Document: Government Financial Statements

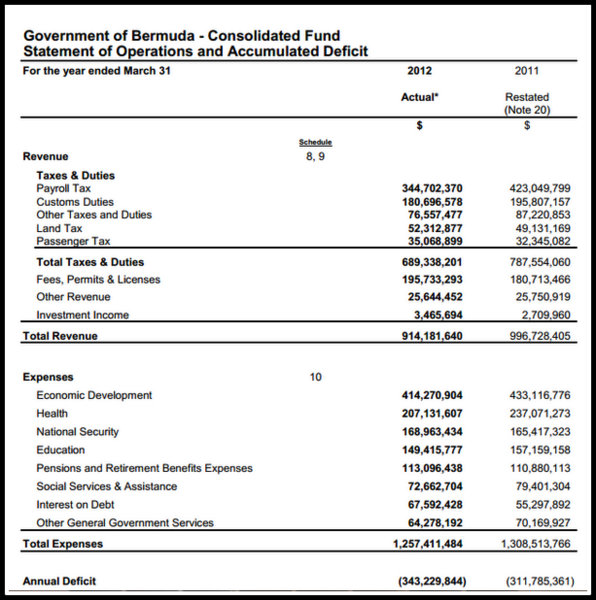

[Updated] The recently released financial statement show the Government’s revenue for the year ended 31 March 2012 was around $914 million, while total expenses were around $1.26 billion — a deficit of around $343 million.

The expenses decreased from the previous year [2011 = $1.3B] as did the revenue [2011 = $996.7M]. The Government’s biggest earner for the year ended 31 March 2012 was payroll tax at $344.7 million, followed by Customs Duties at $180.6 million.

These figures come from the Audited Financial Statements of the Consolidated Fund, which were tabled in the House of Assembly on Friday [Feb 8] by Minister of Finance Bob Richards.

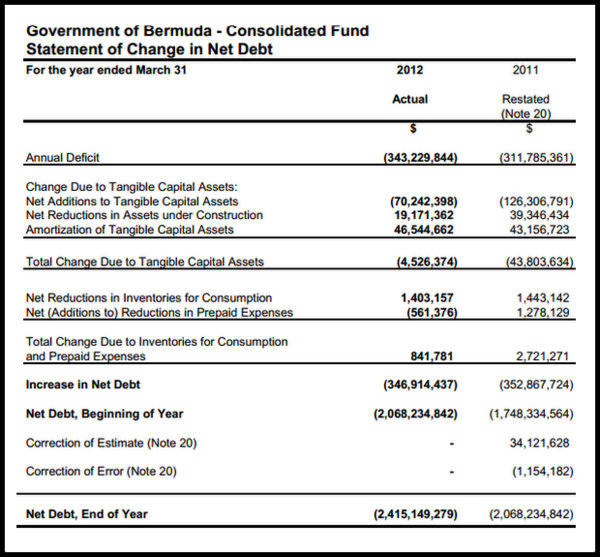

The Auditor General’s report recently referred to the $2.4 billion “net debt”, which caused some question as to why that number is so much higher than the general debt numbers often used.

The discussion of debt normally centers around the “public debt” — the amount the Government has actually borrowed and is paying interest on. The $2.4 billion “net debt” number the Auditor General used refers to both what the Government has borrowed as well as liabilities such as the Pension Fund.

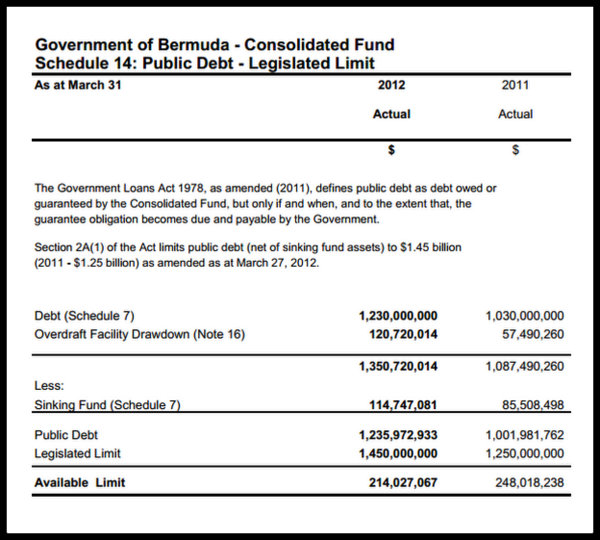

The recently tabled Financial Statements for the year ended 31 March 2012 show that the “public debt” was around $1.23 billion, while the “net debt” was around $2.4 billion.

The net debt numbers are generally included in Financial Statements. The previous set of financials [PDF here] for the year ended 31 March 2011 net debt was listed at around $2.1 billion, whereas the public debt was listed at around $1 billion. The 2010 financial statements listed net debt at around $1.75 million, and public debt at around $969.5 million.

In response to our query, Financial Secretary Anthony Manders said, “The ‘net debt’ number in the Financial Statements of the Bermuda Government Consolidated Fund [which the Auditor is referring to] includes items such as the liabilities of the Government Pension Funds and other government liabilities. The $1.4 billion refers to the funds that government has actually borrowed from lenders.”

The Government Loans Act 1978 defines public debt as “debt owed or guaranteed by the Consolidated Fund, but only if and when, and to the extent that, the guarantee obligation becomes due and payable by the Government.” The Act limits public debt [net of sinking fund assets] to $1.45 billion, which was raised from $1.25 billion in March 2012.

The financial statements released on Friday indicate the Government paid around $67.6 million in interest on the public debt — or around $185,000 per day. This is an increase from the prior year, with the 2011 statements showing around $55.3 million was paid on interest on the public debt.

The full 64-page Financial Statements of the Consolidated Fund are below [PDF here]:

Update Feb 11, 11.56am: We asked the Auditor General for additional information on the net/public debt, and she said, “In layman’s terms, the Net Debt is a result of Government’s spending exceeding its revenues over time and it represents the extent to which future revenues [and future generations] will be required to pay for past transactions [including the unfunded liability relating to pensions payable to Government employees and Ministers and Members of the Legislature].

“At the end of 2003/04, the net debt stood at $522.2 million. Four years later in 2007/08, it reached $1.1 billion and five years later at March 31, 2012 it stood at $2.4 billion.”

Read More About

Comments (38)

Trackback URL | Comments RSS Feed

Articles that link to this one:

- Weekend News, Links, Photos, Videos & More | Bernews.com | February 11, 2013

- Programmes For Financial Assistance Clients | Bernews.com | February 12, 2013

let the $hi+ show begin….

There is clearly a need for an objective discussion about the government finances.

In layman’s terms, goevernment has borrowed about $1.4bn from banks and other lenders. It also owes another $1bn for things like employee pensions.

When we talk about debt, we normally talk about the amount owed to banks etc and not the other money owed – that is standard. Therefore the extra amount referred to by the Auditor General has nothing to with theft or anything of the sort.

On this basis, any comments about theft or otherwise by the former government are ridiculous. The same follows for any comments about former Premier and Minister of Finance Paula Cox. She acted with the advice of her technical officers at the Ministry of Finance.

I disagree with the statement that “any comments about theft or otherwise by the former government are ridiculous.”

There was more than $150 million in highly suspicious cost overruns on Governemnt contracts as reported by two Auditors General. Those contracts often involved flagrant violations of the Financial Instructions laws, including the failure to tender. They also involved numerous large change orders that enabled connected contractors to charge huge mark-up for massive profits.

Unfortunately Premier Cox refused to do what other jurisdictions like the US have done–give the Auditor General the power to subpoena the books and records (including bank records) of Government contractors to “follow the money” to see if they have been giving kickbacks to those that awarded them the non-tendered contracts with massive cost overruns.

If there have been kickbacks, then that is theft.

The amount of cost overruns ($150 million and still counting) may involve some kind of fraud because no government could possibly be that incompetent. (Some of these contracts came in at 100% over the original cost estimates.)

What we don’t know is what they got in return.

By giving the Auditor General subpoena power we can follow the money to discover the last piece of the puzzle. By appointing a Commission of Inquiry we can get that information even quicker.

Now I hope all the OBA Zealots will now read and stop accusing Civil Servants of lying to people.

In an effort to focus on the financial plight of Bermuda Inc.

external bond and loan debt March 31st 2011 $1,030 million

– annualised interest cost $52 million

external bond and loan debt March 31st 2012 $1,230 million

– annualised interest cost $70 million

external bond and loan debt January 31st 2013 $1,505 million

– annualised interest cost $80 million

Assuming that the deficit has not improved since March 31st 2012, it can be expected that the Government must borrow another $300-350 million to cover the deficit for the current financial year to March 31st 2013 which will add further annualised interest of $15 million, so very soon Bermuda will have an annual interest bill of $95 million ………… out of total income of less than $900 mllion!

Forget repaying the debt any time soon. The government must cut the deficit by $350 million per year just to stop the interest payments from increasing even further.

IMHO there is very little prospect of such drastic cost cutting being feasible let alone getting to the point where the debt is reduced.

The deficit isn’t that big. The 350 million figure include pensions and other thing you don’t borrow for as they don’t cost cash.

fair comment – the overall deficit was reported at $350 million but as you say the cash deficit was currently more like $220-230 million. So my analysis is slightly skewed. But I think the message remains.

No, the $324m was actual cash expenses. Stop apologising for the inept way the country was being managed.

Typo. It was $343m.

and the deficit does not include the cost of the hospital…..that comes next year…..

@forwhatitsworth

Your post is probably one of the more accurate and sober posts about the government financial standing. I am not sure if there will be a need to borrow an additional $300m for the current year but we will see.

The important point here is that Minister Richards and the OBA must show their financial mettle with their first budget. They campaigned on opposing various government social programs including bus fares, daycare allowances, civil servant salaries and certain aspects of future care. PLP comments that such programs were necessary to soften the impact of the economic downturn were derided.

On the basis of their pre election promises, the OBA should be held to account to make immediate and drastic cuts. Let’s see if they cut the progams that have the most impact on the average voters!!

The alternative and easy way out will be to carry on the programs with the excuse that they have to in the short term. That will be political speak because there is no legal or other reason not to cut certain programs if they were so opposed to them in the first instance.

The ‘biggest fight’ for us all will be the necessary discussion about reducing Public Service salary payments. Do we simply reduce pay or do we go to a shorter work week, for example a 4 day work week? The tinkering we have seen thus far is laughable since Ministers are not driving GPs but we see senior Civil Servants all over the place in ‘their GPs.’

There are obviously more GPs for senior civil servants (i.e Permanent Secretaries) than Ministers. Lets see an elimination of GPs for the Permanent Secretaries as a start!!

I think it is in the public interest to cut public spending by at least $200m in the next financial year. Lets see how strong the OBA stomach is to make the necessary cuts… February 22 we will all know!

So you’ve gone from arguing for spending, to insisting on cuts. Interesting.

No change for me. Holding the OBA accountable for their pre election commentary.

…which you are mis representing. Pre election they said they would avoid firing civil servants. They said the debt would get worse before it got better. Suddenly you have interpreted that to mean ‘at least $200m in spending cuts’. Looks like you’re setting up a straw man.

They NEVER said the debt would get worse before it got better. They said they would REDUCE DEBT!

yes they did.

They made it clear they may have to increase the debt ceiling once they take over, depending on what they found once they saw the books. They said this several times.

@ Vote For Me: “They campaigned on opposing various government social programs including bus fares, daycare allowances, civil servant salaries and certain aspects of future care. PLP comments that such programs were necessary to soften the impact of the economic downturn were derided.”

Sir/Madam – the above statement is an outright lie which the PLP tried to perpetrate over and over again to influence the vote. The OBA absolutely did not base any part of their campaign on opposing the social programs you mention. If you can find anything in their platform that corroborates your statement, please produce it. Nor were PLP comments derided. That too is a lie.

The Govt needs to take immediate tough hard action on the deb. The Regiment should be stood down to safe 7-8 Million a year.

The police should have all officers leave barracks on go onto the economy and sell non-essential buildings such as the police station in St.Georges, The government should also sell Harmony club at least 3 million a year goes towards police barracks. Prospect should be sold and Police and Regiment can consolidate their headquearters together no need for both facilities. All government hiring should be frozen including police.

The Post office should maintain one post office east, west, central and fire the 100 non required staff. Infact all personell that can retire with 25 or 30 year should be forced retired or encouraged with a buy out package.

Increas land tax on houses. User fees for parks. Parking for motorcycles. Increase postage 35cents really is too low.

Politicians and all senior managers should take a 25% pay cut. All government workers a 10% pay cut. Bring n a VAT tax of 5%.

Bring in an entry and exit fee of $25.00 at the airport and for cruise ships per person. Increase si taxes on booze and cigarettes.

Increase fines. Police should set up teams to enforce warrants oweing an publish list in newspaper.

Create the gambling and lotto agency to regulate a national lotto scratch tickets and casiono. This would create revenue, jobs and increase tourism. They could regulate church Bingo….Bermudas real gambling legacy and other bettting venues.

Give the Harmony club to Bermuda College creta 4 year programs and maasters degrees. Bring in students to learn english, to learn in Bermuda to augment tourism lw season from Sept to April. Teach what Bermuda does best the Ocean, sailing, diving, Buisness, insurance, and a nursuing program and Law.

Immmediately suspend all consulting projects maintaining the bare minimum.

Sell Bermuda Housing units to the tenants. Sell the Atlantic condos for $200,000 and $300,000 (3 Bedroom).

Bermud needs to get moving. Grant all PRC Bermuda status. Build condos in town and sell to work permit holders and locals. Get the economy moving and excited.

Eliminate government low hangining fruit.

Only thing we need to do is fire ya a$$ for coming up with these dumba$$ ideas lmfao

So net debt went from $1.7bn to $2.4bn in two years. The PLP were hell bent on bankrupting the country.

And what was the PLP limited plan in their photo album platform…more of the same! One good thing for the Country, Richards would be too professionally embarrassed to allow for the type of Auditors Report that was just released to come out during his admin!!! Can we sue the previous administration, or at least chase some of the money???

And David Burt was still insisting in mid-January that the PLP had reduced the deficit. Was he lying or incompetent? It had to be one of the two.

Or maybe it is both, lying and incompetent!

Could somebody explain in the expenses column what the $414 million on Economic Development was actually spent on – I’m guessing it is things like BHC, ðeveloping Islamic banking excursions, Bazarian costs, etc but hopefully there will be some things more substantive. In any case, I think it fair to remark that surely a lot of Economic Development falls into capital expenditure and should therefore be depreciated over several years (I told you I was being fair).

Over how many years would you depreciate the $60,000,000 pier in Dockyard? One, two?

Another $22,000,000 to fix that little problem.

Read the Full document. Page 51…

Some comments on here are so stupid!

READ!

@ Victor

You will need to rview page 51 of the financial statements. Use the bernews link above to the .pdf version of the statements

Cut the (job for life) civil service, cut the no longer needed post office and the non productive works and engineering, and ask the civil servants making over 150k to take a cut, their services dont warrant such high salaries, get rid of the cash bleeding quango’s and why not stop dressing all your civil servants in expensive embroidered golf shirts, let them buy their own clothes saving us money and stimulating in a small way the clothing or duty sectors of our economy.

Hey u got a good point- look at how long they take to build a wall- sometimes up to 6 months- if they was doing it for themselves it wouldnt even take 3 weeks.just a waste of tax payers money-

The arguments on the level of public debt is simply a smokescreen.

Why is no one debating the fact that the is the fourth consecutive qualified audit issued by the AG, the numerous “financial instruction” breaches or the fact that monies still can’t be accounted for regarding capital projects etc.?

The debt is there and can’t be simply eliminated.

The fact that this is the fourth consecutive qualified audit and the highlighting of financial instructions have been persistently breached is the real story.

If she didn’t believe the numbers she would have given no opinion. Stop making things sound worse than they are.

It is quite obvious you don’t have a clue about how auditing works. If a company that received one qualified audit it would result in the sacking of teh CFO and possibly the CEO.

Or maybe you forgot to read this part:

“For the Government not to present complete and accurate financial statements for audit within six months after its year end is not in keeping with current international practice for good government accountability,” she said.

“This unacceptable delay resulted in Members of Parliament and the public not having timely access to important information.”

Mrs. Jacobs Matthews noted that her audit opinion on the financial statements of the Consolidated Fund for the year ended March 31, 2012 was qualified, as it had been in the previous three years, due to “serious deficiencies in internal control over the management of various development projects that occurred in the year ended March 31, 2009.”

She explained that the “deficiencies led her to question the appropriateness of certain transactions and the underlying value of assets as at March 31, 2009.”

@Truthsayer dumb ideas well I do not see you sugggesting anything relevant. These ideas would actually work and is the most likely course of action of the government.

@ Not Fooled: “Stop making things sound worse than they are.”

Sir/Madam: So sorry to let you know: They ARE worse and look to get even worse still. There is not enough money to pay people’s pensions – that is, the money you and I paid into the pension fund, that was deducted from our paychecks to be held for us when we are too old to work – MOST OF IT ISN’T THERE!! They used it for something else – who knows what!

There are no jobs for a lot of us, much less for our children, while folks blithely talk of cutting more jobs. There is little money for Financial Assistance for those already out of work. The Union can’t/won’t help. The programs that used to help got their funding cut last year and the year before. People are struggling to keep the roofs over their heads. Many children, and their parents too, start the morning with no breakfast, and maybe had no dinner the night before.

Perhaps you haven’t been listening for the last year or more when people were talking about this. Hopefully, you get it now and are as concerned as the rest of us. I really hope so. This isn’t about party. This is about survival.

Hmmmm….. What will happen now?