‘Greater Strain On Country’s Pension System’

Recommendations in the Contributory Pension Fund Actuarial Report include increasing “contribution rates at higher than 4.0% a year more than benefit increases” and increasing the “retirement age to 70 years over a predefined period of at least 8 years.”

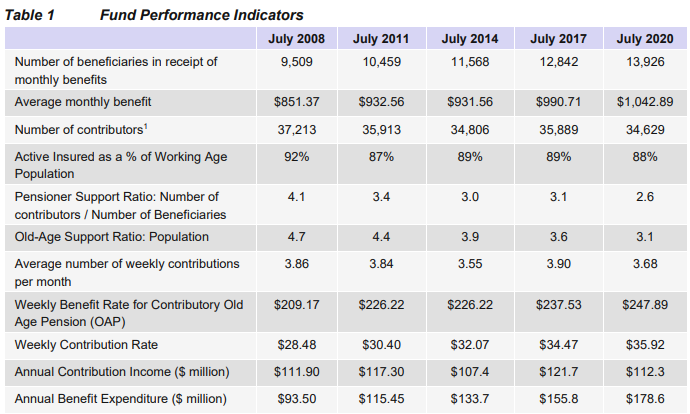

This was from Minister of Finance Curtis Dickinson as he tabled the Contributory Pension Fund Actuarial Report [PDF] as at August 1st, 2020. in the House of Assembly on Friday [Feb 4], with the Minister noting that the number of contributors has declined from 35,889 in 2017 to 34,629 in 2020, a decrease of over 1,200.

Screenshot from the report

The Minister said, “The main purpose of the 2020 Actuarial Review was to consider the implications for future contribution rates of maintaining benefits at their present levels in real terms and to consider the long-term sustainability of the Fund.

“In response to the economic challenges brought about by the COVID-19 pandemic, a temporary amendment was made to the Contributory Pensions Act allowing employees, employers [with employee consent] and self-employed persons to opt to suspend contributions for the period 1 July 2020 to 30 June 2021.

“The viability of the Fund in the short to medium term has decreased with the Fund being able to cover at least 10.5 years of the current expenditure and being positive for the next 24 years. This compares to 11 years and 29 years respectively from the last valuation.

“Even though the actuarial review is an excellent tool in overall pension management, it is must also be recognized that the financial projections for future years are based on reasonable assumptions and they should not be taken as forecasts of the outcome. The projections should be updated at successive actuarial reviews in light of the latest information available.

“Like most of the developed world, Bermuda is faced with the challenges associated with the growth of an ageing population,” the Minister said.

“The old-age support ratio has declined since the last review. The ratio was 3.6 in 2017 and is 3.1 in 2020. The ratio is projected to decline to 1.6 over the next 50 years.

“This increase in our seniors will obviously place a greater strain on the country’s pension system,” he added.

“In light of the foregoing, the recommendations by the Actuary from the report are as follows:

- Increase contribution rates at higher than 4.0% a year more than benefit increases.

- Increase the retirement age to 70 years over a predefined period of at least 8 years.

- A combination of both of these actions with real rates of return remaining steady, would extend the life of the Fund beyond 2070.

“In order to improve the projected financial position of the Fund in the long term the Ministry will carefully consider alternate scenarios included in the report, in conjunction with the recommendations of Pension Reform Committee.

“Contributions rates were increased in August 2018 and the last increase in benefits since 2019. The onset of the COVID-19 and its significant impact on businesses and individuals caused us to put on hold plans for further changes to contribution rates or benefits, for the past two years.

“We are very sensitive to the challenges faced by our seniors and the ongoing struggles of many of our businesses. Further changes in this regard, are likely to be done in response to the work of the Pension Reform Committee to ensure that it is part of a strategic, sensitive and considered solution to assist our community, while addressing the not insignificant challenges highlighted in this report.”

The Minister’s full statement follows below:

Mr. Speaker, in accordance with section 35 of the Contributory Pensions Act 1970, I am pleased to table the Contributory Pension Fund [CPF or the Fund] Actuarial Report as at August 1st, 2020.

The main purpose of the 2020 Actuarial Review was to consider the implications for future contribution rates of maintaining benefits at their present levels in real terms and to consider the long-term sustainability of the Fund. The review includes projections of contribution income and expenditure [on benefits and administration[, projections of the Fund balance [allowing for an assumed rate of investment return[, and projections of the number of years’ outgo secured by the Fund.

Mr. Speaker, the Contributory Pension scheme plays an important role in Bermuda’s pension arrangements, providing a first tier or basic pension to more than 10,960 seniors and other beneficiaries the majority of whom live in Bermuda. There are also disability pensions, and non-contributory benefits. The maximum benefit is currently about $1,500.00 per month. Altogether, some 14,050 persons currently receive benefits under the Act.

Mr. Speaker, the financial position of the Fund over the three years was below expectations, mainly due to lower-than-expected contribution income. This was offset by higher-than-expected investment income and lower than expected benefit payments.

Mr. Speaker, during the 3-year review period, 2017 to 2020, the Bermudian economy experienced minimal growth with real GDP performance averaging 0.05% over 2018-2019 [down from 1.3% over 2015 to 2017] It should also be noted that inflation [annual average Consumer Price Index] declined from an average of 1.7% over 2015- 2017 to 0.4% over 2018-2020.

Mr. Speaker, in response to the economic challenges brought about by the COVID-19 pandemic, a temporary amendment was made to the Contributory Pensions Act allowing employees, employers [with employee consent] and self-employed persons to opt to suspend contributions for the period 1 July 2020 to 30 June 2021.

Mr. Speaker, the viability of the Fund in the short to medium term has decreased with the Fund being able to cover at least 10.5 years of the current expenditure and being positive for the next 24 years. This compares to 11 years and 29 years respectively from the last valuation.

However, we would note, Mr. Speaker, that even though the actuarial review is an excellent tool in overall pension management, it is must also be recognized that the financial projections for future years are based on reasonable assumptions and they should not be taken as forecasts of the outcome. The projections should be updated at successive actuarial reviews in light of the latest information available.

The main findings of the actuarial review are as follows:

- The Fund earned a nominal rate of return net of investment expenses of 4.0% per annum and a real rate of 3.6% per annum over the three years since the last review [4.4% and 4.0% if investment expenses are excluded[. This compares with the real rate of return assumed at the previous valuation of 3.5% per annum.

- The net assets of the Fund grew 2.20% over the three years from $1.93 billion to $1.97 billion. This was 0.7% below the projected value from the previous review.

- Contribution income in 2019/2020 [$112.3 million[ was 7.7% lower than in 2016/2017 and benefit expenditure [$178.6 million] increased 14.6% over the three years since the last review.

- Total expenses for the three years averaged 0.42% of the average Fund, up from 0.37% over the previous 3 years. Total administrative costs increased during the inter-valuation period of $8.2m, $7.9m and $8.5m. Included in these costs are Investment Management fees of $5.1m, $5.5m and $6.9m for the three years 2017 to 2020, respectively. This leaves pure administrative costs remaining of $3.1m, $2.4m and $1.6m respectively.

- Pure administrative expenses averaged 0.12% of the average Fund over the 3 years [down 0.03%[, and were 0.08% of the average Fund at the Review Date compared to 0.14% from the last valuation. As a percentage of contribution income, total expenses have been relatively stable over the last 10 years at 7.2%.

- Since the last review, the number of contributors has declined, from 35,889 in the year ending 31 July 2017 to 34,629 in the year ending 31 July 2020.

- Both the benefit and contribution rates increased during the inter- review period. Benefit rates increased by 1.7%, 1.4% and 1.2% effective August 2017, August 2018 and August 2019 respectively. Contribution rates increased once over the period by 4.2% effective August 2018.

- The Fund is projected to decline steadily until it is exhausted in 2044 under the best estimate scenario. This is 3 years earlier when compared to the previous review.

Mr. Speaker, it should be noted that the funding policy for the Fund is not based on full actuarial funding, but based on sustainable funding. That is, contributions plus investment income should cover benefits and administration expenses on an annual basis while the fund builds up sufficient reserves to cover several years of benefits and expenses to withstand future adverse circumstances.

Mr. Speaker, like most of the developed world, Bermuda is faced with the challenges associated with the growth of an ageing population. The old-age support ratio has declined since the last review. The ratio was 3.6 in 2017 and is 3.1 in 2020. The ratio is projected to decline to 1.6 over the next 50 years. The comparative ratio using the actual contributors and beneficiaries of the Fund declined from 3.1 in 2017 to 2.6 in 2020. This increase in our seniors will obviously place a greater strain on the country’s pension system.

Mr. Speaker it should be noted that, in light of the foregoing, the recommendations by the Actuary from the report are as follows:

- Increase contribution rates at higher than 4.0% a year more than benefit increases.

- Increase the retirement age to 70 years over a predefined period of at least 8 years.

- A combination of both of these actions with real rates of return remaining steady, would extend the life of the Fund beyond 2070.

The CPF is the first pillar of retirement income and the benefits from this Fund, together with other pensions, are important to the ongoing financial stability and security, as well as health, of the seniors in our society. Therefore, it is recognized that it is critical to ensure the long term sustainability of this fund. Addressing this has been a key goal of this administration. In this regard, Cabinet approval was given for the appointment of McKinsey & Company to conduct a comprehensive review of the CPF [as well as the Public Service Superannuation Fund[, with a view towards developing strategies aimed at addressing the significantly underfunded nature of both funds.

Mr. Speaker, it should be noted that over the course of several months, important work has been done by the Pension Reform Committee, assisted by consultants McKinsey & Company and Morneau Shepell, and in conjunction with Ministry of Finance officials and the PFIC, on assessing the current state of the PSSF and the CPF. The work consisted in developing a common set of facts around each fund’s status, developing a preliminary set of recommendations, and engaging key stakeholders in our unions, business community and the Bermuda Government. Legal analysis of the various options is ongoing, and it is intended that these discussions will result in changes to address the critical issues in relation to funding, that have been further highlighted in this report.

Mr. Speaker, the Ministry of Finance intends to continue engaging the Government’s actuary of record, LifeWorks [formerly known as Morneau Shepell[ and any other service provider required, to provide ongoing reviews of all pensions in Bermuda. Such engagements will be appropriately shared with this Honorable House.

Mr. Speaker, Therefore, in order to improve the projected financial position of the Fund in the long term the Ministry will carefully consider alternate scenarios included in the report, in conjunction with the recommendations of Pension Reform Committee.

Mr. Speaker, contributions rates were increased in August 2018 and the last increase in benefits since 2019. The onset of the COVID-19 and its significant impact on businesses and individuals caused us to put on hold plans for further changes to contribution rates or benefits, for the past two years. We are very sensitive to the challenges faced by our seniors and the ongoing struggles of many of our businesses. Further changes in this regard, are likely to be done in response to the work of the Pension Reform Committee to ensure that it is part of a strategic, sensitive and considered solution to assist our community, while addressing the not insignificant challenges highlighted in this report.

Honorable Members are advised that the next actuary review of the Contributory Pension Fund is scheduled for the period ending July 31, 2023.

Mr. Speaker, in closing I wish to express my thanks to the members of the Pension Fund Investment Committee who give of their time and expertise to assist the Government in this work. We also appreciate the work done by the Department of Social Insurance and other areas of the Ministry of Finance in supporting the operation of this Fund. I wish to again emphasise that, as we make the decisions to address the challenges facing his pension plan, we will carefully consider the needs of both current and future pensioners in keeping with Government’s commitment to sensitive and sound fiscal management.

Thank you, Mr. Speaker.

This is basically a Government approved Ponzi scheme. The return is a disgrace and the younger people today may not even get a pension, or will have to wait until they are 70. Add up the years of contributing to the years of getting a benefit and and it really makes no sense to pay into it. Set up a personal plan and get a much better return for the same money.

Yup so true was gunna write the same thing. And you are forced by law to pay into an always broken and changing “ponzi” scheme. When does it have to come down to “humm maybe this scheme will never work no matter how we tweek it, maybe we should pay back all the money to the people that put into it and let people just manage their own retirement fund….” oh wait the money isnt probably there anyway…. a good portion of it is gone to paying all the gov staff that manage it and oh wait we needed to “borrow” some to pay for something else, or we invested in a bad investment and need to wait 10 years for it to recover…. make it make sense. If I did the same ponzi insurance scheme it would get me a criminal conviction for fraud.

Absolutely this. Make the minimum contribution to the government scheme and make private provision with pension contributions for as much as you can afford. Don’t rely on any government pension to provide for you in your old age a) the pension amount is pitiful and b) it is dependent on wider population factors outside your control.

30-6.

What were the years when the PLP, (I think under P Cox, but there may have been more than one,) when the PLP took a pension holiday, where funds were instead spent instead of going into the pension fund? At the time I knew this would have to be paid by us the taxpayer and with interest on top, now they are talking about 5 years of our life. The PLP need to be voted out.

The firt thing they should do is change the defined benefit plans to contributory pension plans. That would mean misters who benefit from the globally proven unsustainable pension plans that they enjoy and we don’t , would ease the burden on the people they serve (us). Why we have to pay for them is disgusting.

So what, move retirement to 70 and the few jobs for young people become fewer because no one retires.

So my generation paid into this plan since our 20s in good faith and now in our 60s and planning on retiring in a year or two tops, I can’t draw the pension I paid for????? So much for Seniors, we are going to be forced to work another 5 years.

There will be no jobs for young folks abs upward mobility ends because people work longer so positions do not become available.

Where are all the action groups like people’s campaign that were “so-called” not political. If this isn’t reason for them to come out of retirement and March and protest nothing will. But then again they are connected and part of the friends and family’s list so I guess they’ll get their early and padded retirement. The rest of us will continue to work so that they can live like things. What a joke this coming has become. 20 years in power and where is the godness? Premier is still on his cryptocurrency bandwagon… Which is so far return zero investment for what he has spent in trips conferences sponsorships and so forth. Well you all voted for it.

When will the minister cease Defined benefit plans. They want us to pay for their bloated pensions.

THIS RIGHT HERE ^^^^ BEST COMMENT EVER!!

Pension/ Ponzi

I understand the hard times we’ve had and also people are living longer. Those that have contributed all their life have a right to these funds. My issue lies with the Financial Assistance. I know there are persons who are desperately in need and I fully support that, but there are ones that take advantage. I would like for the Government to do a complete review of those who are getting this as I’m sure a few are getting too much, just saying…

This is what the late Mr. Burchall warned us about.

Can’t bitcoin bail us out

The screenshot shows a deficit of $66.3 million in 2020 alone.

But this is not news. The actuarial reports have been saying essentially the same thing since the 1990s and successive governments have failed to take action to stem be bleeding of the pension fund.

My suggestions are, first, put an end to final salary pensions and put all civil servants on contributory pension funds and , second, have the Government start paying its way as it goes, not spending money it does not have in the hope of finding money to pay a liability only when it falls due