Papers Filed To Seize Mexican Fugitive’s $2 Million

U.S. authorities have filed a document to seize over $2 million in a Bermuda bank account allegedly belonging to a fugitive Mexican official charged in a corruption case.

U.S. authorities have filed a document to seize over $2 million in a Bermuda bank account allegedly belonging to a fugitive Mexican official charged in a corruption case.

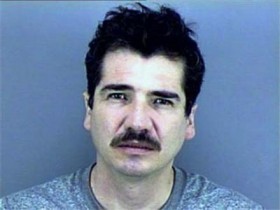

Hector Hernandez Javier Villarreal [pictured] — the former Secretary of Finance for Coahuila, Mexico — is suspected of forging state documents to obtain fraudulent loans totaling more than $220 million.

The court document said, “On October 28, 2011, a local judge from the State of Coahuila charged Villarreal with forging state documents to obtain fraudulent loans for several million pesos between 2008 and 2011.

“On October 29, 2011, Villarreal was arrested and released on bond. Villarreal fled to the United States after that and remains a fugitive from Mexico.”

According to the court document, as of January 4, 2013, Villarreal had $2,275,544.41 on deposit in the Bermuda account.

The seizure is being done under the grounds of being “property that is derived from bribery of a public official, or the misappropriation, theft, or embezzlement of public funds by or for the benefit of a public official.”

Hernandez allegedly stole the money from the state of Coahuila and deposited it into a Texas bank account before transferring the funds to the account in Bermuda, according to the forfeiture complaint filed in U.S. District Court.

This is not the first time the American authorities have filed suits to seize assets belonging to Villarreal. Among the bank accounts seized last year was a San Antonio, Texas bank account containing $700,000 and registered to Toyland LLC, a company controlled by Villarreal’s wife, Maria Botello.

Last year U.S. federal prosecutors also filed lawsuits in San Antonio, Texas seeking forfeiture of the dozen properties in the region, including the a strip mall, multiple residences, CVS pharmacy, storage center, condo unit, carwash, gas station and more.

Last February questions were raised after Villarreal was arrested in Texas, and later released. He and his wife were pulled over for a traffic stop, and the Texas police found $67,000 in cash and a shotgun in the car. They were taken into custody, however they were released despite Villarreal being a wanted man at the time.

One day after ordering Villarreal’s release, State Department officials referenced the Mexican warrant and asked for local authorities to re-arrest the couple. But by then, it was too late.

Fox News report on the release of Villarreal last year:

The full court document is below [PDF here]:

Effin Bankers man…they’ll take anything in! Just try to get it out!I mean 2M transfered from Mexico – to Texas on to bermuda didn’t raise any eyebrows?

The only institution to drive the prince of peace to violence – The Banks – Building and collapsing economies since time immemorial.

What do they actually do? Print money from thin air and loan it to you at interest. Fantastic idea…shoot I should have thought of that myself – no I’d end up fat and greasy and pink in the face like the lot of em’

First of all you shouldn’t go shooting off at the mouth without getting your facts. You should read the PDF document attached at the bottom and see that it clearly states the man had the money at company #1 first, so there fore its not the banks fault. Second the bank would have done its part and checked that it came from a legitimate source. Thirdly the first party didn’t do their job in assuring the funds came from a legitimate source. So you should point blame at company #1.

I get that one fell through the KYC (Know Your Customer)process.

I thought HSBC was the favoured bank for Mexican funds.

So how exactly was this account setup? Just asking cause I need to present so much document to Banks here to have an account. Makes me wonder. I guess the more money you have the better you get treated. Hmmm

Its not the Banks its these investment companies in Bermuda that have their accounts with the Banks. Why isnt the Bermuda Monetary Authority monitoring these Investment companies.

Say hello to el chapo guzman for me

Coahuila is Zetas territory….He’ll be saying hello to Z-40, Miguel Ángel Treviño Morales

#Lazca

lol How do you know it was HSBC???????

The court document names BNTB.

I should correct that. He didn’t get them in trouble. He was in charge when they got in trouble.

Whatever Bank, tell them drop a cool $50,000 in my account! It won’t be missed.

Shouldn’t the money be returned to Mexico?

I am Company Secretary for the company I work for and we have had a bank account with the same local bank for 38 years and we are a local company. Recently I have had to produce so much paperwork and have had to have documents notarized and produce utility bills for myself and my boss all of which took a good deal of time and effort to put together all in the interest of KYC.