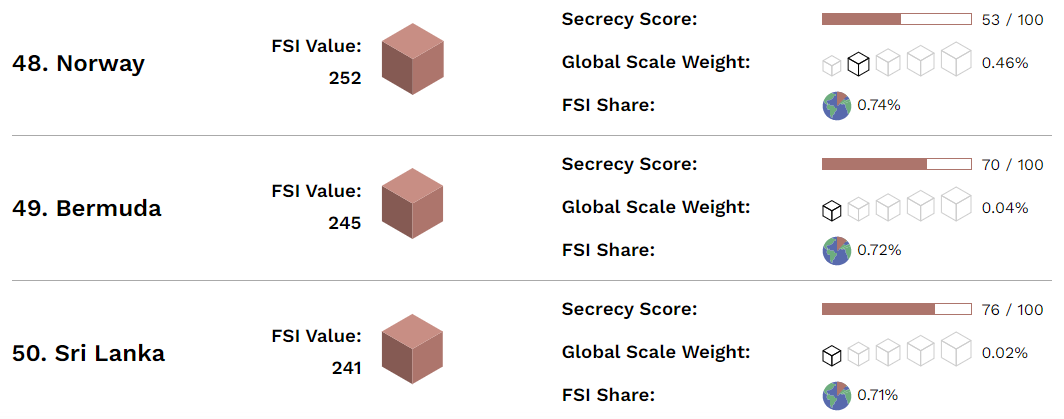

Tax Justice Network Ranks Bermuda 49th

The Tax Justice Network’s Financial Secrecy Index 2022 was published today, with Bermuda ranked in 49th, and the organisation ranking the United States in first, with their statement saying “the US now fuels more global financial secrecy than Switzerland, Cayman and Bermuda combined. ”

The organisation said, “The US has climbed to the top of a global ranking of countries most complicit in helping individuals to hide their wealth from the rule of law, earning the worst rating ever recorded since the ranking began in 2009. The Tax Justice Network’s Financial Secrecy Index 2022, published today, reports that the supply of financial secrecy services, like those utilised by Russian oligarchs, tax evaders and corrupt politicians, has continued to decrease globally due to transparency reforms. But five G7 countries alone – the US, UK, Japan, Germany and Italy – are responsible for cutting global progress against financial secrecy by more than half.

Screenshot from the ranking on their website

“The G7 countries’ undermining of global transparency has further fuelled calls by leading economists for a UN tax convention that moves rulemaking on international tax and finance out of the hands of the few rich countries who have repeatedly been shown to be some of the world’s biggest tax havens.

“The Biden administration took unprecedented action within its first few months in office towards curbing rampant corporate tax abuse by multinational corporations by championing a global minimum tax rate. In his first public address to congress, on the eve of his 100th day in office, President Biden called out Switzerland, Cayman and Bermuda’s roles in enabling multinational corporations to abuse tax: “A lot of companies also evade taxes through tax havens in Switzerland and Bermuda and the Cayman Islands.”

“The US now fuels more global financial secrecy than Switzerland, Cayman and Bermuda combined. In a separate study published in November 2021, the Tax Justice Network reported that the US is responsible for costing the rest of the world $20 billion in lost tax a year by enabling non-residents to hide their finances and evade tax.

“The US adopted a historic transparency law in January 2021 requiring beneficial owners of corporations to be identified and registered, however, due to limited definitions of which legal entities and beneficial owners must register, 23 baked-in exemptions to registration, and an absence of requirements on all trusts, the law did not produce a significant secrecy score improvement for the US on the index.”

“Bermuda ranked in 49th, and the organisation ranking the United States in first”

With over 200 self-governing jurisdictions in the world, we are now in the top 25% of good ones and our main trading partner, the United States, leads the bad ones. Bermuda is another world.