Budget: How Will Government Make Money?

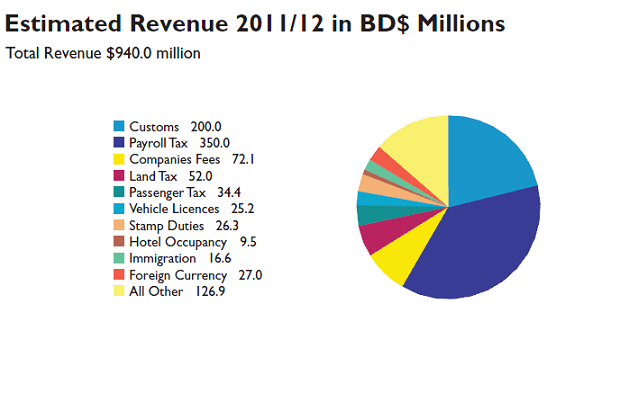

In the 2011/12 Budget, the Minister for Finance projects revenue of $940 million. Payroll tax is predicted to be the largest revenue earner, at $350 million, with Customs the second biggest earner for the Government, with $200 million predicted. Payroll tax and customs fees combine to create almost 60% of the Government’s predicted income.

Listed, in order from largest down, are Government’s projected income streams for the 2011/12 budget:

- Payroll Tax =$350 million or 37.2%

- Customs = $200 million or 21.3%

- “All Other” = $126.9 million or 13.5%

- Companies Fees = $72.1 million or 7.7%

- Land Tax = $52 million or 5.5%

- Passenger Tax = $34.4 million or 3.7%

- Foreign Currency = $27 million or 2.9%

- Stamp Duties = $26.3 million or 2.8%

- Vehicle Licencing = $25.2 million or 2.7%

- Immigration = $16.6 million or 1.8%

- Hotel Occupancy = $9.5 million or 1.0%

Speaking on the predicted revenue, Bermuda Democratic Alliance financial affairs spokesperson Michael Fahy said: “We are at a loss as to how the Government expects to raise the projected revenue of $940 million. We do not believe that there will be the projected turn around in the re/insurance sector to justify the projections. Urging us to pull together is simply not enough. We hope we are wrong and the Premier is right but indicators across the Bermuda market are diametrically opposed to the optimistic outlook expressed by the Premier. Given that the budget deficit is some $80 million more for 2010/2011 then was projected, we simply do not believe the Premier’s projections for the coming fiscal year

Also speaking on revenue, Shadow Minister of Finance Bob Richards said: “Revenues are weak, as the economy is weak. So there is a partial realization of what the reality is. They increased revenues by about $100 million dollars last year, thats what the budget was expecting, but its clear the yield in that was alot less that they had hoped. So they rolled back some of that, some of that increase, that accounts for some of it. The bottom line is in a weak economy revenues are going to be weak.”

In last year’s budget, Government’s revenue projection was $1,058.8 million, however the actual revenue reported in 2010/11 was $977 million – short about $81 million or 7.7%.

For 2011/12 the projected revenue of $940 million is $118.8 million less than last year’s predicted revenue. It is also $37 million less than the amount of revenue actually received in 2010/11.

The approximate differences between past revenue projections and actuals for previous years:

- 2004/05 $694m Projected $783m Actual = 12.8% over

- 2005/06 $750m Projected $814m Actual = 8.4% over

- 2006/07 $835m Projected $884m Actual = 5.8% over

- 2007/08 $917m Projected $929m Actual = 1.3% over

- 2008/09 $985m Projected $950m Actual = -3.6% under

- 2009/10 $969m Projected $917m Actual = -5.4% under

- 2010/11 $1,058m Projected $977m Actual = -7.7% under

Making money for the Bda Government in this the “Postbrownium Period” is simple: Tax each pack of ciggies by $100 – YES $100!!!!! That way, people who still smoke would get us out of debt.

Course I’m an ex smoker myself…..

The PLP need to attract new business…but they will not come here because Bermuda is now viewed as not being welcoming. The PLP don’t want to change their immigration rules cause they want to socially engineer this island to keep it PLP. The PLP would rather rule in hell than serve in heaven.

This is the bottom line. A country run entirely for social engineering and not economic reasons will fail. They all have. I agree that the PLP is stuck in the engineering mode and unless we can break that mold, and conquer our xenophobia we will be doomed to third world status pretty quickly.

One little problem with making Cigarette addiction that costly. Well, lets just say, “Crack-Heads” steal to support their addiction,they don’t stop smoking crack because it is expensive.

More tax on food and cell phones we are all obese so less food is great and paying to chat is a luxury or should be

That comment is very small minded, are we are all obese and chat to Mommy all day? not me, hopefully i will still be able to afford the foods i like and use my cellphone which is mostly for business. I would however like to see a cellphone legal age limit, so we can stomp out 15 year old female children talking to male strangers all day.

These estimates on raising revenue are just that, estimates. Payroll tax depends on people actually working, hotel occupancy tax depends on visitor numbers, customs duties depends on imports based on sales of material items (and we all know people aren’t shopping), company fees if the companies stay in Bermuda.

I hope the government isn’t banking on this revenue or we are all in trouble….well more trouble than we are in now.

How many unpaid traffic fines remain at the Magistrates Court???? Come on police do your job and make that money

Police are doing their jobs giving out tickets. Its the courts who don’t have it together. The systems that don’t track whether you’ve paid – so people don’t.

Well um um, om jess a stoopid dopey Bermooojan an al keep on wotin P Al P .

I say drop all Taxes and collect it all from goods imported, with the exception of basic food items. This way you will guarantee 100% collection. Lets face it, a good portion of payroll tax goes uncollected each year, and why should we as business people, be the collection agents for the Government.

I think this is a more progressive way to collect revenue, and I think it is also more equitable. The more you consume, the more you pay.

In my front line of tourism years, which ended with The Platinum Period BTW, I met many great financial minds. How Bermuda raised taxes was always a favourite subject with them. Not one advocated a change to the US style of income tax as a better method. We already have a form of income tax. Payroll tax. I had a great argument with David Saul over that one years ago.

All these bankers, CEOs, CFOs, Wall Street people I met liked the consumer based tax that we have a form of. The graduated percentage for land tax, vehicles i.e. the more it is the higher the percentage you pay in tax. Basically if you have a high income & are happy to live in a modest house & drive a small car, you don’t pay much tax. It is your choice. If you want bling, pay big tax on it.

Perhaps customs duties on retail items where the duty has to be financed while it sits on the shelf should be dropped for a VAT at the point of sale.

I do understand what you are saying, and this indeed would be the ultimate consumption based taxation. I am just thinking, that we might be more effective if we stop using businesses as that collection agency. So why not have the most effective collection agency, “Customs”, collect them. that way we know what is collected is actually being paid over.

As far as collecting for traffic offenses is concern, they need to just use the system already in place. which is, not to re-license a vehicle until all is paid up. And yes I agree, junk food should be taxed enormously, and use some of that to subsidies healthier choices. This will pay off big time, in less pressure on the health care system.

Does anyone have any idea or much it cost to medicate and treat just one diabetic?

These folks usually also have High Blood Pressure and heart disease. Tonnes of money goes into treating these folks every year.

they will go forward and take over the cooperation of Hamilton…access to milions more

The title of this article: “Budget: How Will Government Make Money?” is a little misleading. Nonetheless over the last four years I suspect we’ve become so programmed with the expectation that the role of Government is to “make money” (for politicians) that its not unsurprising.

One question on the budget – why have the government not reduced the amount of GP cars out on the road? We have over a hundred of them and they receive free gas and the politicians seem to use them as personal cars as well so just get rid of ~90 of them. I guarantee that will help some savings but I’m sure the PLP people will never give up their precious GP cars.

Maybe one day PLP voters will realise that their own political party sold them out over time for their own benefit. Might be too late by then though and we’ll all be holding million dollar mortgages on homes and commercial buildings worth 10% of the mortgage amount.

A different perspective.

If we assume that the low unemployment rate enjoyed for the last 10 years up until 2008/9 was exagerated by he government’s willingness to employ more people as part of its efforts to share the wealth, it also hides the failure of the economy to create jobs fpor Bermudians accross the board both skilled and unskilled.

If the government had not increased its work force, would they have filled the jobs done by expats. Or would they turn their noses up at these jobs or be unable to fill them through lack of skills. It doesn’t really matter, there would be less jobs available. This would mean overall a shortfall in the numbers of people employed and paying payroll tax.

International business employs mainly skilled workers and as these reduce again jobs are being lost.

The whole premise that International business could sustain the economy is false as it required the government to charge more and more tax to keep people employed by the government.

Now International business’s central benefit to our international companies is being taken from under us by Foreign governments. This is escalating and is creating a perfect storm with the fall of tourism at the same time.

This should be the focus of where we go from here and it is not the government that can get us out of our predicament. It is business people and entrepreneurs.

What is going to be the next golden goose? and are we going to treat the next golden goose a little more friendlier?

I think it ironic that the Bermuda delegation is caught up in Bahrain troubles, but i do hope they get home safely.

Bahrain is another place that relies heavily on outside capital and expats to keep its economy going.

Remember the chant “We are not a tax haven!” and we all be safe! LOL

How will Government make money? I would think a good start would be to follow the trail of money overspent, lost, ‘unaccounted for’ by those who were calling the shots in the last administration.

It seems certain people of supposedly fixed income got very very wealthy in the past decade. Perhaps they know where the money went & can assist in the return of it.

Nah…Never happen. Too many skeletons in too many closets.

The headline of this article displays a complete misunderstanding of what is really going on. The government never, ever ‘makes money’. It has no expertise at all in ‘making money’. All the government ever does is to take money from people and businesses, and then spend it.

I make money (I go to work every day), and my employer (hopefully) makes money. The government takes it from us. End of story.

The real issue is: how is the government going to ensure that businesses do well, and thereby employ people, and expand the tax base? On this point, the government has no clue what to do. Cox ‘hopes’ that restaurants and hotels will employ more people. Right. How many successful new hotels and restaurants have we heard about recently?

“Not quite budget comments but an issue that has come up in the past”. I agree with senator Burch, we need to employ Bermudians in our local comapnies , But there are attitude and work ethic issues plageing the aveage worker especially in the construction industry .I employee majority locals in my company but these employees have been with me 10-20 years .

They are good people and hard workers and we provide a high level of quality work .Mr.Burch! thank god he has now put a stop to the Landscapeing compnaies who have for years been useing landscapers to carry out construction work .I myself have experienced this as i have Bid for jobs and to be undercut by landscape companies by hundreds of thousands of dollars less.As they can afford to do the job cheaper as they are paying landscapers considerably less hourly rates than we have to pay in Construction companies .

They are also paying considerably less in payroll taxes .They all know who they are and i will tell you they are predominetly Portuguese who have made tons of money on this rock ,who are extermely arrogant and have been running construction companies under landscape buisness names, and takeing away jobs from hard working Bermudians .

I feel they have gotten what they deserve ! there bellies have been full for years !Its now time to sort this mess out and get those fat cats slimmed down.Let them find locals to cut grass and not use Portuguese foreign workers to cut the throats of our county and its people .