Report Calls Bermuda “Notorious” Tax Haven

“Approximately 60 percent of companies with tax haven subsidiaries have set up at least one in Bermuda or the Cayman Islands, two particularly notorious tax havens,” according to a new report from the Citizens for Tax Justice.

The report [PDF] from the Citizens for Tax Justice, which international media call a left leaning organisation, and Bermuda receives some 167 mentions, while Cayman Islands has 170 mentions, Singapore has 232 mentions and Switzerland has 185.

The report’s executive summary said, “U.S.-based multinational corporations are allowed to play by a different set of rules than small and domestic businesses or individuals when it comes to the tax code.

“Rather than paying their fair share, many multinational corporations use accounting tricks to pretend for tax purposes that a substantial portion of their profits are generated in offshore tax havens, countries with minimal or no taxes where a company’s presence may be as little as a mailbox.

“Multinational corporations’ use of tax havens allows them to avoid an estimated $90 billion in federal income taxes each year.

“Congress, by failing to take action to end to this tax avoidance, forces ordinary Americans to make up the difference. Every dollar in taxes that corporations avoid by using tax havens must be balanced by higher taxes on individuals, cuts to public investments and public services, or increased federal debt.

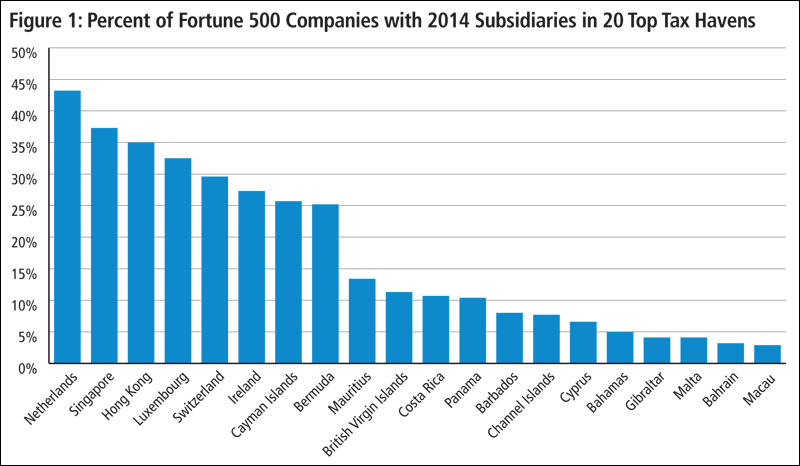

“This study examines the use of tax havens by Fortune 500 companies in 2014. It reveals that tax haven use is ubiquitous among America’s largest companies and that a narrow set of companies benefits disproportionately.

“Most of America’s largest corporations maintain subsidiaries in offshore tax havens. At least 358 companies, nearly 72 percent of the Fortune 500, operate subsidiaries in tax haven jurisdictions as of the end of 2014.

“All told, these 358 companies maintain at least 7,622 tax haven subsidiaries. The 30 companies with the most money officially booked offshore for tax purposes collectively operate 1,225 tax haven subsidiaries.

“Approximately 60 percent of companies with tax haven subsidiaries have set up at least one in Bermuda or the Cayman Islands — two particularly notorious tax havens.

“Furthermore, the profits that all American multinationals — not just Fortune 500 companies — collectively claimed they earned in these two island nations in 2010 totaled 1,643 percent and 1,600 percent of each country’s entire yearly economic output, respectively.”

The report also states, ” In 1999, the profits American multinationals reported earning in Bermuda represented 260 percent of that country’s entire economy. In 2008, it was up to 1,000 percent.”

Chart extracted from the report:

Finance Minister Bob Richards has addressed the “tax haven” accusation on multiple occasions, once saying: “If there are problems with the UK, the US or anybody in Europe collecting their taxes, it’s because their system is deficient, not because we’ve done something wrong.

“We haven’t set up our country to be a tax haven. The situation we have in Bermuda is that we have a tax structure that goes back over 150 years.

“We haven’t changed our tax system in 150 years so it has to do with the tax systems in the developed countries. If there’s a revenue shortfall, it’s the tax systems in these countries,” said Minister Richards.

In addition, Britain’s Prime Minister David Cameron said he does “not think it is fair” to refer to Overseas Territories as tax havens, as “they have taken action to make sure that they have fair and open tax systems.”

I wonder how many tax deductions (legally) the producers of this report claimed. Any and they are hypocrites.

lol I’m more concerned by the fact that Bermuda was mentioned less than all those other countries….our competition is getting past us!

Picture on the front doesn’t look Like Nederlands (Holland) or any of the top 6 in their chart.

“Notorious”? Shall we sue for libel? Min. Richards can take charge!

It’s not Bermuda’s fault! It’s those countries damn faults for not sorting out their own tax affairs!