Pension Funds Wary Of ‘Entrenched Board’

Bermuda-based Texan oil-drilling contractor Nabors Industries Ltd., already being sued by shareholders for its executive pay practices, faces new pressure from public pension fund systems in five American states.

Bermuda-based Texan oil-drilling contractor Nabors Industries Ltd., already being sued by shareholders for its executive pay practices, faces new pressure from public pension fund systems in five American states.

The “Wall Street Journal” reports today [Dec. 13] shareholders want to give investors more power to oust Nabors directors.

Public pension funds in California, Connecticut, Illinois, New York and North Carolina have said they have proposed giving Nabors shareholders the right to list board candidates on official company ballots, which currently list only management’s choices.

The funds collectively own about 1.7 million of Nabors’s 288 million shares. The company’s stock has lost about a quarter of its value this year.

“Nabors has a long history of poor governance, including a board that has consistently been unresponsive to shareholder concerns,” said North Carolina Treasurer Janet Cowell.

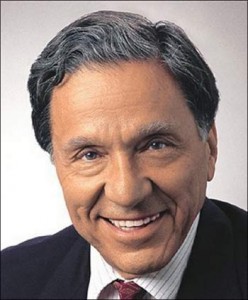

Nabors stirred an outcry this year with news that chairman Eugene Isenberg [pictured at top] would receive $100 million in cash under his contract for relinquishing his chief executive title, though he wasn’t leaving the company.

Nabors later disclosed the US Securities & Exchange Commission was looking into perks received by company executives, such as personal flights on company jets.

“Expropriating the corporate treasury to fund egregious CEO pay packages at shareholder expense is both a symptom and a consequence of Nabors’s entrenched board,” said New York City Comptroller John C. Liu. The city’s five pension funds are among the new resolution’s sponsors.

A Nabors spokesman declined to comment to the “Wall Street Journal”. The Bermuda-registered company’s operating headquarters are in Houston.

t to unseat them