Financial Centres ‘Will Tremble Before IRS’

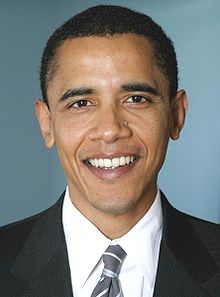

An Irish economics lecturer says his country, Bermuda, the Netherlands and other “tax havens” which allow multinationals corporations to shift profits through their financial systems will almost certainly be targeted if US President Barack Obama wins re-election in November.

An Irish economics lecturer says his country, Bermuda, the Netherlands and other “tax havens” which allow multinationals corporations to shift profits through their financial systems will almost certainly be targeted if US President Barack Obama wins re-election in November.

Writing in the “Irish Independent” today [Mar.6], University of Limerick lecturer Steve Kinsella says international financial centres like Ireland and Bermuda are slow to recognise they are now being branded as “tax havens” by the cash-strapped US administration.

“So let’s say it out loud: Ireland is a tax haven,” he said. “Tax havens exist to allow large sophisticated companies to pay less tax by funneling profits through financial intermediaries. Ireland, along with the Netherlands and Bermuda, are all modern tax havens.

“Our leaders may bristle at the pejorative phrase ‘tax haven’. They point out that Ireland isn’t exactly like a tax haven, in that it doesn’t share certain features of a textbook tax haven .. However, if you recognise that Ireland is a tax haven, then you must be aware of the threats we face as one.”

Mr. Kinsella said Ireland– struggling to recover from a dramatic economic decline in recent years — should be less worried about the price of oil or International Monetary Fund restrictions on its budget than President Obama, a national hero in a country where he can trace some of his roots.

“We will tremble before the US Internal Revenue Service,” he says. “Noises are being made as part of the US presidential election. The fact that so many US multinationals are availing of tax havens abroad is beginning to dawn on a cash-strapped US administration.

“If re-elected, Obama may close off the dozens of tax loopholes multinationals currently use, cutting Ireland’s recovery off before it starts.”

Last month the Obama administration took aim at so-called corporate tax havens including Bermuda in a proposed overhaul of the US corporate tax system which would lower the tax rate for companies and try to encourage job creation in the United States.

US Treasury Secretary Timothy Geithner expressed disdain for the current business tax system, calling it “uncompetitive, unfair and inefficient” and riddled with special favours.

According to the “Wall Street Journal”, the White House plan would eliminate “dozens” of tax loopholes and use the savings to lower the top income-tax rate for corporations to 28% from 35%.

To stop multinationals from shifting profits to low-tax jurisdictions including Bermuda and Ireland, the administration would set out the rate for the new minimum tax on foreign earnings.

Upward of $100 billion in taxes are avoided annually by big corporations by booking their profits outside the US in offshore financial centres like Bermuda, the Netherlands and Ireland.

Corporate tax avoidance became a hot-button issue in the US last year after the Bloomberg financial news service revealed details of Internet giant Google’s use of a network of off-shore financial centres including Bermuda to cut its tax bill by more than $3 billion in three years.

Google’s decision to funnel profits through domiciles like Bermuda was criticised by politicians, business leaders and commentators in both America and the United Kingdom.

Recently the US Senate Permanent Subcommittee On Investigations issued highly critical report on the subject, citing multinationals’ use of Bermuda along with such other financial centres as the British Virgin Islands, the Cayman Islands and Switzerland to reduce — or entirely eliminate — their American tax bills.

Will the last person left in Bermuda , please turn off the lights .

People like you really get my goat! First off Bermuda is over 400 years old and has gone through much change. We are a tough bunch of people who can and will endure no matter what. So you go along to wherever you feel will be your utopia and live happily ever after!

Where are all of those “I Love Obama” t-shirts that I saw so many of 3 years ago – - not being worn by American expats, I might add!!!! Hmmmmm? Why don’t you all dig those shirts out now and wear em’ proud??? Hmmmmmm?

This “offshoring” was created by the IRS/convoluted US tax system and an Irish tax loophole, Bermuda is just the conduit. Each sovereign country should be able to chose who they tax and how much.

Explain to me why the US should be entitled to overseas tax revenue on these companies foreign domiciles anyway? The US tax system is protectionist and backward, we all work in a global community now.

http://www.businessweek.com/technology/google-tax-cut/google-terminal.html

propoganda is missing the point. These companies avid paying taxes in any country!