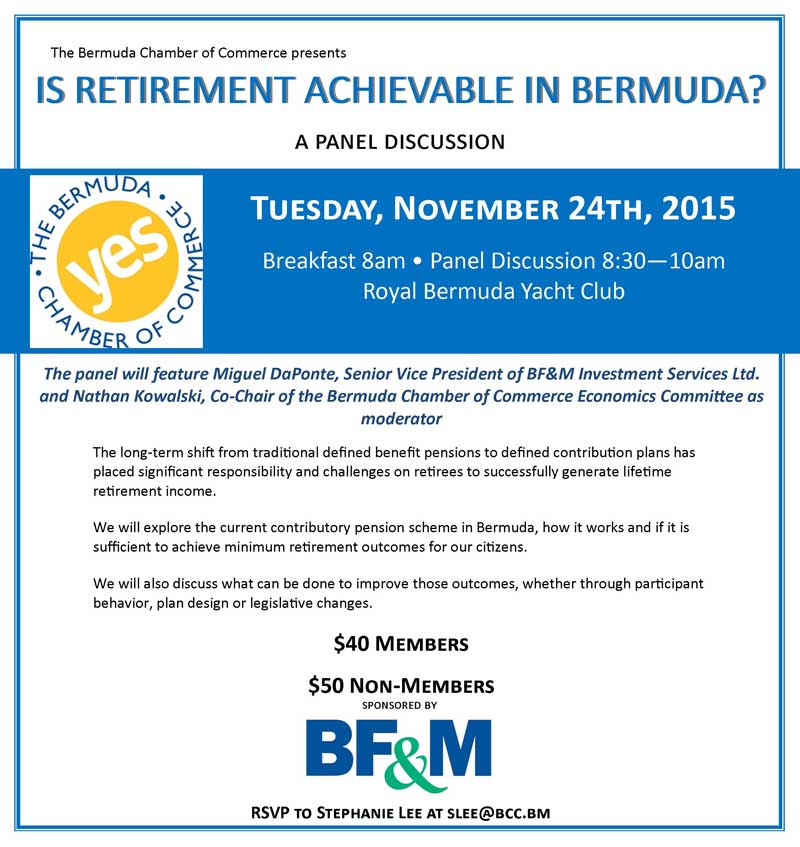

Panel: Is Retirement Achievable In Bermuda?

The Chamber of Commerce is set to host a discussion of achieving retirement in Bermuda on Tuesday, November 24th.

Moderator for the session, Nathan Kowalski, is Co-Chair of the Bermuda Chamber of Commerce Economics Committee states, “This is a timely and relevant topic. We have just heard that the senior population in Bermuda will outpace the ‘millennial’ population by 2017.

“This puts even more strain on the social insurance as there are less persons contributing to it. Those of working age now should be concerned if their pension will be available to them at retirement.”

Mr. DaPonte highlights, “In this breakfast session, we will explore the current contributory pension scheme in Bermuda how it works and if it is sufficient to achieve minimum retirement outcomes for our citizens.

“We will also discuss what can be done to improve those outcomes whether through participant behavior, plan design or legislative changes.”

The breakfast panel will take place on Tuesday, November 24th at Royal Bermuda Yacht Club, 15 Point Pleasant Road, Hamilton. Doors will open from 8am with the session beginning at 8:30am.

The cost is $40 for members of the Chamber, $50 for non-members. Those wishing to attend should contact Stephanie Lee at slee@bcc.bm; or call the Chamber on 295 4201.

If you want to retire then save you money it is really that simple. Start by not wasting money on this posh breakfast you don’t need.

$50 for breakfast, let me see, I can go Market Place and get a dozen eggs, bread, orange juice, fruit, cereal and milk, that’s breakfast for de week.

Yeah if you been making 6 digits a year for the last 20…otherwise…you tell me.

When you say 6 figures you mean $250000 + for 20 years

“Those of working age now should be concerned if their pension will be available to them at retirement.”

Sorry, Mr. Kowalski, but this sounds a bit like scare-mongering to me. Yes, retirement and an aging population is a serious problem for most developed countries – the U.S. is going through the same problem with Social Security. But our Social Insurance scheme isn’t going away; no Government is going to end it, it would be political suicide to do so. There are simply too many seniors who rely on it, and seniors/ baby boomers are a major voting bloc.

So it will exist, but most likely we will see changes to the scheme – they will either decrease the benefits, increase the age you can receive it (ie. from 65 to 67) or increase the weekly social insurance tax working people pay now.

Social insurance was never meant to fully cover a person’s retirement – only to supplement it. It should only be one source of retirement income, supplemented by 1) personal savings 2) any pension from your employer, whether defined or contributory and 3) any income from rental properties, etc. Some seniors also work part-time in retirement.

The main problem with retiring in Bermuda is the cost of living – it is simply too high for most seniors to afford without help. Many in the U.S. are looking at less expensive retirement destinations, in South America , Asia, etc, where one can get by on as little as $1,200 a month. So perhaps this may be an option for some Bermudians.

Because the dynamic of work and retirement is changing so much, it may be time to look at another way of doing things. Here is a movement that has caught on recently, which, personally, I think is worth exploring:

http://www.mrmoneymustache.com/

Retiring & staying in Bermuda is near impossible for most. At a time when Bermuda needs to keep money sloshing around locally people are headed overseas & taking their retirement money with them.

Who can fault them when housing, transport, food, utilitys, medical insurance can be had for so much less elsewhere.

It Looks like some of you have not figured it out yet.

I could blame all those who suffer from a lock of foresight.

Could it be conservation, or just living one day at a time.

Here is a list that has a profound affect on all but the very wealthy, makes you wonder how they got that way , some times I wonder if having too much money could be worse than having to little., after all the wealthy can only wear one pair of shoes .

Do poor people live longer ?

Are we living in a two tier economy ?

Food ; Transportation; Savings Interest rates; Loan and mortgage interest rates ; Electric Power; Taxation ; Extravagant life style; Throw away Nation; Credit card; Budgeting or lack there of; High rents; Medical expenses; Insurance.