PwC Survey: Global CEOs On AI And More

CEO confidence in their company’s revenue prospects has “fallen to its lowest level in five years, as business leaders grapple with uneven returns from artificial intelligence, rising geopolitical risk, and intensifying cyber threats,” PwC said.

A spokesperson said, “According to PwC’s 29th Global CEO Survey, only three-in-ten [30%] of CEOs say they are confident about revenue growth over the next 12 months—down from 38% in 2025 and a recent peak of 56% in 2022. The findings suggest that as CEOs navigate a complex operating environment shaped by rapid technological change, geopolitical uncertainty, and economic pressure, many companies have yet to translate investment into consistent financial gains.

“The survey is based on responses from 4,454 CEOs across 95 countries and territories.”

Arthur Wightman, Territory Leader, PwC Bermuda, said: “Business leaders face a challenging year ahead, with growing concerns over volatility, cyber risk, and geopolitical tensions. Despite short-term uncertainty, our survey of global CEOs finds they remain focused on long-term transformation—driving innovation, investing in AI, and entering new sectors to navigate the shifting global economy. Of note, among CEOs pursuing major acquisitions in the next three years, 44% plan to do deals beyond their current sector or industry.”

A spokesperson added, “AI emerges as a defining fault line for growth and profitability

“The biggest question on CEOs’ minds is whether they are transforming fast enough to keep pace with technological change, including AI. Forty-two percent cite this as their top concern—well ahead of worries about innovation capability or medium to long-term viability [both 29%].

“Despite widespread experimentation, only one-in-eight [12%] CEOs say AI has delivered both cost and revenue benefits. Overall, 33% report gains in either cost or revenue, while 56% say they have seen no significant financial benefit to date.

“The survey points to a growing divide between companies piloting AI and those deploying it at scale. CEOs reporting both cost and revenue gains are two to three times more likely to say they have embedded AI extensively across products and services, demand generation, and strategic decision-making.

“Foundations matter as much as scale. CEOs whose organisations have established strong AI foundations—such as Responsible AI frameworks and technology environments that enable enterprise-wide integration—are three times more likely to report meaningful financial returns. Separate PwC analysis shows that companies applying AI widely to products, services, and customer experiences achieved nearly four percentage points higher profit margins than those that did not.

“Confidence falls as tariffs and cyber risks intensify

“CEO confidence has softened further amid rising exposure to external risks. One-in-five CEOs globally [20%] say their organisation is highly or extremely exposed to the risk of significant financial loss from tariffs over the next 12 months, though exposure varies widely by region—from 6% across the Middle East to 28% in the Chinese Mainland and 35% in Mexico. Among US CEOs, 22% report high exposure.

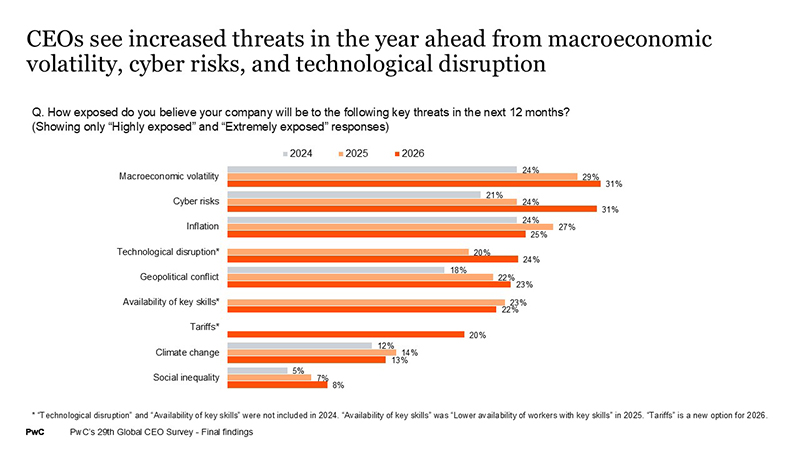

“Concern about cyber risk has risen sharply, with 31% of CEOs now citing it as a major threat—up from 24% last year and 21% two years ago. In response, 84% say they plan to strengthen enterprise-wide cybersecurity as part of their response to geopolitical risk. Concerns about macroeconomic volatility [31%], technology disruption [24%], and geopolitics [23%] have also edged higher, while concern about inflation is marginally down [from 27% last year to 25%].

“Reinvention becomes a strategic imperative

“Despite the challenging outlook, CEOs increasingly see reinvention as essential to growth. More than four in ten [42%] say their company has begun competing in new sectors over the past five years. Among those planning major acquisitions, 44% expect to invest outside their current industry, with technology the most attractive adjacent sector.

“A little over half of CEOs [51%] plan to make international investments in the year ahead. The United States remains the top destination, with 35% ranking it among their top three markets. The UK and Germany [both 13%] and the Chinese Mainland [11%] also feature prominently. Interest in India has nearly doubled year-on-year, with 13% of CEOs planning international investment placing it among their top three destinations.

“Execution gaps remain. Only one in four CEOs say their organisation tolerates high risk in innovation projects, has disciplined processes to stop underperforming initiatives, or operates a defined innovation centre or corporate venturing function.

“Time is also a constraint: CEOs report spending 47% of their time focused on issues with a horizon of less than one year, compared with just 16% on decisions looking more than five years ahead.”

Read More About

Category: All, Business, technology