Column: What Happened Between 2006 – 2016?

[Opinion column written by Larry Burchall]

To get the maximum value from your next few minutes of reading, do not – I stress – do not mentally insert or allow the entry into your mind of any of these acronyms or words: OBA, PLP, BDA, UBP, NLP, black, white. Keep all those words and acronyms out of your mind.

If you can do that, you will be able to see and read the numbers as numbers, in the same way that a physician reads a blood pressure gauge. You will then begin to see the story told by those arbitrary numbers.

If you cannot do that, you’ll cloud your own mind, mess up your own vision, and you’ll get no value whatsoever from your next few minutes of examining what is a clinical look at Bermuda, its machinery of Government, its national workforce, and its economy.

Statement on numbers – Except for the ResPop figure for 2006, all numbers are either calculations or are drawn from Government accounts.

Government Finances

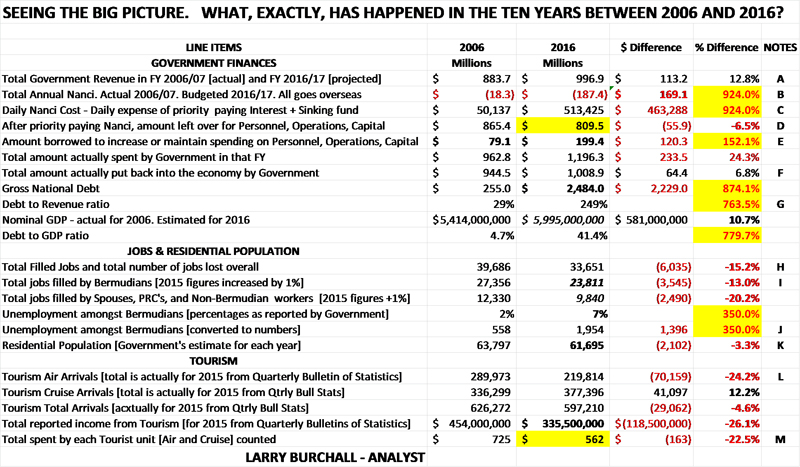

A – In ten years, Government revenue has increased only 12.8%. From $883.7m actual for 2006/07, to $996.9m projected for 2016/17. That means revenue was increasing by 1.2% a year.

B – [1] Increasing 26.2% a year, Nanci was rising over twenty times faster than revenue. Nanci’s rise cancels the effect of the rise in general revenue. You can see that in 2016, Nanci’s daily cost was over nine times higher than just ten years earlier. Nanci’s Usain Bolt rise outpaced the much slower growth in revenue. [Nanci = Debt Service Cost = Interest on Debt + mandatory annual contribution to the Sinking Fund.]

[2] Nanci has mushroomed from a manageable $50,137 a day in 2006 to 2016’s un-manageable $513,425 a day.

C & D – The money that Government actually has with which to pay for Personnel, Operations, and minor Capital has decreased. It was $865.4m in 2006, but only $809.5m in 2016. In each of those ten years, Government compensated by increasing its borrowing. $79.1m borrowed in 2006. $199.4m borrowed in 2016. Over those ten years, the quantity of dollars available for spending on Personnel, Operations, and minor Capital was DECREASING by 0.7% a year.

E – [1] In 2006, after extracting $883.7m in taxes from the economy, priority feeding Nanci at $18.3m, and borrowing a top-up of $79.1m – Government actually put $944.5m back into the economy.

[2] In 2016, after extracting $996.9m in taxes from the economy, priority feeding Nanci at $187.4m, and borrowing a top-up of $199.4m – Government should end up putting about $1,008.9m back into the economy.

[3] In those ten years, and by 2016, Government’s economic stimulus impact through normal Government spending [Government ‘put back’] within the economy, was growing at 0.66% per annum. So in ten years, Government ‘put back’ is up only 6.8% overall. Given the impact of inflation, this actually works out to be a negative. It has been a drag on economic growth. This Government spending pattern with its negative impact became visible and obvious only after 2008. During the period 2006 – 2016, Government was extracting too much and putting back too little. However strong economic growth between 2006 [and before] and 2008 concealed that imbalance.

F, G – In 2006, in theory, Government could have paid off the whole National Debt by using 3.5 months of its revenue [3.5 months is 29% of a year]. However, in 2016, it would take 30 months of current projected annual revenue to achieve a similar pay-off.

Jobs and Residential Population

H, I, J – The national jobs picture is stark. The 2006 to 2016 comparison points up these numbers:

- [1] In 2006, there were 39,686 filled jobs in Bermuda. In 2015, there were 33,319 filled jobs in Bermuda. A job loss of 6,367.

- [2] In 2016, with a 1.0% improvement, there could have been about 33,652 filled jobs in Bermuda.

- [3] In 2015, there were 3,780 fewer Bermudians filling jobs, as well as around 1,950 Bermudians who were on-Island and reported as unemployed. With a 1% improvement in 2016, there could be about 23,811 Bermudians filling jobs – an increase of 236 jobs filled by Bermudians.

- [4] In 2015, there were around 2,587 fewer non-Bermudians filling jobs in Bermuda. With a 1% improvement in 2016, there could be about 9,840 non-Bermudians filling jobs – an increase of 97 jobs filled by non-Bermudians.

- [5] Overall, in 2016, there are likely to be 6,035 fewer jobs available in Bermuda for anybody to fill. That number assumes a 1% improvement, which points to 6,035 jobs filled in Bermuda.

- [6] In 2016, Bermuda suffers from structural unemployment. This is new to Bermuda. It is a more difficult problem than the old familiar problem of ‘seasonal’ unemployment so characteristic of a seasonal Tourism industry.

- [7] Special note:- At an improved 23,811 in 2016, the total number of jobs filled by Bermudians would still be significantly lower than the total number of jobs filled by Bermudians a generation ago in 1981 when it was reported as 24,191.

K – Residential Population [ResPop];

- [1] Government has not measured or calculated ResPop for each of the years 2001 to 2009. However, for 2006, separate calculations show that ResPop was likely around 65,000/66,000 in 2006; and ResPop rose to 68,000/69,000 in 2008.

- [2] Government has reported that ResPop was 64,237 at Census in 2010; 61,954 in 2014; and 61,777 in 2015.

- [3] Government recently reported a 2016 ResPop of 61,695. ResPop in 2016 remains lower than the ResPop counted in Census 2000 [Census 2000, ResPop was counted as 62,059].

- [4] Overall, from real ResPop of 68,000/69,000 in 2008, there would have been about a 10% ResPop decline. From real ResPop of 65,000/66,000 in 2006, there would be a 5% ResPop decline. Either decline is economically significant.

- [5] Any country with a significantly declining ResPop will have a declining economy. This happens because a significant ResPop decline results in an overall decline in all consumer demand for all goods and all services.

Tourism

L, M – [1] Tourism is hanging on. Total Arrivals are holding near the 600,000 mark. However the balance has swung with a decrease in Air Arrivals and an increase in Cruise Arrivals. The split between total Air and Cruise Arrivals is now 63% Cruise to 37% Air. That’s the reverse of the forty year pattern between 1960 and 2003.

[2] Spending by Tourists is down absolutely. The average spend per Tourist in 2006 was $725. The average spend per Tourist in 2015 was $562. Down 22%.

[3] The reduction in average spend per Tourist is explained and confirmed by the fact that total income from Tourism in 2016 had fallen to Tourist income levels last seen in the 1980’s.

General Comment

Squeezed by flat-lining Government revenue and fast-rising Nanci, in 2016, Bermuda’s economy is in the doldrums. Any growth is partly stifled by Government’s increasingly desperate grab for cash revenue. Without adding materially to ResPop, Bermuda’s economy will continue to wallow and wobble around a nominal GDP between $5.8bn and $6.3bn.

If Government is to feed Nanci [currently $187m a year], pay Personnel [currently $472m a year], pay for Operations [currently $450m a year], and sustain minor Capital spending [currently $87m a year] then Bermuda’s economy must grow past GDP of $7.0bn GDP [nominal]. If $7.0bn GDP [nominal] is reached, Government should have revenue [at 17% tax uptake] of $1.2bn.

Specific Comment on the Airport: At this juncture, any surrender of Revenue for anything, as is currently proposed for the Airport, will negatively impact and worsen the Government’s overall bad revenue situation. Review Notes A, B, C, & D and you can work out the final impact of a $37m revenue surrender for yourself.

Any ‘economic stimulus’ from construction work at the Airport will be small. It will not and cannot replace or materially compensate for Government’s reduced revenue stream.

With Airport work planned over 3.33 years [40 months], the economic stimulus from the maximum $150m that will actually be spent in and remain in Bermuda works out to about $45m a year. Given a high GDP multiplier of 2.00, that multiplier creates a $90m annual boost in nominal GDP. At 17% or 18% Government tax uptake, that additional $90m in nominal GDP can only provide an additional $15m to $16m a year in tax revenue to Government. This $15m to $16m increase in tax revenue does not compensate for the $37m annual revenue surrender.

In 2015, and again in 2016, the government appointed Fiscal Responsibility Panel have said that the Airport revenue surrender should be treated as an additional and new expense.

Tax increases, severe cuts, or continued borrowing are the only three options that can compensate for the net loss in Government’s existing revenue stream.

With the economy in the state that those arbitrary numbers have just described, any significant tax increases by Government will stultify any growth in the economy.

- Larry Burchall

20 Most Recent Opinion Columns

- 09 Jan: Column: Social And Economic Empowerment

- 09 Jan: Column: ‘Our Island’s Future Is In All Our Hands’

- 08 Jan: Column: Differences Resolved Through Dialogue

- 06 Jan: Column: ‘Opportunities That Will Benefit Us All’

- 05 Jan: Column: How To Plan For Early Retirement

- 03 Jan: Column: ‘Bermudians Get The Highest Priority’

- 03 Jan: Column: Taking On AME Is A ‘Losing Proposition’

- 03 Jan: Column: ‘Fences Is An Intense, Must-See Movie’

- 21 Dec: Column: ‘The Numbers Speak For Themselves’

- 18 Dec: Column: Innovative Leadership Development

- 16 Dec: Column: PLP C#26 Candidate Neville Tyrrell

- 16 Dec: Column: OBA C#26 Candidate Robyn Swan

- 16 Dec: Column: IND C#26 Candidate David W. Burch

- 15 Dec: Column: ‘Gatekeepers Of Blue-Chip Reputation’

- 14 Dec: Column: Healthy Living Cuts Heart Disease Risk

- 13 Dec: Column: 7 Words That Could Make A Difference

- 12 Dec: Column: Bermuda Is Unique, Not A Tax Haven

- 12 Dec: Junior Food Critic Review: Casablanca

- 09 Dec: Column: Rolfe Commissiong On A ‘Rich Legacy’

- 07 Dec: Column: Knowing How To Manage Your Debt

Opinion columns reflect the views of the writer, and not those of Bernews Ltd. To submit an Opinion Column/Letter to the Editor, please email info@bernews.com. Bernews welcomes submissions, and while there are no length restrictions, all columns must be signed by the writer’s real name.

-

To be politically fair, can we also have the comparatives for 2012 in your analysis?

Sounds like you want it both ways Larry. You say that we need to grow our GDP, but then say that the any economic stimulus from the airport will be minimal. Is this piece really political party neutral as you start out? Because at the end, you still imply that the airport is a bad deal.

The OBA has been met with opposition, from well, the opposition on every single measure they try to implement to increase our GDP. The AC, the airport, concessions given to hoteliers for St. Georges and Morgans Point.

The debt situation was handed over to the OBA on a platter, and there was not much else they couldve done other than borrow more money to meet obligations.

Honest question for you: if the PLP won the 2012 election, do you think the 2016 figures would be any different than what they are?

” Is this piece really political party neutral as you start out? Because at the end, you still imply that the airport is a bad deal.” – to be fair you don’t have to be a PLP-supporter to dislike the airport deal, or an OBA-supporter to like it.

So whats the effect if government doesn’t build the airport and just keeps fixing the old one up?

Annnnnnnnnnnnnnnnnnnd the reason behind this is: PLP/UBP!

Ok, so we had both a secular and cyclical downturn in the economy circa 2007. Spending like money grew on trees without comprehending Warren’s statement ” we find out who is swimming naked when the tide goes out”. The OBA was elected as capital and confidence was on the run and deficits and organizational skills were exploding and lacking. Initiatives like the SAGE report took place and the patient was in OR to stop bleeding and manage finance. As we know that growth in an economy comes from population and or productivity growth. Government has been trying to create more efficiency in its operations since then, with success and has regained capital investment confidence. Efforts to cut Government payroll costs were blocked mostly, and then they attempted to grow population through pathways to status- which I guess you made a lot of pro noise about. Now we are in a position to get off our back foot and start punching with our weight forward- a new and much needed disposition and airport gateway is needed- your $37 mil number is bogus and has been delineated to you- yes we are keeping 18 mil of costs but they are taking 10 mil and much more in operating/management and maintenance costs. Yes we need to raise nominal GDP, but the measured approach with a shift of gears here is appropriate.Not sure what you think is the way to move forward but I have heard a big fat zero about solutions from anyone but Government.

You need to show the years leading to 2016. That is extremely misleading. The ups and down’s didn’t just happen overnight. 2006 is prior to 2008 when the entire world experienced a huge shift in funds, of course ’06 is going to look good, 2016 is still cleaning up the mess of ’08, years later.

Nice idea, poorly executed.

Would have been useful to see split between 2013 and 2016. I’d be vary curious to see this comparison.

Bermuda

So Larry beyond not building an airport (which would have to be heavily patched instead!) What do you recommend?

He has been pointing out for years that without big government spending cuts, debt interest will eat up more and more of the budget and hurt more and more of the economy. The longer that serious cuts are put off, the worse the cuts will be when they finally come.

I understand the need to apply the KISS principle but what we have is two snapshots. One before the wheels came off the bus & one after the wrecker arrived to salvage the remains of the driver induced crash.

It would be nice to see the timeline & some of the skid marks as the bus went into the ditch.

Capt. Burchall,

I would like to inquire as to what solution you propose for the airport. I’m not thrilled with the OBA’s plan but realistically what alternative do we have?

If we borrow $200 million to renovate the current airport that will add at least $10 million a year in debt servicing costs for the interest alone.

What alternatives do we have?

I was with you til the ‘Stultify’.

Thanks for the article Larry.I bought into the first part about reading with a open mind free of politics…and I tried to digest it line for line.

I feel let down that you slammed the airport in the last paragraph which is about the most political topic of the new year. But wait, you asked the reader to be politically neutral…there is no mention of the author avoiding politics.