Retail Sales Decrease 5.3% In December 2018

After adjusting for the retail sales rate of inflation – measured at 2.0% in December – the overall volume of retail sales declined 5.3%, according to the recently released Retail Sales Index.

“All retail sectors recorded declines in sales volume with building material stores recording the largest volume decrease of 16.3% followed by apparel stores which recorded a 15.2% decline in sales volume,” the report said.

“In value terms, retail sales decreased 3.4% to an estimated $108.0 million. Excluding Sundays, there were 24 full shopping days, the same as in December 2017.”

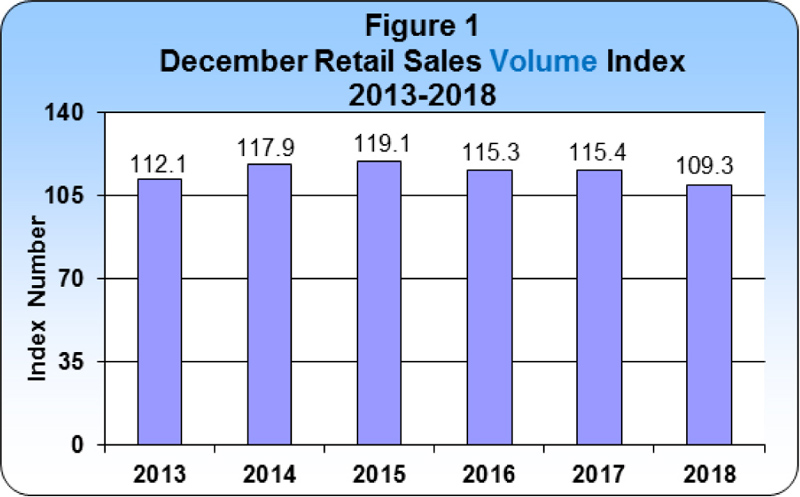

Chart extracted from the report:

Minister for the Cabinet Office Walton Brown noted that the December 2018 RSI now shows categories of selected overseas declarations that represent a combination of goods purchased directly from overseas, such as online shopping.

The Minister explained, “After adjusting for the retail sales rate of inflation, measured at 2.0 per cent in December, the overall volume of local retail sales fell 5.3 per cent.”

“The December 2018 Retail Sales Index publication now shows categories of selected overseas declarations that represent a combination of goods purchased directly from overseas, online shopping, gifts, etc.”

“Declarations by returning residents via the airport declined 4.1 per cent million to $7.0 million. However, imports by households via sea more than doubled to $2.2 million. Imports via courier and via the post office remained unchanged at $10.6 million and $0.6 million, respectively.”

The full 2018 December Retail Sales Index is below [PDF here]:

I honestly thought this reading would get a bit better once they started including online purchases, but nope. This is pretty dismal no matter how you look at it

Sugar Tax gonna fix everything

Tick tock tick tock

Down the tubes we go….

It is now 10 months of declining retail sales and the decline seems to be getting worse. To have a 5% decline in December does not look good for January onwards. Add in the increases in taxes and Bermuda’s economy is fast declining, with no positive signals. Imports from overseas means less money spent in Bermuda = less jobs. 25-11 will go down as the symbol of Bermuda’s demise.

Further proof that confidence in Bermuda continues to plummet under our glorious and all knowing PLP government. Is anywhere else in the world undergoing a home made recession ?

Smart people will continue to hold their $ close and resist spending on anything not deemed as essential as long as this lot are in .

This is what we voted for.

Here we are in another PLP home-made recession.

On the upside statue sales and mini bus rentals are on the rise.

I thought it was ‘statute’ sales?

Thanks plp everything is decreasing. Do you think it is something that you are doing wrong?

Thanks PLP!

If government keep up this taxing stuff retail will not be the only thing steadily decreasing.

Well done , wonder what Mr Brown will say this time.

Even at OBA worst they couldnt do as bad as this govt doing.

25-11

Anndddd the PLP will blame their terrible record on this soon to be announced “recession” #youhearditfirsthere

Is down, business confidence is down.

Bermuda is on the EU Blacklist.

Cayman’s economy is steaming along.

When will Bermuda wake up and address the causes for this.

Is Bermuda really open for business? Just listen to Roban’s comments earlier about Ascendant. These are not comments from a business friendly government no matter how the rhetoric is spun.

We reap what we sow.

Not to worry, the Finance Minister has accounted for the drop in retail sales with the consequent drop in revenue collected (import duty) and the risk of diminished Payroll Tax due to layoffs in his 2019/2020 budget. And still we will have a surplus!

The pay scale has been dragging behind for years. Inflation has done it’s damage along with continuous taxes at multiple

Angles and huge health deductions in our weekly Pay checks. Any wonder why I am in debt with my family and I am just

Trying to survive? Bermuda is seriously overpriced to it’s gradual demise. I still continue to hear of people moving away,

As the economy is no longer sustainable while raising a family, or you sacrifice your children for your work. SAD.

Look at the chart. 2013-2017. There is that OBA bump again. 2018. Whoops! Down the tubes we head again. 25-11. Take a look in the mirror to see who is responsible.