Video: Bermuda Tax Regime Criticised

A renowned US economist says countries which lower their tax rates to attract foreign capital are “entering into a race to the bottom that will ultimately undermine their economies” — and criticises multinationals including Google for “park[ing] a lot of its international earnings in Bermuda.”

A renowned US economist says countries which lower their tax rates to attract foreign capital are “entering into a race to the bottom that will ultimately undermine their economies” — and criticises multinationals including Google for “park[ing] a lot of its international earnings in Bermuda.”

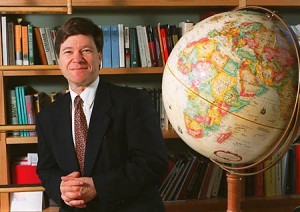

Professor Jeffrey Sachs [pictured], director of the Earth Institute at New York’s Columbia University, was talking to the “Wall Street Journal” today [Dec. 19] about countries embroiled in the ongoing euro-zone debt crisis.

But he branched off to attack off-shore domiciles like Bermuda which play crucial roles in complex tax-avoidance schemes of the type Ireland has introduced in recent years.

Dr. Sachs was particularly critical of Ireland’s low-tax regime — and even more disapproving of companies which take advantage of it: “Ireland lived off a tax policy that said ‘come bring your investment capital here we won’t tax it,’ and it also opened up massive abuses because a lot of US companies put their corporate headquarters in Dublin and then used that as a base to channel even more of their resources to the Caribbean -— basically a gaming of the international system.”

“… Take a company like Google which has an arrangement with the Internal Revenue Service in the US to park a lot of its international earnings in Bermuda and that is channeled through the international corporate headquarters in Dublin.”

The Bloomberg financial news service last year revealed Internet giant Google’s decision to engage in tax avoidance using a network of off-shore financial centres including Bermuda. As a consequence, Google has cut its US tax bill by more than $3 billion in three years.

Google’s decision to funnel profits through domiciles like Bermuda was criticised by politicians, business leaders and commentators in both America and the United Kingdom.

“Wall Street Journal” Interview With Professor Jeffrey Sachs

Stupid argument.

Doesn’t Florida have a zero personal income tax rate in order to help attract retirees from heavily taxed states like NY and NJ?

Doesn’t Vermont have a zero sales tax rate to attract shoppers from the more heavily taxed states like NY and NJ?

Doesn’t Ireland have a lower corporate income tax rate than the rest of Europe to try to attract Eurozone business from higher taxed jurisdictions like the UK and France?

Tax, along with regulatory policies, have long been used to attract business from one jurisdiction to another. It’s called competition. Get used to it.

Professor Jeffrey Sachs is a close-minded, US centric, fool. He cares not that the US tax code is the biggest load of sh!t to ever hit the planet. Unfortunately he gets away with outright lies that Bermuda helps entities to evade their taxes. Bermuda does none of the sort!! STOP YOUR LIES YANKEE FOOL…!!!!

Final comment about guys like Sachs. Persons like him did NOT make the US a great country. Great Americans took a hard look at themselves, took responsibility for their actions, then solved their problems. Guys like Sachs who blame foreigners for US problems just make thinGs worse. My message to Sachs is GROW UP…and take responsibility that the US is broken because Americans have lost their way.

The US tax code is what allows entities like Google to funnel monies through Bermuda to take advantage of the regulations……IMHO Bermuda gets no where near the bang for its buck for allowing Corporations to set up “name plates” compared to those who have a phycial presence on the island….the name plates like Google and thousands of others pay legal fees and minor accounting fees and we get labled as a tax haven….The US tax code allows individuals and corporations the latitude to take full advantage of all that is legal within the code to pay the lowest tax…..its the billions of tax dollars they are losing that causes the Jeffrey Sachs of the world to cry for those loop holes to be closed….for what its worth I still pay taxes on deferred earnings and options for that were earned while living in NY and NJ because the tax code says so…..and I’ve lived here for a long time…..

I dont understand this guys position.

Within the USA, States and Cities use tax as a means to attract and retain business.

Because Bermuda (and other countries) has a lower overall tax rate compared to the USA, we are “bad”?

What if we had a higher tax rate, would we also be “bad”?

Well put!!! Sachs is an idiot fool..!

Like the US taxation system is perfect……….

The real problem is that the US Govt. taxes US Corporations on their non-US earnings and other countries do not do this. So large US multi-nationals have to find ways to avoid paying coporate income tax twice or they then struggle to compete in the worldwide market place. Don’t throw stones if you live in a glass house…

He’s an idiot. Bermuda doesn’t/didn’t lower it’s tax rate to attract foreign capital, it has had the same tax structure since the days of privateers.

Bermuda probably earned a few dollars from Google…..and only a few compared to the 3 billion that they saved….Google may have a shell company here and retain Appleby for a few thousand and through a series of buttons getting pushed they shuttle their revenued around the globe….and in return for the $40 or $50k that makes its way to Bermuda we get millions of dollars of bad press. go google…

Dumbest comment I’ve read all day.

based on your inept defense of Torus that is a compliment….