Column: Looking At The Airport Figures

[Opinion column written by Larry Burchall]

On this Airport scheme, with nicknames, accusations, and “no numbers” whizzing or not whizzing about, let’s get to basic figures.

One: There are real numbers. The numbers exist now. The numbers are set out in Government’s own published accounts: “Approved Estimates of Revenue and Expenditure for the Year 2015/16”. [Let’s call that AERE15/16]

Two: From AERE15/16 – The Airport’s projected Revenue for 2015/16 is shown as $30,818,000. $20,000,000 comes from Departure Tax [upped in this FY from $35 to $50]; and $10,818,000 from aircraft landing fees and a miscellany of other charges.

Three: From AERE15/16 – The Airport’s projected Expenses are $19,331,000. Consisting of $3,312,000 for Maintenance; $6,966,000 for Terminal Operations and Finance/Administration; and $9,053,000 for Air Operations [Air Traffic Control, Weather, Runway maintenance, Perimeter Security]. There is also a $2,900,000 expense for the mandatory and internationally required dedicated BFRS Airport Fire/Rescue service. However, this BFRS expense is not specifically allocated to the “Airport” under the Airport expense head. It is handled, separately, as a purely BFRS expense.

Four: From AERE15/16 and primary school arithmetic – The Airport Profit [Revenue minus Expenses] is projected to be $30,818,000 minus $19,331,000 equals $11,487,000 for 2015/16. So the basic annual NET profit is $11,487,000. [Really, though, it is actually the gross profit because the essential – cannot operate the Airport without it - BFRS expense is not included.]

Five: From the Minister [Go to the second video in the Bernews report of the March 31st 2015 Town Hall meeting in St George] – After a new build, the CCC/Aecon scheme will result in Aecon receiving all the Revenues and carrying all the Air Terminal and Terminal maintenance expenses from the Airport over the next 30 or 35 years [30? 35? Not terribly important. I’ll use both figures].

Six: From the Minister – By giving Aecon all the Revenue and ALL the Expenses from the Airport, Aecon will receive thirty or thirty-five years of Revenue; but will also carry thirty or thirty-five years of the expenses. By simple arithmetic, Aecon will receive the net of Revenue minus Expenses: $11,487,000 x 30 years = $344,610,000 or $11,487,000 x 35 years = $402,045,000.

Seven: From the Minister – After a new build, Aecon will not carry any Air Operations or Fire/Rescue expenses. So Aecon will not carry the $9,053,000 expense pack shown and set out in Fact Three. So instead of carrying $19,331,000 in expenses, Aecon will, after a new build, only carry: $19,331,000 minus $9,053,000 = $10,278,000 in Air Terminal and Finance/Admin expenses.

Eight: By arithmetic – The adjusted new build Revenue and Expense numbers become: Revenue [overall] $30,818,000 minus Air Terminal & Finance/Admin expenses $10,278,000 = New Net annual profit received by Aecon will be $20,540,000.

Nine: By arithmetic – The Revenue giveaway to Aecon becomes $20,540,000 x 30 years = $616,200,000 or $20,540,000 x 35 years = $718,900,000.

Ten: Simple logic – After considering Facts Two to Nine, it is obvious that after a new build by Aecon, the Bermuda Government [us taxpayers] will retain financial responsibility for: Airport Operations at $9,053,000 and BFRS cover at $2,900,000. By arithmetic, this totals $11,953,000 a year. Over 30 or 35 years that’s $358,590,000 or $418,355,000 that the Bermuda Government will pay to support and maintain the Airside operations at the LFW International Airport. Aecon will handle the passenger moving tasks and Terminal maintenance, and are projected to receive at least $616m or $718m in clear profit.

Eleven: From AERE15/16 – Airport Departure tax revenue in 2014 was $13,410,000. By simple arithmetic, at $35 a head, this tax revenue was generated by 383,000 persons who departed through LFW.

Twelve: From the BTA – In 2014, Bermuda had 225,000 Air Arriving tourists. Simple logic and common sense – each tourist Air Arriver converts to one tourist Air Departer.

Thirteen: Simple logic – In 383,000 people paid Departure Tax. Of these, 225,000 were departing tourists. Therefore 158,000 Departure Tax paying people had to be local residents.

Fourteen: Simple Arithmetic – Since 158,000 [40%] of the people who paid Departure Tax in 2014 were local residents, some 40% of that year’s Departure Tax revenue was actually generated by local residents. [In 1981, local residents generated just under 20% of the total Departure Tax.]

Fifteen: A concealed fact – The 2015/16 $35 to $50 hike in Departure Tax is also a hidden tax on local residents who provide 40% of the total Departure Tax that Government receives. From AERE15/16, the $20 million in projected Departure Tax revenue will come from a hoped-for increase in Tourist Air departures – about $12m from 240,000[?] Air Departing tourists. The remaining $8m will come from local residents. So for 2015/16, locals got a well-concealed $8m tax increase.

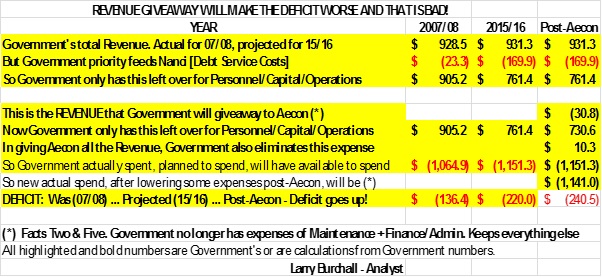

Finally: Government would be giving away desperately needed revenue. In abstract numbers, the chart shows the Government’s really deep dilemma. You should see that the ultimate impact of the proposed Airport Scheme is that it increases the annual Deficit, thereby worsening the national Debt and national economic problem. This deficit worsening happens because of the Revenue giveaway. Study the chart carefully.

Specially note that Government’s projected dollar revenue for 2015/16 is just marginally higher than Government’s dollar revenue of eight years ago in 2007/08.

Specially note also that after feeding Nanci, Government’s net or spendable projected 2015/16 dollar Revenue falls way below [15% below] the spendable [net] revenue of eight years ago, 2007/08. That means that a $31m revenue giveaway by this Airport scheme will worsen an already desperately bad national financial situation and would, for instance, take 2015/16’s net dollar revenue down to 20% below the net dollar revenue from eight years ago.

And then there are inflation and cost and price increases since 2007/08.

As currently proposed, this Airport scheme is really, really, unwise. In the Bermuda Government’s current and near future revenue circumstances, it is – or would be – a new peak of strategic national fiscal imprudence.

- Larry Burchall

20 Most Recent Opinion Columns

- 28 Sep: Column: Firms A ‘Watershed For Our Jurisdiction’

- 25 Sep: Column: Visors? Let’s Tackle Young Jobless First

- 21 Sep: Column: 21st Century Workforce Development

- 21 Sep: Column: Vic Ball On Union & Govt. Relationship

- 18 Sep: Junior Food Critic Review: Rustico In Flatts

- 17 Sep: Column: Michael Weeks On Dark Helmet Visors

- 17 Sep: Column: “Will There Be A Tech Backlash?”

- 17 Sep: Column: Burchall On Looking Forward Until 2017

- 11 Sep: Column: Why Are OTs Denied Representation?

- 10 Sep: Column: Looking At “The European Method”

- 09 Sep: Column: Students Potential In New School Year

- 09 Sep: Column: Debt ‘Redline Day’ Three Years Closer

- 08 Sep: Column: Dr James On High Blood Pressure

- 06 Sep: “10 Tips To Make Back To School Awesome”

- 06 Sep: Column: Next Time You See “Ottie” Thank Him

- 03 Sep: Column: Undertaking, DUI, Crashes, Road Safety

- 01 Sep: “Use Momentum To Keep Moving Forward”

- 01 Sep: Column: Recalling Militia & Rifles Amalgamation

- 27 Aug: Column: ‘One Can’t Believe Impossible Things’

- 27 Aug: Column: In Danger Of Losing Intellect, Creativity

Opinion columns reflect the views of the writer, and not those of Bernews Ltd. To submit an Opinion Column/Letter to the Editor, please email info@bernews.com. Bernews welcomes submissions, and while there are no length restrictions, all columns must be signed by the writer’s real name.

-

Read More About

Category: All