar Tax goes into effect on 1st October in a phased approach starting with 50% duty on candies, sugary drinks [sodas], pure sugar and dilutables [syrups, etc.]. ”

A Ministry of Health spokesperson said, “The Sugar Tax goes into effect on 1st October in a phased approach starting with 50% duty on candies, sugary drinks [sodas], pure sugar and dilutables [syrups, etc.]. Drinks without sugar, 100% fruit juice and diet drinks will not be affected.

“The items were selected following consultation with the public and assessing international experience with sugar taxes. The duty increases to 75% in April 2019.

“In Bermuda three out of four adults are overweight or obese, which can cause diabetes, heart disease, kidney disease, some cancers and other conditions. Half of our population drinks at least one sugary drink a day, which contributes to the island’s obesity problem.

“Bermuda spent over $100 million on diabetes and kidney disease last year. We all pay for these costs through insurance premiums and health subsidies. If Bermuda is to contain health costs, obesity and chronic disease will have to be reduced.

“The sugar tax is expected to help redirect consumers and businesses to healthier options that will promote health rather than damage it.

“The Department of Health conducted a public consultation on the sugar tax proposals following Pan American Health Organization standards. In total 351 persons and organisations responded with a minority of 44% against the tax.

“Sugar taxes have worked in other countries and the Ministry anticipates it will contribute to broader measures to reduce obesity. Just like tobacco use decreased from 22% to 13% with the ban on smoking in public places, consumer behaviour regarding sugar should change favourably over time with the new duties.

“This can present business opportunities as consumers are increasingly looking for non-sugary and healthier alternatives,” the Ministry said.

OBA MP Michael Dunkley said, “Today, Oct 1st, the first phase of the Sugar Tax comes into effect with the implementation of a 50% tax on selected sugary items. This is followed by phase two next April when the tax is raised to 75%.

“While I have always declared my interest, it is important to once again signal that it is highly unlikely this tax will have the intended consumer purchase changes and health benefits that the Government would intend.

“Instead it will increase the cost of grocery items, greatly impact small business, many of them black owned and some for generations, and result in job losses and potential business closures.

“The tax is very selective in what items are taxed and without explanation leaves out many other sugary products. By the nature of what has been included in this new tax it is discriminatory.

“To make the situation worse the PLP Government did not effectively consult, ask the many small businesses who tried to consult and get answers!

“Then during the passage of the legislation in the House the PLP added in an exemption for ‘home bakeries’ which has still not been explained properly.

“With the tax soon to be in effect it is my belief that this last minute triage will not have the impact the government intended as it is selective in who it helps and is too cumbersome to be used by any business that might qualify.

“It is my view that there are much more effective ways to have significant health benefits. However sadly in their rush to tick the box of election promises the PLP have passed another poor piece of legislation.

“The PLP Government is not off to a good start in trying to control health care costs and make Bermuda a healthier place.”

This is the most rediculous act that is starting today.

As if we do not pay through our nose for everything else on this island.

Now the government will be taxing us on sugar.

Do they really think for one minute that people are going to stop buying as they have been doing all this time? Get a life Bermuda Governmnent.

Why don’t you tax us on the use of toilet paper next.

Aa long as its Charmin.

Exactly what they are counting on. People will complain but eventually give in and pay. Bermudians just roll over and take whatever any Government gives them. SMH.

Watch these crabs increase prices on the sugar they have stocked up on since they got the heads up.

When are you going to learn how to spell? It’s “ridiculous”.

An excellent move! As stated, over time it should have a positive impact. Fast food, fatty food and sugar have negatively impacted all of us! This way we’ll have to think twice before reaching out for that piece of cake, candy or can of soda! If it reduces diabetes in just a fraction of the population, it has served its purpose! It will force wholesalers to make better selections too once their imported garbage stops selling!

Why do you need a gov’t implemented sugar tax to “…think twice before reaching out for that piece of cake, candy or can of soda”??

Like smoking, people could have opted NOT to smoke in public places, but didn’t. Like speeding, people know the limits, but break it on a regular. Unfortunately, people make crap choices all the time. This will help because if the cheaper option is also the healthier option, people will opt for it.

The cheaper option isn’t the healthier one though, that is still the sky high option, sugar is just more expensive across the board.

Without a corresponding duty relief on healthier alternatives, this initiative is simply a cash grab by govt and an easy excuse for retailers to jack up the price on affected items.

And cost people jobs as well. Funny how people for this stupid nanny tax refuse to see that. Thanks plp for costing us more jobs. Just in time for christmas i see

No, it is in time for Halloween!

But like the increase with cigarettes and alcohol, people still buy them anyway. If it didn’t work for those nasty habits that effect others, why do you think this will work??

People will make their own choices no matter the price.

We all know they will, but a decent chunk will not. It will affect small business here which is what this administration claims to be helping. Thats the issue. People who are already suffering will suffer more. But again this admin is for the average joe. Smh.

Onlooker you are dreaming. Sugar is an addiction just like the price increase on cigarettes people will still pay. And the government knows that. Money Money Money!

Onlooker you are dreaming. Sugar is addictive, and just like the increase on the price of cigarettes people are still going to pay. And the government knows this. Money Money Money! Government trying to legislate behavior a no no.

Is there a list as to what items will be affected?

I think there 2025 plan meant to say job losses,well done voters!

Mean while back at the bitcoin bank.

Looks like I will be handing out carrots for Halloween this year

You think people will stop buying sugar for their Koolaid. LOL NO people will not stop buying SUGAR…and that is the plan. The plan isn’t to educate people on the dangers of their food choices – the plan is to have US ALL continue to buy the TAXED goods! SMH

One of the problems is the amount of juice and juice boxes consumed. There is more sugar in the juices than some of the dilutables but juice is promoted as being healthy. Juices should be taxes as well.

the beginning of the end, tax and spend I tell u they never learn sad really .. betta start making bootleg swizzle again

Hasn’t worked anywhere else, but hey, we’re different. Should be taxing high fat foods too, right? (Mayo for eg.)

Look people, this is an OPTIONAL TAX! If you don’t want to pay this tax, don’t buy crap food. Simple as that. Your choice.

IF however, you CHOOSE to pay this tax, think of your tax dollars as a “PRE-PAYMENT” for the medical costs you will incur later in life. Cuz frankly, I’m sick of paying for your health care!

Your choice people! Choose to pay it or don’t but Stop b*itching about it!

Optional. What a crock of s””t

Just about everything consumed has sugar in it

Take your head out of your butt and see how this is gonna hurt the common folk. It’s not a health move it’s a make easy money move for a govt spending more than they r making not to mention our guests who are encouraged to try our signature drinks, dark and stormy Rum swizzle.

Next time u buy groceries let us know how it goes and how much more it’s gonna cost u

“Hurt the ‘common folk’?” It ABSOLUTELY will! It will hurt ALL ‘folk’ who CHOOSE to continue to buy these products. And YES, I am clearly aware that there is hidden sugar/high fructose corn syrup in MANY MANY everyday items. (Hello ketchup). I try my hardest to avoid those. But hey, even I love a good cupcake once in a while. I just accept the fact that I will now be “pre-paying” my own medical bills whenever I choose to enjoy one of those tasty little cakes.

I repeat, pay the tax, or don’t. Your choice.

May u never ever get sick or develope a condition beyond your control. U do know there are differemt kinds of diabetes right? Type 1 is beyond anyones control to prevent. It isnt “caused” it just happens. Type 2 is developed. By your statement im sure your grocery bags are full of non gmo fully organic items then huh? So in fact youd spend a hell of a lot less paying this “optional” tax.

I’m well aware of the different types of diabetes, thanks. Also well aware of the different kinds and causes of obesity (glandular, hormonal, diet). People who fall into any of these categories ALREADY know they shouldn’t be buying and eating this type of garbage and hopefully, for their own health, they aren’t buying it and therefore don’t have to worry about paying this OPTIONAL tax.

Don’t get me wrong, I’ve never met a tax I liked or agreed with but this one here, this is one that I have a choice to pay or not so you better bet I’m gonna try my hardest not to pay it.

There are 26 countries that presently have sugar tax (27 if you now include us), including the UK, UK, Portugal, Ireland and some states of the U.S. While the problem sugar has not only on our bodies but also our wallets in the form of diabetes & high health insurance is said to be the reason behind the sugar tax. What it does is punish the consumers rather than the producers of the products. I can understand that our government isn’t in a position to tax the producers of the sugar products, I think there should also be steps to not pass the tax onto the consumer.

This, however, puts the consumer in a powerful position, they can demand the importers of these sugary products to switch to healthier options in place of the products affected by the sugar tax. In turn, we as a whole start to live a healthier lifestyle as well as save money by not having to pay into the sugar tax as much.

“50% – First Phase Of Sugar Tax In Effect Today” … well, ain’t that sweet?

This is crazy smdh i need to see this list cause for one juices contain sugar. This is so not need. Island is near impossible to live on as a local already.

The only thing this will do, if affect the small business and the lower income workers. If this is about health, then lower the duty on fruits and vegetables. Fruits are outrageously priced and I purchase stwawberries and 20% are already rotten. Its all about making money. Just like electric cars, but that is another story.

Groceries are ridiculously expensive in Bermuda, sugar or no sugar. The healthier choice foods, ie. fruit and vegetables should have been reduced in price. Many people eat an unhealthy unbalanced diet, high in carbohydrates because it is cheaper. This along with consumption of high sugar food leads to high blood sugar levels that can over time contribute to the onset of type 2 diabetes. Its not that most people are guzzling sugary drinks all the time and eating candy bar after candy bar. It’s a bigger picture of an overall unhealthy diet. Fruit and vegetables need to be cheaper so they are and option for the average family. Maybe now use the money from the sugar tax to subsidize costs of fruit and veg.

Well said!!!

A tax on food.

Hopefully when we go to the grocery store today the prices haven’t gone up. This tax should be on the next shipment…..but you know they will put the price up on what’s already on the shelf.

Why not instead find ways to make healthy food more affordable? This is just making all food unaffordable.

This is a sad day for the low/middle income familys that struggle to make ends meet on a day to day basis now. Esp when it comes to buying groceries. Do you think we want to buy the high in sugar products no but the healthy items are two expensive for us to purchase. Why not the government sit down with the owners of these grocery stores and discuss a way they can lower the prices on the healthier items.

Might I make a suggestion to the private citizens, organizations, and government officials that suggested, developed, passed and supported this initiative?

Put OUR money where your mouth is.

This initiative makes us pay as a penalty for the obesity and poor choices of a portion of Bermuda. It has been suggested that this is nothing more than a grab for additional taxes from the public. This suggestion has been vehemently denied by those pushing this initiative.

If if this is truly not a grab for more money from the people of Bermuda and an a earnest attempt to encourage Bermudians to lose weight and embrace a healthier life style, why not go the next step.

Remove all duty from all sports and exercise equipment.

No duty on pedal cycles, weights, cricket equipment, football equipment, home gyms, electronic exercise monitors, water skis, scuba equipment, netball hoops, balls, spinning cycles, in short, everything.

So, how committed are those that backed the sugar tax?

Can we see the legislative changes required to remove duty on these items as quickly as we saw the legislation go forward to the sugar tax?

Watching for answer.

Halloween sign: “Sorry no candy this year. Thank the government”

Why not have everyone who is buying sugary items like candy put that money into health savings accounts in their name, related to their credit cards, or have a health savings account due to their consumption of unnatural additives containing syrups or processed sugars. Regular sugar in its purest form isn’t going to cause everyone to get fat, it’s the candy bars, syrups, carbohydrates in chips, etc. that cause those issues, and I say let people who have chronic health problems pay into their own account for those purchases over a certain limit per year. Period. I remember the German health care system used to allow everyone to pay for the smokers and overweight people, rates were the same for everyone, and they finally wised up and realized those who live less carefully should be paying more for their health care during the year in incremental payments for being morbidly obese with no pre-existing condition, not eating right if diabetic, etc. Let those of us who come as tourists be exempt, please! That’s how we know if your politicians really care, since we aren’t living there seeping off the health care charges.