Full Report: “Bermuda In The World Economy”

The Bermuda Government today [July 14] released the 2014 report “Bermuda in the World Economy”.

“The report, commissioned by the Ministry of Finance and the Washington D.C. office, was prepared by Transnational Analytics LLC president and top economist Charles Ludolph, a former deputy assistant secretary of the U.S. Department of Commerce,” the Ministry said.

“The study focused on the role that Bermuda plays in the world economy as a leading supplier of insurance and financial services, an innovative financial center, and a provider of key transport services to the United States, Europe, and Asia.

“It closely examines the success of Bermuda businesses and government in adapting to the new rigors and uncertainty of the world economy during the recession and post-recession period.

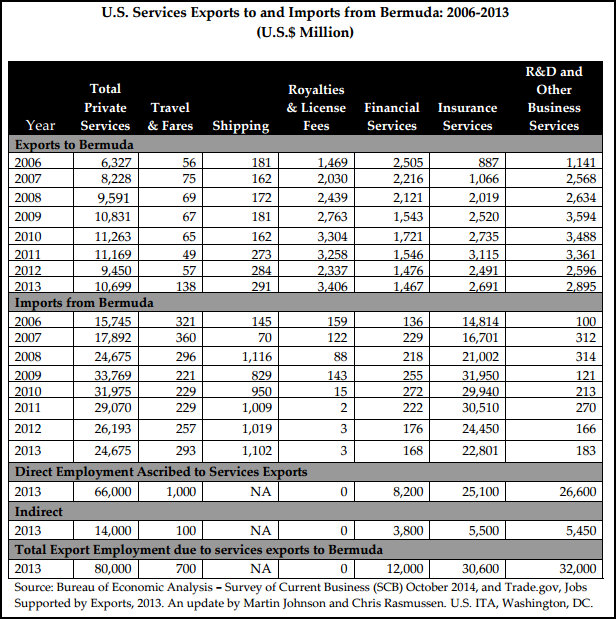

Chart #1 extracted from the report:

“It is the latest in a series of reports on Bermuda’s significance to the major economies of the world, including the United States and Canada, France, Germany and the United Kingdom, as well as China and its financial centers of Singapore and Hong Kong.

“A new element in this study is the analysis of investment flows between Bermuda’s financial markets demonstrating the positive effect of Bermuda’s investment laws on job creation and the financial health of U.S. pension funds and state governments.

“It also explains how Bermuda competed in the world economy during the 2008-2013 global financial crisis and expanded support of international financial investment in aircraft, insurance, and shipping, particularly for the United States, Ireland and the United Kingdom.

- During the 5 year period, major economies increased their investment into Bermuda financial markets significantly, financing wide body commercial jets, the world’s energy tanker fleets, and catastrophic loss risk management.

- Bermuda’s companies supported at least 500,000 jobs in the eight major nations analyzed, including 300,000 in the United States, 70,000 in the United Kingdom and 25,000 in Canada.

“By 2013, Bermuda’s trade in goods and services with the eight economies analyzed rose to pre-crisis levels of $50 billion and Bermuda stood out as one of the chief services trading partners with Europe, Canada and the United States.

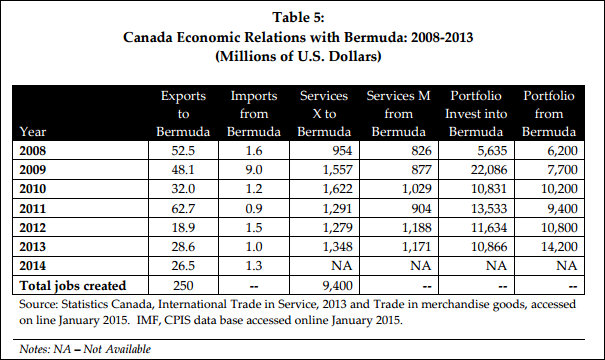

Chart #2 extracted from the report:

“The study reviews how deeply the world economy changed as a result of the long global economic recession and how Bermuda’s role changed along with it. Since 2007, Bermuda stood out as a leading global reinsurance provider with one third of the top global reinsurance companies. The captive insurance industry and the commercial insurance market in Bermuda are significant players in US healthcare.

“For North America, Bermuda supported 50,000 jobs in the wide-body commercial jet market when emerging national airlines and aircraft leasing companies obtained $6 billion in the Bermuda investment market which was otherwise unavailable.

“Since 2010, U.S. state governments raised over $5 billion in the Bermuda financial market to establish additional property loss coverage for earthquake, wind and fire disasters.

“As a result of the financial crisis, U.S. and Canadian pension funds and local governments are investing at least $6 billion in Bermudian investment vehicles from ILS investment companies to equity in Bermuda aircraft Special Purpose Vehicles to overcome investment constraints in traditional banking and capital markets.

“Bermuda’s investment sector supported Asian investors in Hong Kong and China to raise more than $60 billion in private investment capital, contributing significantly to China’s effort to overcome its banking and capital market restrictions and to achieve much needed economic development.

“Bermuda holding companies are an essential part of China’s economic development strategy. Banking, capital market and exchange rate restrictions in China make it difficult to raise debt and capital to finance economic growth. Bermuda regulatory stability provides the access to capital markets necessary for China to achieve its economic development goals. China placed $100 billion in Bermuda to access needed private equity and bank finance.

“For Europe, Bermuda’s economic role has expanded as the European reinsurance industry sought growth. Led by Lloyd’s reinsurance syndicates, European insurance companies have expanded their participation in Bermuda with billions of dollars of investment.

“UK insurance companies have opened 12 special purpose insurers in Bermuda since 2011 raising $700 million in needed capital for coverage of insurance liabilities. Bermuda companies now represent 26% of Lloyd’s overall insurance writing capacity. German insurance companies raised an additional $1.5 billion through Bermuda Special Purpose Insurers.

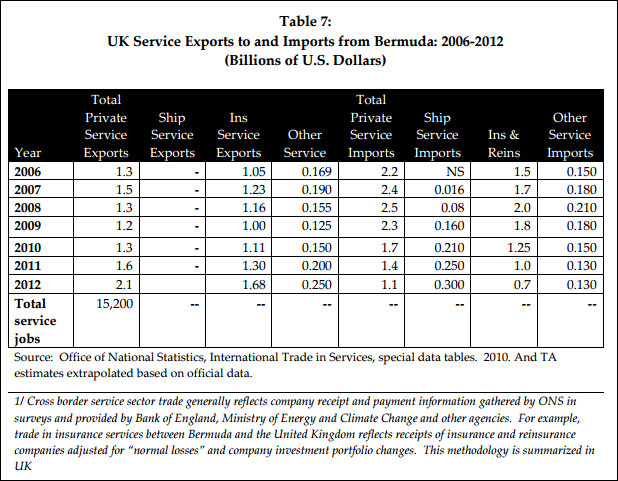

Chart #3 extracted from the report:

“The study captures the strength of Bermuda as a financial funding center for business sectors like aircraft and ship finance, reinsurance and alternative risk management finance, meeting needs of Asia, North America and Europe. The study indicates that Bermuda shows particular capacity in helping world economies overcome finance constraints caused by regulation and economic crisis.”

Deputy Premier and Minister of Finance Bob Richards said, “This analysis will heighten awareness of the substantial role Bermuda plays in the support of global commerce.

“The report has culled financial data from major trading nations to show Bermuda is a key business partner that provides the mature, reliable, legal, regulatory and professional capacity to enable innovative solutions to business issues.

“It also underscores the view that Bermuda as a financial centre is in a prime position to continue delivering highly sought after financial services solutions to institutions in an evolving business environment.”

Cheryl Packwood, Bermuda’s Overseas Representative in Washington said, “Bermuda’s world-wide reputation for regulatory stability and innovation comes across here as key to its success as a funding center for reinsurance and transportation. Investors and borrowers in Europe, Canada and the United States depend on Bermuda as a key part of their post-crisis investment strategies.”

The full 84-page report follows below [PDF here]:

A long story made short: “The report has called financial data from major trading nations to show Bermuda is a key business partner that provides the mature, reliable, legal, regulatory and professional capacity to enable innovative solutions to business issues.”

Continueing: Cheryl Packwood, Bermuda’s Overseas Representative in Washington said, “Bermuda’s world-wide reputation for regulatory stability and innovation comes across here as key to its success as a funding center for reinsurance and transportation. Investors and borrowers in Europe, Canada and the United States depend on Bermuda as a key part of their post-crisis investment strategies.”

Funny, they mentioned global economic recession and P.L.P was not mentioned.

Mmmm

I work in this industry, which provides 80% of Bermuda’s FX earnings. Which I might add is crucial for an island that produces absolutely nothing and imports everything.

I can tell you that the industry was not made to feel very welcome with the past administrations ‘Sven an Jonny’ analysis, the mandate to expel key employees within the term limit timeframe, the accusation leveled of contributing to perceived deteriorating social cohesion, and raising payroll taxes 14% and foreign current purchase tax by 100% with absolutely no consultation or forewarninng.

There is a reason why our peers (I.e. Cayman et al) have not experienced 6 years of negative GDP growth and why their economies are growing. Also, during that time the reinsurance sector actually expanded. Just not in BDA unfortunately.

Not all of the issues can be laid at the PLP’s feet, but their contribution to the decline cannot be dismissed either.

Cayman is suffering from a catalog of social problems along with their continual growth of GDP. Feel free to read their papers and policy documents from their equivalent of Bermuda’s Financial Assistance, Education, Youth and Sports and Child and Family Service departments. The Cayman government has welcomed foreign businesses openly and failed to simultaneously create a path to scale up their locals in the process. Social problems that are not addressed and dealt with effectively will balloon and have the potential to derail economic success. We must remember that and learn from the past.

A point to add is that the business of the majority of the companies domiciled in Bermuda experienced far less impact as a result of the recession than did others. Had these companies been nurtured by the PLP at this critical time the state of IB in Bermuda would be markedly different at present.

The industry’s most dynamic growth occurred under the PLP Government post 911 when our GDP also doubled from approx. 3 billion to 6 billion dollars (2000 to 2008).

Stop with the racist lies IB.

The irony of it is that those three or four sectors who benefited the most from that PLP facilitated growth were the same sectors who uncritically support the OBA.

In other words IB you need to show a little more gratitude to the PLP.

Truth Teller – you just lost your argument by making it a race thing. Why are they ‘racist lies’ and not just ‘lies’?

Sorry you lost – you were making a good point but you just had to pull that race card.

Learn by this valuable error. PLP used up all the race cards – there are none left. That you CAN blame on PLP.

Truth Teller stated only facts. You cannot argue against facts.

Yes, correct; but “racist lies?” That’s a bit dark you think?

Check your time lines. Growth on the back of one party’s policies and then demise under the foot of another’s.

C’mon…..seriously?….Get outtah here….really?….I don’t believe yooouuuu…

Looking forward to reading the report. Knowing that Bermuda supports worldwide jobs and investments, the next step is to identify ways that this success is felt by the man on the street in Bermuda. Clearly the trickle down effect is not working.

Strange thing to say as it appeared to work quite well when we were at our IB peak and there was virtually no unemployment, construction was a booming business and many locals prospered from appreciating housing prices with their mortgages supported by rental income primarily from IB employees.

This trickle down effect provided numerous jobs throughout the economy during that time which allowed locals to be employed and in many cases hold more than one job if they chose to do so.

It isn’t a coincidence that the ‘man on the street’ has suffered as IB has contracted. This is why we achieved our highest GDP in tandem with the most work permits issued and why the opposite has happened with a declining population.

It is correlation.

No one “wants” to hold more than one job they “have” to-to make ends meet. It is clear what side of the “tracks” you are from. I pray one day you and your family do not have to feel the pain so many are feeling worldwide wherever your false economies propagate themselves.

IB if you are so in tune with your industry and its peripheries then surely you know that it is almost time for the curtain to drop on it all.

It’s posts like these that make me wonder who taught this kid how Bermuda’s economy actually works. I’ll give this “Young Bermudian” a pass since he/she is well, young. Please don’t sit and wait and expect everything to be handed to you…. and please please please do not believe everything the PLP spout at you.

Clearly you have no idea what you are talking about. Do a little research. Ask your parents who foot the bill for the roof over your head, food, school uniforms, Belco….during the boom. Think before you speak.

IB, I appreciate your feedback. For clarification purposes, I would like to see Bermuda identify ways that our local economy can become more resilient to external factors. We became overly dependent on foreign services, and did not invest in local economic infrastructure that will provide jobs and stability on island that weather global shocks. We may have a high GDP but that does not reflect the security of happiness and well-being for many Bermudians. We need to invest the capital gains from our success story so that Bermudians can be more self-sufficient.

That’s a nice idea, but one that is totally unrealistic for an island that imports everything to survive. As such we will always be at the mercy of external factors (I.e. Oil prices, external political decisions etc.). So we will neve be self-sufficient until we discover more land to produce for our own and decrease reliance on imports. In other words the utopia that you speak of will never happen.

As I said before, we need foreign investment/currency in order to survive as the goods we import/purchase comes from other countries and the bermuda dollar is worth nothing beyond our shores.

To sum up my point, a 21 square mile island that doesn’t produce/manufacture or export one thing will always be at the mercy of external factors. Always.

IB… I’m not denying that we will not be influenced by external factors, and yes we need them to survive. We CAN however develop policies to ensure that negative external influences are not catastrophic. IMO community wealth building is needed here more than ever. It’s not a new concept, just not a traditional one. I’m not looking for a utopia…I’m looking for opportunities for the average hardworking person to be able to have a roof over their head an buy food without paying both legs and an arm. The path that Bermuda is headed does not give that person an opportunity to be proud of Bermuda’s economic success worldwide.

Your thoughts are lovely and you are not the first to express them. Can you be the first to clearly outline how this happens?

We are a mere puddle of talent and natural resources that has been exposed for what we are once the torrential rainfall of money stopped.No-one PLP or UBP/OBA prepared Bermuda for the lean times.I can see how easy it occurred with the gravy train rolling at high speed for so many years and all of us with an air of invincibility.Our civil service was top heavy then, but who cared TOOT TOOT train c’mon through.I remember as a kid if your father worked for the PWD you were laughed at.Later if not gifted in the three R’s the PWD was a safe job to have that paid a decent wage, at least you weren’t selling drugs.Now a anyone in government is seen by the private sector as lazy and too privileged.Weird world we live in eh?

To top heavy THAN……sorry

Thoughtful piece . I was fascinated by the insight . Does someone know where my company could get a sample a form copy to fill out ?