Mosaic Launches M&A Risk Coverage In The US

Mosaic Insurance announced that it has begun underwriting transactional liability coverage in the United States.

A spokesperson said, “Mosaic Insurance has begun underwriting transactional liability coverage in the United States amid a current upsurge in mergers-and-acquisitions [M&A] activity.

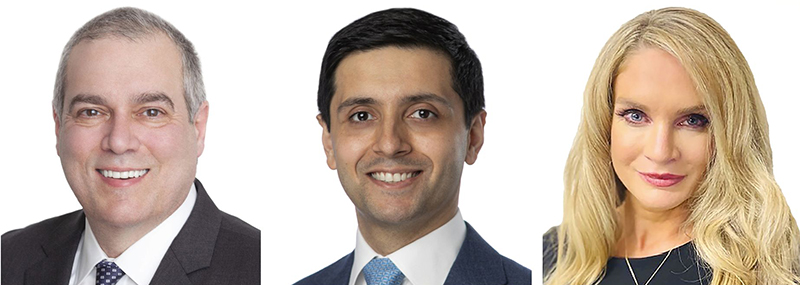

Mosaic’s leading transactional liability executives: William Monat, Stavan Desai, Katherine Spenner

“The global specialty insurer, launched in February, offers a lead market on M&A coverage. Mosaic will deploy a maximum initial capacity of USD$25 million per risk and expects to increase that amount to match demand. Its product line includes Representations and Warranties Insurance [RWI], a staple for private equity and strategic buyers and sellers in M&A deals, including stock and asset purchases, mergers, restructurings, recapitalizations, and other structures.”

“The transactional liability business has been a cornerstone of our specialty strategy from the start,” said Mosaic Co-Founder and Co-CEO Mitch Blaser. “Our leadership and M&A team are known for their deep expertise and a market-leading heritage in this field—and the timing couldn’t be better, with current appetites and opportunities for acquisitions on the rise.”

“We’re excited to enter the market at a time when there’s a real need for both additional underwriting capacity and deep experience in this sphere,” said Mosaic’s Global Head of M&A William Monat, who joined the company in April, after more than 20 years as a leader in the transactional risk insurance sector as an underwriter, broker and lawyer, including a decade as head of Willis Towers Watson’s M&A practice in North America.

“The upswing in deal activity began late last year and continues to heat up, thanks to available capital, motivated buyers and sellers, and significant pent-up demand,” he said. “We look forward to building our M&A portfolio, starting in the US, and expanding globally later this year.”

The company added, “Mosaic is growing a highly experienced M&A underwriting team in the US, based in New York under the leadership of Monat, Stavan Desai, and Katherine Spenner. To date, the company has a team of seven M&A specialists and plans to hire additional talent in the coming months.

“Desai, SVP, M&A Team Leader, guides Mosaic’s underwriting team in North America. Previously, he was a senior M&A underwriter for AIG and served as a senior attorney at Schulte Roth & Zabel, where he concentrated on private equity, M&A, leveraged buyouts, and alternative asset management deals.

“Spenner, SVP, Chief Legal Officer, M&A, leads product development and underwriting execution across the M&A insurance portfolio at Mosaic. She most recently served as chief underwriting officer for the transaction liability group at Everest Insurance, after nearly a decade representing public and private-equity M&A clients at White & Case and Torys.”

“We see immediate opportunity to provide tailored solutions for middle-market M&A transactions which can be lost in the shuffle of unprecedented deal volume in the US,” said Desai. “The sector is on track for a record-setting year of private-equity and strategic deal activity.”

Founded in February 2021, Mosaic combines Lloyd’s Syndicate 1609 with a wholly-owned syndicated capital management agency and underwriting hubs in Bermuda, London, the US, and Asia. The company focuses on complex specialty lines of business and has launched underwriting teams to date in cybersecurity, political violence, political risk, professional liability and financial institutions lines.