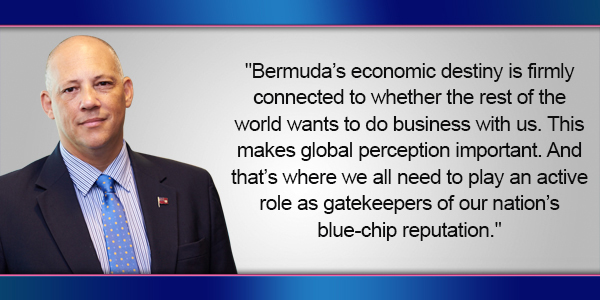

Column: ‘Gatekeepers Of Blue-Chip Reputation’

[Opinion column written by Ross Webber]

If this year is remembered beyond Pokemon Go, Klopp’s revival of the Reds, the passing of rock legends, the Queen’s 9oth, or Usain Bolt’s “triple, triple,” it may be for the populist politics that helped sway public perception worldwide.

Commentators ascribe Brexit’s bombshell to this 2016 phenomenon, as well as Donald Trump’s ascendancy to the White House.

Whether the outcome affects us positively or adversely, these socio-political shifts will have an impact on our country, no matter which side of the respective political fence—or wall—we may find ourselves.

Our international business sector is particularly sensitive to such changing agendas—whether those of Capitol Hill, Brussels decision-makers or Theresa May’s UK Cabinet. No man—and no business— is an island these days.

And, despite the physical nature of our archipelago, even our little island isn’t an island in geo-political and globalisation terms.

Irrespective of our geographic independence, Bermuda’s economic destiny is firmly connected to whether the rest of the world wants to do business with us. This makes global perception important. And that’s where we all need to play an active role as gatekeepers of our nation’s blue-chip reputation.

This month’s Oxfam assault sought to unravel our hard work in a perfect example of our new era of “post-truth” [announced, incidentally, as the Oxford Dictionary’s word of the year this month].

In a concocted manipulation of facts and figures appealing to public emotion over intellect, the British charity argued that Bermuda topped its list of “tax havens”—guilty of depriving onshore countries of tax revenue that would otherwise be spent on philanthropy or social infrastructure in the developing world.

Its notion is diametrically opposed to the Bermuda market’s actual value and highly cooperative role in the global community. One BBC Radio interviewer pushed back against the hyperbole of Oxfam’s Oliver Pearce, steering him to admit he was actually talking about “a perfectly legal mechanism that companies use to reduce their tax bills.”

As irritating as the ill-informed attack was, the good that came out of such injustice for Bermuda was heartening to witness.

The episode activated a quick and contagious collaboration between the BDA, our Ministry of Finance, the government’s London office, and stalwart industry ambassadors like the Association of Bermuda Insurers & Reinsurers [ABIR] and our own new BDA Board member, Stephen Weinstein of RenaissanceRe—all of whom helped put forth facts vs fiction to set the international record straight.

We were able to present compelling stats proving our business community raises capital rather than hides it.

In a combined response of press releases, statements and interviews, we spoke about Bermuda’s stellar regulatory system, our country’s transparency and treaties, our commitment to BEPS initiatives, our robust regulatory framework, our historic beneficial ownership registry—and, most of all, Bermuda companies’ massive global economic contribution via trade, pension-fund investment, employee-benefits coverage, onshore job creation and reinsurance—the latter upholding some of the exact regions Oxfam accused us of threatening.

Most heartening, perhaps, was the unison brought about in Bermuda by Oxfam’s mud-slinging. On this issue, both the island’s political parties proved in total agreement, with PLP Senator and Shadow Economic Development Minister Kim Wilkerson condemning the charity for its “alarmingly under-researched report.”

My fellow Bernews columnist Larry Burchall also eloquently laid out the best antidote to the current penchant for “fake news”—a fulsome, evidence-based argument that detailed “Why Bermuda is unique, not a tax haven” that ended rather aptly with the seasonal zinger, “Oxfam are being naughty and that’s not ‘nice.’”

Touché, Larry, we couldn’t agree more.

Ross Webber is CEO of the Bermuda Business Development Agency [BDA.bm], an independent, public-private partnership working to attract investment and maintain business on the Island.

20 Most Recent Opinion Columns

- 14 Dec: Column: Healthy Living Cuts Heart Disease Risk

- 13 Dec: Column: 7 Words That Could Make A Difference

- 12 Dec: Column: Bermuda Is Unique, Not A Tax Haven

- 12 Dec: Junior Food Critic Review: Casablanca

- 09 Dec: Column: Rolfe Commissiong On A ‘Rich Legacy’

- 07 Dec: Column: Knowing How To Manage Your Debt

- 05 Dec: Column: If We Forget, We Are Doomed To Repeat

- 05 Dec: Column: Do We Seek To Polarize Or Strengthen

- 02 Dec: Column: ‘Ralph Nader Champion For People’

- 01 Dec: Column: ‘Airport Is A Bad Deal For Bermuda’

- 27 Nov: Column: ‘Diversification Benefit Of New Arrival’

- 23 Nov: Column: ‘A World That Is A Work In Progress’

- 21 Nov: Column: Bermuda’s Steadily Improving Economy

- 21 Nov: Column: Airport Project Video Was ‘Misleading’

- 18 Nov: Column: White Should Not Have Been Released

- 16 Nov: Column: How To Time Your Retirement

- 14 Nov: Column: Global Entrepreneurship Week Events

- 14 Nov: Column: Competent Healthcare At Fair Cost

- 14 Nov: Column: Viable Option For Economic Growth

- 09 Nov: Column: ‘The Winds Of Donald Trump’

Opinion columns reflect the views of the writer, and not those of Bernews Ltd. To submit an Opinion Column/Letter to the Editor, please email info@bernews.com. Bernews welcomes submissions, and while there are no length restrictions, all columns must be signed by the writer’s real name.

-

I appreciate your article and the overall combined response to the Oxfam article.

However, in my humble opinion I think everyone may be missing the forest through the trees here.

You can shout to the rafters about transparency, a reinsurance sector with boots on the ground etc etc, but that is going to hold no water with the leaders of the populist wave that is about to crash on top of us.

They will have one question – what is your corporate tax rate? You will have one response – Its zero.

That is the end of the conversation. They are going to hang up the phone well before you can talk about how robust your regulatory framework is.

If Bermuda didn’t exist, and all the companies based here were in London or New York, the UK and US governments would be earning more tax revenue. I’m pretty sure that is a correct statement although I’ll entertain arguments to the contrary.

The UK and US governments are facing an aging population that is no longer paying into their tax coffers, but are instead starting to collect their social security cheques. They also are going to have to start spending hundreds of billions on infrastructure modernization. They are coming for the money, and there is not much you can do to stop them.

It’s well past time for Bermuda to start thinking about how we end this conversation once and for all and actually get ahead of this, instead of just responding to the next article or black listing. The only way to do that in my opinion is with a thorough overhaul of Bermuda’s tax system that includes the introduction of some form of corporate taxation.

Will that be the end of International Business in Bermuda? Well yes if you introduced a 30% corporate tax rate it probably would. But what about a 6% rate, combined with a reduction in payroll tax? Could that kill two birds with one stone by getting us off all these tax haven lists once and for all, and making it easier for companies to actually base people here? BEPS anyone?

Would the introduction of a reasonable corporate tax and the elimination of payroll tax altogether for certain businesses that need to employ lots of people (cough…cough…hotels…cough) actually lead to more of these types of business being established here (cough…cough…R&D dept…cough)? Could a VAT type tax have a role to play, or would that be detrimental?

Is the combined BDA, ABIR, BMA, MOF, OBA, PLP looking into this sort of thing – preferably with calculators in hand? What are the various positions? Any literature out there we can look at and consider as citizens?