Amendment To Increase Pensions By 2.75%

[Updated] Premier David Burt tabled an Amendment to increase pensions and other benefits under the Contributory Pensions Act 1970 by 2.75%, noting that the “increase will raise the basic contributory pension from $1,077.14 to $1,106.75 per month and the maximum contributory pension from $1,564.18 to $1,607.19 per month.”

Speaking in the House of Assembly today [July 1], the Premier, who is also the Minister of Finance, said, “In this Government’s 2017 Election Platform this Government pledged to put our seniors first with initiatives such as annual cost of living increases for social insurance pensions at the rate of inflation and I am pleased to announce today that it is a commitment that this Government will continue to uphold.

“Therefore, in accordance with Section 37 of the Contributory Pensions Act 1970, earlier today I tabled the Contributory Pensions [Amendment of Benefits] Order 2022.

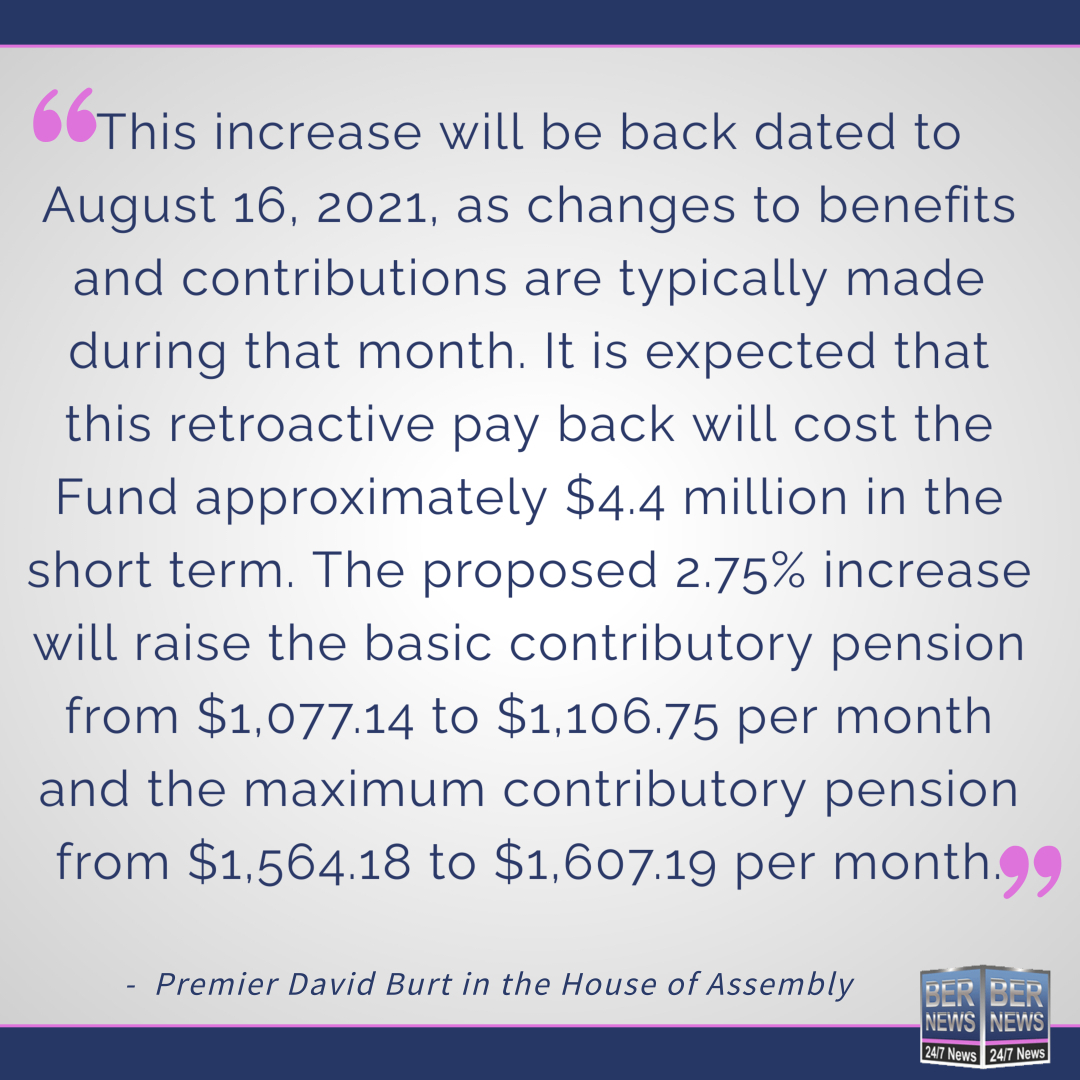

“The purpose of the Order is to increase pensions and other benefits under the Contributory Pensions Act 1970 by 2.75%. This increase will be back dated to August 16, 2021, as changes to benefits and contributions are typically made during that month. It is expected that this retroactive pay back will cost the Fund approximately $4.4 million in the short term.

“The proposed 2.75% increase will raise the basic contributory pension from $1,077.14 to $1,106.75 per month and the maximum contributory pension from $1,564.18 to $1,607.19 per month.

“As this increase will be back dated, the 10,000 residents receiving social insurance benefits will also receive a lump sum payment of up to $473.11. This increase will mean that seniors will receive between an extra $355 to $516 each year.”

Update 6.24pm: The Government said, “Please note that a critical line was omitted in Premier Burt’s original statement as delivered in the House [see below] However, during the question and answer session, the Premier did provide that information to the house.

The addition stated, “The work to reform the Contributory Pension Fund is at an advanced stage and, as we promised the people of Bermuda, the proposals now include the provision to make social insurance contributions progressive. It is this Government’s intention to introduce the full suite of changes during the Budget Session of 2023 to make sure Social Insurance is well secure into the future.”

The Premier’s full statement follows below:

Mr. Speaker, in this Government’s 2017 Election Platform this Government pledged to put our seniors first with initiatives such as annual cost of living increases for social insurance pensions at the rate of inflation and I am pleased to announce today that it is a commitment that this Government will continue to uphold.

Mr. Speaker, this Government remains focused on improving the quality of life of our seniors and lessening the hardships that they endure. Therefore, in accordance with Section 37 of the Contributory Pensions Act 1970, earlier today I tabled the Contributory Pensions [Amendment of Benefits] Order 2022.

Mr. Speaker, the purpose of the Order is to increase pensions and other benefits under the Contributory Pensions Act 1970 by 2.75%. This increase will be back dated to August 16, 2021, as changes to benefits and contributions are typically made during that month. It is expected that this retroactive pay back will cost the Fund approximately $4.4 million in the short term. However, as per the Government Actuary, in the long term the 2.75% increase in benefits would represent a small negative impact to the overall status of the Fund.

Mr. Speaker, the proposed 2.75% increase will raise the basic contributory pension from $1,077.14 to $1,106.75 per month and the maximum contributory pension from $1,564.18 to $1,607.19 per month. As this increase will be back dated, the 10,000 residents receiving social insurance benefits will also receive a lump sum payment of up to $473.11. This increase will mean that seniors will receive between an extra $355 to $516 each year.

Mr. Speaker, the overall CPI rate increased 0.5% during the period from August 2019 to July 2020, and 0.4% from August 2020 to July 2021.

However, it was noted that the food component for the relevant periods increased 2.8% and 2.3% respectively. Given the importance of proper diets to the health and overall well-being of our seniors, it was determined by the Ministry of Finance that an increase above the prevailing CPI rate would be appropriate in the circumstances. This 2.75% increase therefore fully covers the overall rate of inflation, but also allows for some recognition of the specific impact on seniors on limited incomes due to the increase in food prices.

Mr. Speaker, the 2020 Actuarial Report for the Contributory Pension Fund was tabled in this Honourable House on February 4, 2022. The 2021 increase in benefits would normally be accompanied by a corresponding increase in contributions. However, Honourable Members and the Public will however recall that in the 2018 Throne Speech, Government announced that Bermuda’s social insurance system will be changed from a fixed-rate contribution to one based on a percentage of income.

Mr. Speaker, as stated previously when the 2020 Actuarial Report was tabled in February of this year, over the course of several months, important work has been done on assessing the current state of the Contributory Pension Fund and to consider how to address funding gaps. The work consisted in developing a common set of facts around the fund’s status, developing a preliminary set of recommendations, and engaging key stakeholders in our unions and business community.

Mr. Speaker, this Government was not elected to maintain the status quo. As such, the historic and unfair system that sees a CEO making $400,000 annually pay the same amount, in contributions, as a worker making $40,000 annually cannot and will not continue. Social insurance contributions based on a percentage of income is not a unique concept to Bermuda as it has been implemented in many other countries around the world, including the United Kingdom over forty-five years ago. This change will increase the take-home pay of low-income workers, while ensuring that our pension fund is sustainable for future generations. It is the right and proper thing to do.

Mr. Speaker, in closing, this Government is proud of its record of delivering for our seniors. We kept our promise to increase the prescription drug benefit under Future Care. We kept our promise to build more affordable housing for our seniors. We kept our promise to expand the seniors care benefit under Future Care. We kept our promise to introduce a Charter of Rights and Responsibilities for seniors. And today, Mr. Speaker, we are keeping our promise to increase Social Insurance to support the seniors of Bermuda.

Thank-you Mr. Speaker.

Well done Premier.

This government values its seniors and stands firm to its promises.

Well, it does explain the need to constantly lie about the true rate of inflation.

But, it’s vote buying when we can ill-afford it.

It’s not even election season and the PLP Government is buying votes!

With what money?

It’s all borrowed from our children. They really are bunch of clueless twits.

“They really are bunch of clueless twits.”

I disagree. I think the PLP Government knows exactly what it is doing. Whether or not you agree with what the PLP Government is doing is a very different issue.

Keep the same energy when overworked Govt. Quango (BHB) workers ask for a decent Cost of living increase.

Burt would have done better to stop before his comparison with the 2.5% inflation rate. AS Bermuda knows this is a basket of goods, and in that basket are things like the cost of hotels overseas and overseas education. I doubt too many seniors are in education overseas and benefitting from the decrease in costs, but food locally has increased way more than 2.5%. Also he forgets to mention the BHB portion of Future Care went up last year. The increase is good, but nothing like as good as he makes it out to be as it is not enough to cover everyday increased costs, but then he has a very lucrative overall benefit package.