Official Govt & Legal Notices For Jan 13 2021

The official Government and Legal notices for today [Jan 13] include list of proposed planning applications, contracts valued $50,000 or more, registrar of companies annual fees and returns, appointments, and notice of intended marriage.

Large Group Exemption Commission Of Inquiry- Historic Land Loss

- Notice Type: Government Notice

- Notice Sub Type: Public Notification

- Notice ID: GN0037/2021

- Public Authorities / Department: Ministry Level

- Publication date: 13 January 2021

Public Health [Covid-19 Emergency Powers]

[No. 3] Regulations 2020

Large Group Exemption:

Whereas the Minister of National Security considers that the proposed Commission of Inquiry – Historic Land Loss is justifying an exemption from the prohibition in regulation 4 [1] and [2] of the Public Health [COVID-19 Emergency Powers] [No.3] Regulations 2020 on groups of more than ten persons assembling;

Now therefore, the Minister grants an exemption under regulation 4 [4] of those Regulations to Commission of Inquiry – Historic Land Loss permitting a group of more than ten persons to assemble January 14th to January 22nd, 2021 between 9:00 am and 5:00 pm at 1 South Road, Warwick Parish [Royal Bermuda Regiment Camp] with the following conditions:

Conditions:

All persons attending the Commission of Inquiry – Historic Land Loss must maintain appropriate physical distancing which is described as; maintaining a distance between all persons who are not members of the same household of at least –

six feet; or

three feet, provided each person is wearing a mask which completely covers their nose and mouth,

and follow any relevant guidance.

Recording of names and contact information of persons attending the event for the purpose of contact tracing. Information to be retained for 28 days post-date of the event.

Adherence to all applicable COVID 19 Health Guidelines as published by the Ministry of Health.

The Ministry of National Security reserves the right to withdraw the permission to have more than ten persons assembled at the event without notice or cost to the Bermuda Government subject to the status of COVID 19 in the local community.

The Bermuda Police Service / Ministry of National Security Official have right to attend and observe compliance of the conditions as prescribed above.

The Honourable Renee Ming JP MP

Minister of National Security

January 13, 2021

List Of Proposed Planning Applications Advertised On January 13, 2021

- Notice Type: Government Notice

- Notice Sub Type: Notification Of Planning Applications Registered

- Notice ID: GN0036/2021

- Public Authorities / Department: Planning

- Publication Date: 13 January 2021

Government Of Bermuda

Department Of Planning

Dame Lois Browne‑Evans Building, 58 Court Street, Hamilton HM 12, Bermuda

Phone: [441] 295‑5151 Fax: [441] 295‑4100

Listing Of Plan Applications Registered [For Advertisement]

Applications Advertised on January 13, 2021. This list was printed on January 13, 2021.

Objections to applications must be received within 14 days of the date advertised [January 27, 2021]

Summary of Application Details

The applications shown below are available for review on the EnerGov Customer Self Service Portal [https://planningenergov.gov.bm/EnerGov_Prod/SelfService#/home], or during normal working hours at the Department of Planning, 5th Floor, Dame Lois Browne Evans Building, 58 Court Street, Hamilton HM 12.

Letters of objection should state any interest which the objector[s] may have in property nearby, supply an address at which notice may be served on the objector[s], and provide a concise statement of the grounds of the objection.

For further information on the objection procedure see the Development and Planning [Applications Procedure]

Rules 1997.

Application Application #

Paget

The Stingray Trust SUB‑0034‑20

21 Happy Talk Lane

Paget BM DV04

Proposed boundary adjustment, conveyance of portion of land to #23 and creation of 5 ft. [1.52m] wide pedestrian right of way.

[Final Approval]

Peace Lutheran Church P0003‑21

154 South Road

Paget BM DV04

New 5 ft. retaining wall and re‑grading of western portion of site to replace collapsed wall and support seabright avenue.

[Final Approval]

Smiths

Corrado Trust PLAN‑0550‑20

Lot 3 Lolly’s Well Road,

North of 43 Lolly’s Well Road

Proposed detached house [2 dwelling units total].

[In‑Principle Approval]

Alexander & Sylvie Werther P0008‑21

30 Skyline Road

Smiths BM FL08

Proposed conversion of lower level to a one bedroom unit [2 units total].

[Final Approval]

Hamilton

Nicolas Papadopoulo PLAN‑0563‑20

24 South Road

Hamilton BM HS02

Proposed demolition of part of the existing house, rebuild similar on existing footprint, studio dwelling unit on ground floor, renovate existing pool house and replace existing drive with new and new 6 ft. high entrance pillars.

[Final Approval]

PATI Office Of The Privacy Commissioner

- Notice Type: Government Notice

- Notice Sub Type: PATI Contracts Valued $50,000 Or More

- Notice ID: GN0035/2021

- Publication Date: 13 January 2021

Bermuda

Public Access To Information [Contracts Valued $50,000 Or More]

Office Of The Privacy Commissioner Notice 2021

GN / 2021

The Privacy Commissioner who has supervision of the Office of the Privacy Commissioner, in exercise of the power conferred by section 6[6] of the Public Access to Information Act 2010, gives the following Notice:

Citation

1. This Notice may be cited as the Public Access to Information, Contracts Valued $50,000 or More, Office of the Privacy Commissioner Notice 2021.

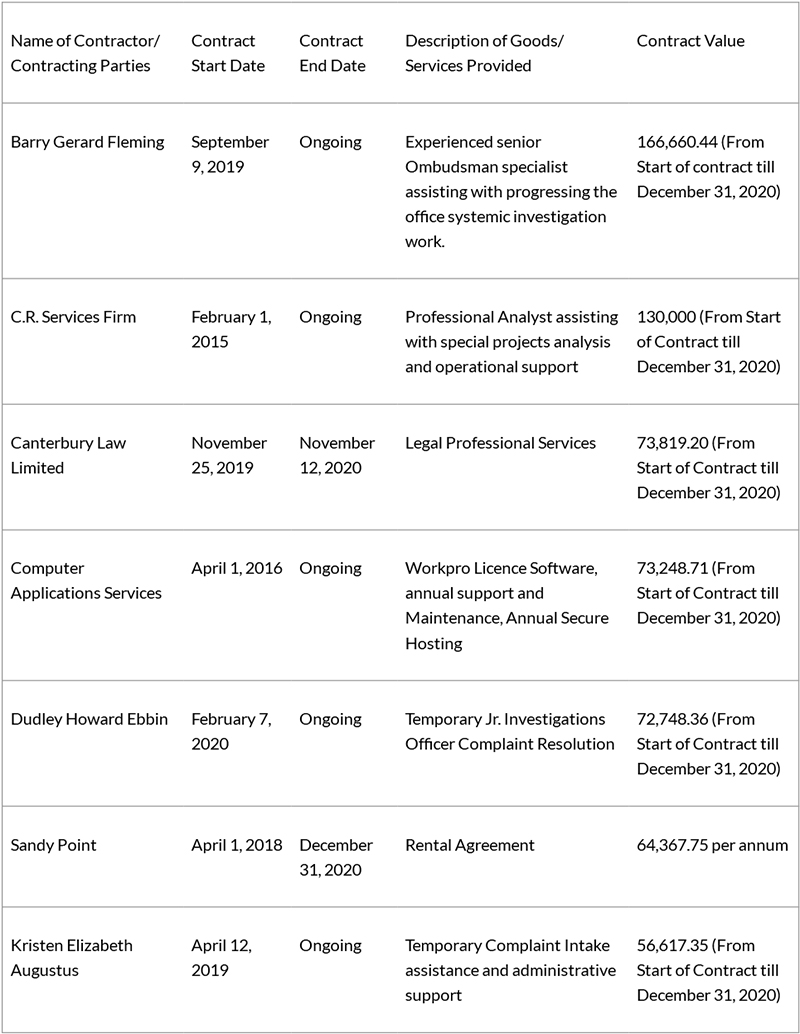

Contracts to which this Notice applies

2. This Notice applies to the contracts contained in the following Table:

Table

Made this 13th day of January, 2021

Alexander M. White

Privacy Commissioner who has supervision of the Office of the Privacy Commissioner

Registrar Of Companies Annual Fees And Returns Due January And March 2021

- Notice Type: Government Notice

- Notice Sub Type: Public Notification

- Notice ID: GN0034/2021

- Public Authorities / Department: Registrar Of Companies

- Publication Date: 13 January 2021

Companies Annual Fees And Returns

Due January And March 2021

For the convenience of the public, the following is a summary of the Annual Returns and Fees for companies operating pursuant to The Companies Act 1981, The Exempted Partnerships Act 1992, The Overseas Partnership Act 1995, The Limited Liability Company act 2016 and/or The Segregated Accounts Companies Act 2000.

The Companies Act 1981

1. Exempted Companies

1-1 Every exempted company shall in the month of January submit to the Registrar of Companies a declaration signed on behalf of the company as to the company’s principal business and its assessable capital together with the appropriate fee payable.

Fifth Schedule

Where the assessable capital of the exempted company is:-

- $0 – $12,000 – $2,095

- $12,001 – $120,000 – $4,275

- $120,001 – $1,200,000 – $6,590

- $1,200,001 – $12,000,000 – $8,780

- $12,000,001 – $100,000,000 – $10,980

- $100,000,001 – $500,000,000 – $19,605

- $500,000,001 or more – $32,676

1-2 Where the exempted company has been designated as an FSC under the Internal Revenue Code of the U.S.A. and has submitted to the registrar a certified copy of the document which evidences such designation:

- Small foreign sales corporation which does not lease aircraft – $615

- Regular foreign sales corporation which does not lease aircraft – $1,240

- Foreign sales corporation small or regular which leases aircraft – $2,079

[iv] Where the exempted company is one whose capital is denominated in a currency other than Bermuda area currency or currency of the United States of America and the Bermuda area currency equivalent is $15,000 or less – $2,095

[v] Where the exempted company is one whose capital is denominated in a currency other than Bermuda area currency or currency of the United States of America and the Bermuda area currency equivalent is $150,000 or less – $4,335

1-3 Fees and declarations in respect of Exempted Companies should be delivered to the Registrar of Companies on or before the 31st day of January 2021.

1-4 Fees submitted after the due date attract a penalty of $300.

2. Overseas [Permit] Companies

2-1 Where the principal business of the permit company is finance business or insurance business or in the case of a permit company which is open-ended, mutual fund business – $4,335

Where the permit company has a physical presence in Bermuda – $2,095

Where the permit company does not have a physical presence in Bermuda, but where its principal falls within one of the specified categories – $2,095

In any other case – $25,000

2-2 Fees and declarations in respect of Overseas Companies should be delivered to the Registrar of Companies on or before 31st March 2021.

2-3 Fees submitted after the due date attract a penalty of $300.

3. Local Companies

3-1 Every local company shall in the month of March forward to the Registrar of Companies a Form 14 Return of Shareholdings in the company as at the 31st December signed by one director.

3-2 Every local company shall not later than 31st March 2021 submit to the Registrar of Companies the appropriate fee.

Where the issued capital is:

- [i] Less than $50,000 – $685

- [ii] $50,000 or more but less than $250,000 – $1,020

- [iii] $250,000 or more but less than $500,000 – $1,700

- [iv] $500,000 or more but less than $1,000,000 – $3,385

- [v] $1,000,000 or more but less than $5,000,000 – $6,765

- [vi] $5,000,000 or more but less than $10,000,000 – $12,890

- [vii] $10,000,000 or more – $19,330

3-3 The Annual Return and fee should be delivered to the Registrar of Companies in addition to a filing fee of $50.00 in respect of the Return.

3-4 Fees submitted after the due date attract a penalty fee of $150

4. Local, Exempted And Overseas Companies

4-1 Where the company is one which is engaging in or carrying on in Bermuda, wholesale trading business in respect of petroleum and other oils or liquefied petroleum gas

- Local Company – $19,330

- Exempted Company – $20,300

- Overseas Company – $20,300

4-2 A company liable to pay the fees provided for in sub-paragraph A[b] and B[c] of paragraph one, of Part II of the Fifth Schedule must pay those fees in addition to any other fee that the company is liable to pay under section 121 [1] or section 135 [see 1-1 and 2-1].

4-3 Where the company’s business includes the management of any unit trust scheme: in respect of each unit trust scheme managed by the company as at the date of the declaration under section 131[1] and 121[1] – $3,050

4-4 Non-Resident Insurance Undertakings [NRIU]

Every Non-Resident Insurance Undertaking shall no later than 31st March 2021 submit to the Registrar of Companies the amount of $10,000.

5. Licenced Companies- Section 114B OR 129A Licences

5-1 All companies holding a licence under section 114B or 129A of the Companies Act 1981 shall pay a fee of $1,000 upon the issue of the licence.

5-2 A fee of $1,000 is payable by 31st January of every subsequent year for the duration of the licence.

5-3 Any 114B licensed local company which fails to pay the fee provided by this section shall be guilty of an offence and liable on conviction by a court of summary jurisdiction to a fine not exceeding one hundred dollars for each month during which such fee remains unpaid.

5-4 Any 129A licensed exempted company which contravenes 129A [1] shall be guilty of an offence and liable on summary conviction to a fine not exceeding $500 for each day the offence continues or on conviction on indictment to a fine not exceeding $1,500 for each day the offence continues.

The Exempted Partnerships Act 1992

6 Exempted Partnerships

6-1 An exempted partnership shall on or before 31st January in each year, send to The Registrar of Companies a declaration in writing signed by a partner or by a person duly authorised to sign on behalf of the partnership, stating the general nature of the business transacted by the exempted partnership together with the annual fee – $2,350

6-2 Under section 12 [2] If an exempted partnership fails to send a declaration to the Registrar in compliance with subsection [1], every partner shall be liable to a penalty of $250.

6-3 In accordance with section 11 [5] and subject to subsection [6] where in any year a partnership referred to in subsection [3] [a] or [b] fails to pay the annual fee, every partner shall be guilty of an offence and shall be liable on conviction by a court of summary jurisdiction to a fine for every day during which the default continues. Notwithstanding the provisions of section 11 subsection 6 [b] the Registrar may accept payment of the sum due together with a penalty of $100 and upon such acceptance the provisions of subsection [5] shall not apply.

The Overseas Partnerships Act 1995

7. Overseas Partnerships

7-1 Every Overseas Partnership shall no later than 31st January in each year submit to the Registrar the amount of $2,350.

7-2 Fees submitted after the due date result in a default fine of $315.

The Limited Liability Company Act 2016

8. Exempted Limited Liability Company

8-1 Every Exempted Limited Liability Company shall no later than 31st January submit to the Registrar of Companies the fee referred to in section 253 subsection 1 – $900.00

8-2 Fees submitted after the due date attract a penalty of $315.

9. Local Limited Liability Company

9-1 Every Local Limited Liability Company shall no later than 31st March submit to the Registrar of Companies the fee referred to in section 253 [1] – $900.00

9-2 Fees submitted after the due date attract a penalty of $315.

10. Licenced Companies- Section 14 Licence

10-1 Every local limited liability company holding a licence under section 14 of the Limited Liability Company Act 2016 shall pay a fee of $1,000 upon the issue of the licence.

10-2 A fee of $1,000 is payable by 31st March of every subsequent year for the duration of the licence.

10-3 Any section 14 licensed local limited liability company which fails to pay the fee provided by this section commits an offence and liable on conviction by a court of summary jurisdiction to a fine not exceeding one hundred dollars for each month during which such fee remains unpaid.

11. Licenced Companies- Section 25 Licence

10-1 Every exempted limited liability company holding a licence under section 25 of the Limited Liability Company Act 2016 shall pay a fee of $1,000 upon the issue of the licence.

11-2 A fee of $1,000 is payable by 31st January of every subsequent year for the duration of the licence.

11-3 Any section 25 licensed local limited liability company which fails to pay the fee provided by this section commits an offence and liable on conviction by a court of summary jurisdiction to a fine not exceeding one hundred dollars for each month during which such fee remains unpaid.

The Segregated Acccounts Companies Act 2000

12. Segregated Accounts Companies

In addition to the annual fee or tax otherwise payable, Segregated Accounts Companies shall pay an annual fee of $295 in respect of each segregated account operated by the company, subject to a maximum annual fee of $1,180 in the aggregate.

General Notes

13. Payment Instructions

13-1 All cheques in respect of fees, similarly all returns mentioned, should be made payable to the Accountant General and forwarded to the Registrar of Companies, Government Administration Building, 30 Parliament Street, Hamilton HM 12 by the required date. Annual fees paid via electronic transfer must be confirmed as received in the Registrar of Companies bank accounts by the due date in order to avoid a penalty.

13-2 All bank fees are borne by the sender. Any shortages in fees will reflect as an underpayment and will generate a penalty, if applicable. Companies will be deemed to be non-compliant until the difference is paid in full. Contact the bank for transaction fees.

13-3 All electronic transfers must include the company’s registration number[s]

13-4 All U.S. Dollar cheques will be accepted at par with the Bermuda Dollar to companies denominated as Non-Resident under the Exchange Control Act.

13-5 Insurance Business Fees, Trust Company fees and Bank and Deposit Company fees are to be submitted to the Finance Business Planning Dept. of the Bermuda Monetary Authority, 42 Victoria Street, Hamilton HM 12.

13-6 Every company must notify the Registrar of the situation of its registered office [which shall not be a post office box] on Form 13.

The ROC reminds CSPs, companies, and limited liability companies of the wire transfer process as follows:

- Company/CSP transfers the money to the ROC BMD or USD bank accounts

- Company/CSP obtains Bank transfer information

- Company/CSP to send email to the following Revenue division team member of the ROC – rocaccounts@gov.bm with bank transfer information and the excel spreadsheet [attached] clearly stating how the monies should be allocated. Please ensure to include the company name, registration number and type of application.

Accordingly, the ROC hereby requests that the above wire transfer process be adhered to in order to ensure all fee remittances is appropriately allocated in a timely manner upon receipt.

PATI Amendment To GN0022/2020

- Notice Type: Government Notice

- Notice Sub Type: PATI Contracts Valued $50,000 Or More

- Notice ID: GN0033/2021

- Public Authorities / Department: Ombudsman

- Publication Date: 13 January 2021

Bermuda

Public Access To Information [Contracts Valued $50,000 Or More] [Office Of The Bermuda Ombudsman] Notice 2020

GN / 2020

The Ombudsman who has supervision of Office of the Bermuda Ombudsman, in exercise of the power conferred by section 6[6] of the Public Access to Information Act 2010, gives the following Notice:

Citation

1. This Notice may be cited as the Public Access to Information [Information Statement- Contracts Valued $50,000 or More] Office of the Bermuda Ombudsman Notice 2020.

Contracts to which this Notice applies

2. This Notice applies to the contracts contained in the following Table:

Table

Made this 8 day of January, 2020

Victoria Pearman

Ombudsman for Bermuda who has supervision of the Office of the Bermuda Ombudsman

Special Courts Panel Board

- Notice Type: Government Notice

- Notice Sub Type: Appointments

- Notice ID: GN0032/2021

- Public Authorities / Department: Government House

- Publication Date: 13 January 2021

Government Boards And Committees 2021

The following Board is appointed from 1 January 2021 to 31 December 2021 under the applicable Legislation, unless otherwise indicated:

Special Courts Panel

Magistrates Act 1948

- The Wor Maxanne Anderson, JP – Chair

- Mrs Denise Astwood, JP

- Mrs Wendy Augustus, JP

- Mr Eugene Ball, JP

- Mrs Annette Barclay, JP

- Mrs Hope S Berg, JP

- Mr Andrew Bermingham, JP

- Mr Delano Bulford, JP

- Mr Roderick Burchall, JP

- Mrs Joan Burgess, JP

- Mr Michael Arnold Caines

- Mrs Marlene J Christopher JP

- Mr Clevelyn Crichlow, JP

- Mrs Donna Daniels

- Rev Jimmie Ray Denwiddie, Sr, JP

- Rev Deborah Evans JP

- Major Herman Elvin Eve

- Mrs J Ann Francis, JP

- Mr David Frith, JP

- Mrs Judith Hall-Bean OBE

- Mr Robert Keith Horton

- Ms Kerry A Judd JP

- Mr Alan E Lugo JP

- Rev Veronica Outerbridge JP

- Mrs Sabrina Phillips, JP

- Mrs Olga Rankin

- Mr C. Winston Rawlins, JP

- Ms Gwyneth Rawlins

- Mrs Mary Samuels JP

- Mr Kenrick S Shillingford JP

- Ms Carol-Ann M Simmons

- Mrs Corneila Simmons, JP

- Mr Orin Simmons

- Mr Warrington Melvin Simmons, JP

- Mr Colin Andrew Smith

- Rev George E W Smith, JP

- Mrs Geraldine Smith, JP

- Mr Gladwin Dean Smith

- Mrs Jane Spurling, JP

- Mr Albert Steede JP

- Mrs Kathy-Ann Swan

- Mr Llewellyn Trott

- Ms Linda S Tucker

- Mrs Wilma Yearwood, JP

Alison Crocket

Deputy Governor

Defence Board

- Notice Type: Government Notice

- Notice Sub Type: Boards Appointments

- Notice ID: GN0031/2021

- Public Authorities / Department: Government House

- Publication Date: 13 January 2021

Government Boards And Committees 2021

The following Board is appointed from 1 January 2021 to 31 December 2021 under the applicable Legislation, unless otherwise indicated:

Defence Board

Defence Act 1965

- Maj [Ret] William Madeiros, MVO, ED –Chair

- Col J David Gibbons, OBE, ED, JP – Deputy Chair

- Col Sumner H Waters

- Lt Col C Eugene Raynor, OBE [Mil], ED, JP

- Maj [Ret] Raymond E Smith, ED

- Ms Roxanne Eve

- Dr Deborah Trimm JP

- RSM [Ret] Sherwyn Richardson EM

- Mr Sean Tucker

- Ms Kelly Francis

Promotions Board For The Bermuda Regiment

Defence Act 1965

- Maj [Ret] William Madeiros, MVO, ED – Chair

- Ms Roxanne Eve – Deputy Chair

- Col J David Gibbons, OBE, ED, JP

- Lt Col C Eugene Raynor OBE [Mil], ED, JP

- RSM [Ret] Sherwyn Richardson EM

- Mrs Tracy Berkeley

Alison Crocket

Deputy Governor

Marriage Notice: Azaire Smith & Ryan Goddard

- Notice Type: Legal Notice

- Notice Sub Type: Notice of Intended Marriage

- Notice ID: LN0006/2021

- Public Authorities / Department: Registry General

- Publication date: 13 January 2021

The Marriage Act, 1944

Notice of Intended Marriage

The persons named and described hereunder have given notice to me of their intended marriage, namely:-

Azaire Layla Joanne Smith of

Pembroke Parish [Single]

and

Ryan Alexander Mark Goddard of

Warwick Parish [Single]

Any person knowing any just cause or impediment why this marriage should not be allowed should enter caveat forthwith in the office of the Registrar General.

Dated this 13th day of January 2021.

Aubrey Pennyman

Registrar General

Marriage Notice: Monica Imbriaco & Thomas Torter

- Notice Type: Legal Notice

- Notice Sub Type: Notice of Intended Marriage

- Notice ID: LN0005/2021

- Public Authorities / Department: Registry General

- Publication date: 13 January 2021

The Marriage Act, 1944

Notice of Intended Marriage

The persons named and described hereunder have given notice to me of their intended marriage, namely:-

Monica Virginia Imbriaco of

1 Robinhood Drive

Mountain Lakes, New Jersey 07046

U.S.A. [Divorced]

and

Thomas James Torter of

1 Robinhood Drive

Mountain Lakes, New Jersey 07046

U.S.A. [Divorced]

Any person knowing any just cause or impediment why this marriage should not be allowed should enter caveat forthwith in the office of the Registrar General.

Dated this 12th day of January 2021.

Aubrey Pennyman

Registrar General

Marriage Notice: Diana Martin & Jeremy Spencer

- Notice Type: Legal Notice

- Notice Sub Type: Notice Of Intended Marriage

- Notice ID: LN0004/2021

- Public Authorities / Department: Registry General

- Publication Date: 13 January 2021

The Marriage Act, 1944

Notice Of Intended Marriage

The persons named and described hereunder have given notice to me of their intended marriage, namely:-

Diana Lee Martin Of

Southampton Parish [Divorced]

And

Jeremy Peter Spencer Of

Southampton Parish [Divorced]

Any person knowing any just cause or impediment why this marriage should not be allowed should enter caveat forthwith in the office of the Registrar General.

Dated this 12th day of January 2021.

Aubrey Pennyman

Registrar General

The official notices above have been republished from the relevant section on the official Government website. If you wish to view ‘hard copies’, the Department of Libraries & Archives prints them and you can visit the main library on Queen Street or the Government Archives in the Government Administration Building on Parliament Street to view them.

Read More About

Category: All