Official Govt & Legal Notices For Dec 31 2021

The official Government and Legal notices today [Dec 31] include notification of planning applications registered, contracts valued at $50,000 or more and PATI information statement.

List of Proposed Plan Applications Advertised On December 31, 2021

- Notice Type: Government Notice

- Notice Sub Type: Notification of Planning Applications Registered

- Notice ID: GN1449/2021

- Public Authorities / Department: Planning

- Publication date: 31 December 2021

Listing Of Plan Applications Registered [For Advertisement]

Applications Advertised on December 31, 2021. This list was printed on December 31, 2021.

Objections to applications must be received within 14 days of the date advertised [January 14, 2022]

Summary of Application Details

The applications shown below are available for review on the EnerGov Customer Self Service Portal

[https://planningenergov.gov.bm/EnerGov_Prod/SelfService#/home], or during normal working hours at the

Department of Planning, 5th Floor, Dame Lois Browne Evans Building, 58 Court Street, Hamilton HM 12.

Letters of objection should state any interest which the objector[s] may have in property nearby, supply an address

at which notice may be served on the objector[s], and provide a concise statement of the grounds of the objection.

For further information on the objection procedure see the Development and Planning [Applications Procedure] Rules

1997.

Application

Southampton

P0563‑21

Scott & Allison Watson‑Brown

124 Middle Road

Southampton SN02

Proposed Pool House and Storage Shed Accessory Structures to Existing Dwelling, New 4ft. High Wall and Gate and

Cesspit

[Final Approval]

Warwick

P0577‑21

Duncan Dawson

Harbour Road, Warwick [Thin Strip of Land between Harbour Road and the Great Sound. North of 2 & 4 Mizzentop and West of Longford Road and Harbour Road Junction].

Proposed New Dock and Floating Dock for Mizzentop Residents for Recreational Purposes ‑ Boating and Swimming.

[Final Approval]

Public Access To Information [Contracts Valued $50,000 Or More]

- Notice Type: Government Notice

- Notice Sub Type: PATI Contracts valued $50,000 or more

- Notice ID: GN1448/2021

- Public Authorities / Department: Information Commissioner’s Office

- Publication date: 31 December 2021

Bermuda

Public Access To Information [Contracts Valued $50,000 Or More] [Name Of Public Authority] Notice 2016

GN / 2016

The Information Commissioner who has supervision of the Information Commissioner’s Office, in exercise of the power conferred by section 6[6] of the Public Access to Information Act 2010, gives the following Notice:

Citation

1. This Notice may be cited as the Public Access to Information, Contracts Valued $50,000 or More, Information Commissioner’s Office Notice 2020.

Contracts to which this Notice applies

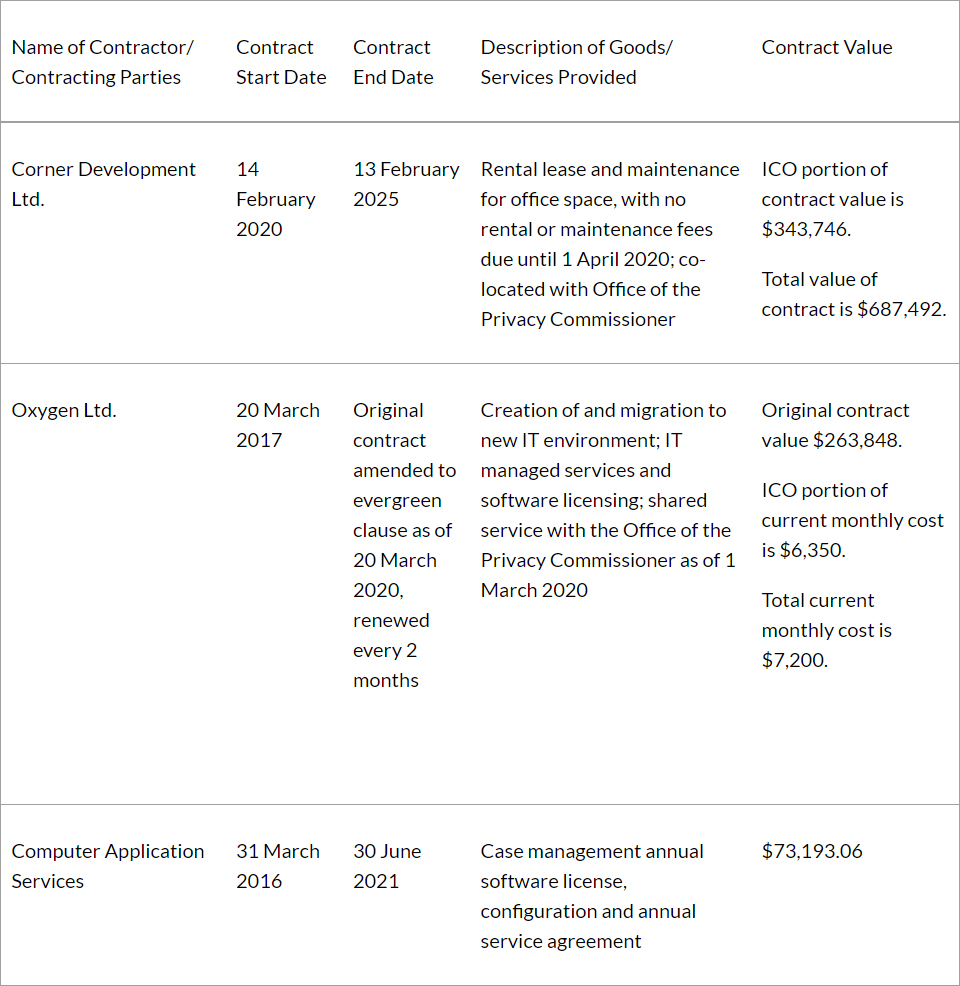

2. This Notice applies to the contracts contained in the following Table:

Table

Made this 30th day of December, 2020

Gitanjali S. Gutierrez

Information Commissioner who has supervision of the Information Commissioner’s Office

Ministry Of Finance :- PATI Information Statement

- Notice Type: Government Notice

- Notice Sub Type: PATI Notice

- Notice ID: GN1447/2021

- Public Authorities / Department: Public Access to Information [PATI]

- Publication date: 31 December 2021

Government Of Bermuda

Ministry Of Finance

PATI Information Statement

Name of Public Authority: Bermuda Public Accountability Board

Introduction:

Purpose of the Public Access to Information Act 2010: Under section 2 of the Public Access to Information Act 2012, the purpose of the Act is to-

[a] give the public the right to obtain access to information held by public authorities to the greatest extent possible, subject to exceptions that are in the public interest or for the protection of the rights of others;

[b] increase transparency, and eliminate unnecessary secrecy, with regard to information held by public authorities;

[c] increase the accountability of public authorities;

[d] inform the public about the activities of public authorities, including the manner in which they make decisions; and

[e] have more information placed in the public domain as a matter of routine.

Reason that the public authority has an information statement: Under Section 5 of the Public Access to Information Act 2010, every public authority in Bermuda must produce an information statement.

The purposes and aims of the information scheme, and what the public authority hopes to achieve through the information statement: This statement aims to make it easy to access key information about the Bermuda Public Accountability Board’s activities.

Summary of what is in the information statement: Categories of information contained in the information statement, including information provided are as follows:

- Structure, Organization and Legislation – who we are, what we do, our Board of Directors, and applicable legislation;

- Functions, powers and duties of Bermuda Public Accountability Board;

- Obligations under the PATI Act;

- Services and programmes;

- Records and documents held;

- Administration manuals;

- Decision-making documents;

- Name and contact details for the Information Officer; and

- Locations of the information statement.

Section A: Structure, Organization and Legislation [s5[1]a]

The Bermuda Public Accountability Board [BPAB] was established upon enactment of The Bermuda Public Accountability Act of 2011 [the Act] to provide oversight of Bermuda accounting firms that audit Public Interest Entities [PIEs], as defined by the Act and subsequent amendments thereto. The Act provides for a comprehensive, independent and transparent system of oversight by establishing BPAB and granting it powers to carry out the independent supervision of PIE public accountants. The oversight of PIE public accountants provided under The Act is also in accordance with Articles 29, 30, and 32 of the Directive 2006/43/EC of the European Parliament and Council as amended from time to time.

BPAB has engaged an Executive Director to manage the operational, strategic and financial day-to-day operations of BPAB, including the administration, programs, and strategic planning of BPAB. All key decisions of BPAB require approval of the majority of the Board of Directors.

Board of Directors

The Directors of BPAB are responsible for oversight of BPAB’s activities and affairs. The Board has a Chairman, a Secretary and three other non-executive members. Three of the Directors are professional accountants to ensure that the Board maintains accounting expertise. The two remaining members are seasoned financial and investment professionals that help deliver prudent independence and oversight. The Act specifies that a Board member is initially appointed for a three-year term, with extended terms as permitted by the Act.

The Directors of BPAB are as follows:

The Hon. Gerald Simons, OBE, Chairman

Gerald Simons is a retired insurance company executive and a former politician. In 2012 he retired from the Argus Group, a multi-line insurance company, after over 40 years of service, 12 of which were as President and CEO. Argus operates in Bermuda, Gibraltar and Malta. Mr. Simons served in the legislature of Bermuda from 1982 to 1995 and was a member of the Cabinet for 11 years holding various portfolios including education, environment and culture. In 2018 he ended six years as chairman of the board of the Bermuda Monetary Authority, the integrated financial services regulator in Bermuda. Over the course of his career Mr. Simons has served as a member of the board of a number of publicly traded companies including a bank and a public utility. He is the current chairman of the audit committee of the Bermuda Institute of Ocean Sciences. Mr. Simons has served as chairman or president of a number of organizations including the Bermuda Employers’ Council and The Bermuda National Trust. In 1996 Mr. Simons was made an officer of the Most Honourable Order of the British Empire [OBE] for service to Bermuda.

Tony Bibbings, Chairman Compliance Committee

John Anthony [Tony] Bibbings recently retired from the insurance industry in Bermuda. He most recently worked at Artex [Arthur J Gallagher] as an insurance broker into the Bermuda market and oversaw the management of smaller insurance companies mostly owned by their insureds, that is, captive insurance companies. Prior to nine years at Artex, he worked for six years for Beecher Carlson Bermuda in the same capacity. Prior to that, he worked as an underwriter at Swiss Re New Markets in Atlanta, Georgia and Scandinavian Re in Bermuda. In 1987 Tony moved to Bermuda from Canada where he had just earned his Chartered Accountant designation in Ontario. He has remained a member in good standing of CPA Ontario since 1987.

Andrew M. Marsh

Andrew M. Marsh is managing partner of an independent investment consulting and advisory firm in Bermuda. He also serves as an independent director for private investment companies. Andrew brings over 25 years of in-depth capital markets and asset management experience working for top global investment firms including Goldman Sachs [J. Aron & Company], Dai-Ichi Kango, and Alfred Berg in London, Stockholm, and Hong Kong. Since Andrew’s move back to Bermuda in 2001, he has spent time working in senior positions for hedge funds and asset management companies as chief economist, proprietary trader and equity analyst.

Wanda Mwaura, Secretary, Executive Director

Wanda Mwaura has served as the Executive Director of BPAB since January 2020. She also serves as non-executive director on various boards and chair of a risk and insurance committee and chair of audit committees for various entities. Wanda was formerly the Chief Accounting Officer of PartnerRe Ltd. and a Partner of Ernst & Young Ltd. [EY]. During her 17- year career at EY, Wanda served on various boards and committees including the Institute of Chartered Accountants of Bermuda [now known as CPA Bermuda], the Bermuda Insurance Institute, and the former Atlantic School of Chartered Accountants. Wanda is a CPA, CA and a member of the Chartered Professional Accountants of Bermuda.

Michelle Seymour Smith, Treasurer

Michelle Seymour Smith is an accomplished leader with over 20 years of international experience in public companies in the insurance and reinsurance industry. She most recently served as the Chief Transformation Officer of Arch Capital Group having previously held roles as Chief Financial Officer and Chief Operating Officer of Arch Reinsurance Ltd. Michelle has been recognized as one of 100 Influential Women in Insurance and Reinsurance by Intelligent Insurer and was named as a Fellow of the International Women’s Forum Leadership Foundation Program in 2017. Michelle is a CPA, CA and a member of the Chartered Professional Accountants of Bermuda.

Legislation

BPAB is constituted by the Bermuda Public Accountability Act 2011 [the “Act”]. The Act was amended in 2015, 2017 and 2020 to make certain conforming changes to clarify BPAB’s ability to impose civil penalties and to revise the definition of a Public Interest Entity [PIE].

The procedures of BPAB are further set out in subordinate legislation made pursuant to the Act.

See links on the Legislation page of our website at www.bpab.bm for the legislation contained in the Act, Amendments thereto, Rules and Regulations as follows:

- Bermuda Public Accountability Act 2011

- Bermuda Public Accountability Act 2011 Commencement Day Notice 2012

- Bermuda Public Accountability Amendment Act 2015

- Bermuda Public Accountability [General] Rules 2015

- Bermuda Public Accountability Act 2011 Commencement Day Notice 2015

- Bermuda Public Accountability [General] Regulations 2015

- Bermuda Public Accountability [Review Proceedings] Regulations 2015

- Bermuda Public Accountability [General] Amendment Rules 2016

- Bermuda Public Accountability Amendment Act 2017

- EU Withdrawal [consequential Amendments] Act 2020 [bermudalaws.bm]

Section B: 1] Functions, powers, duties of the Authority [s5[1]b]

BPAB is responsible for the oversight and registration of public accountants in Bermuda that conduct audits of Public Interest Entities [“PIEs”].

Registration

Every audit firm in Bermuda that audits a PIE must be registered with BPAB. Registration is for a one-year period and must be renewed annually. At present, BPAB oversees four audit firms in Bermuda [the Big 4] that are registered as “PIE public accountants” as follows:

- Deloitte Ltd.

- Hamilton, Bermuda

- Date of Registration – November 1, 2021 to 2022

- Ernst & Young Ltd.

- Hamilton, Bermuda

- Date of Registration — March 1, 2021 to 2022

- KPMG Audit Limited

- Hamilton, Bermuda

- Date of Registration — March 1, 2021 to 2022

- PricewaterhouseCoopers Ltd.

- Hamilton, Bermuda

- Date of Registration — March 1, 2021 to 2022

Inspection and Investigation Activities

BPAB is constituted by the Bermuda Public Accountability Act 2011 [the “Act”], including subsequent amendments thereto in 2015 and 2017.

The procedures of BPAB are further set out in subordinate legislation made pursuant to the Act containing Rules and Regulations.

Section 32 of the Act and Rule 13 in Part 4 of the Bermuda Public Accountability [General] Rules 2015 [the “Rules”] specifically covers “Inspections and Investigations” providing for the inspections at least once in every three-year period for each of the registered PIE public accountants. Under the Act and Rules, BPAB may at any time determine that a special inspection is required, or where applicable, an investigation.

Inspection Activity

Inspections are assessments of the compliance of each PIE public accountant with the provisions of the Act and Regulations, the professional standards and rules, and the quality control policies of the PIE public accountant, in connection with the issuance of audit reports on the financial statement of PIEs.

Under the Rules, either the Compliance Committee, or any person or entity authorized by BPAB to participate in the inspection, may take such steps and perform such procedures as BPAB determines to be necessary or appropriate. These include document requests and oral interviews.

Rule 12 of the Rules provides that each member firm [and its professionals, partners and employees] are obliged to cooperate with inspections and comply with all BPAB demands and requests.

Inspection Reporting

Inspections result in the production of inspection reports as per Section 14 of the Rules which is to set out any weaknesses in the PIE public accountant’s system of quality controls, any significant deficiencies in any audit engagement reviewed, and recommendations for improvement with regards to the PIE public accountant’s system of quality controls.

Following an inspection under Rule 13, the Compliance Committee will first produce a draft inspection report containing the findings of the inspection. Within 30 days of receiving the Compliance Committee’s draft report, the member firm shall respond to the recommendations contained in the draft report. Upon considering the member firm’s responses, the Compliance Committee may make such amendments as it thinks fit and/or finalize the draft report.

Remedial Action

Upon finalization of an inspection report, Rule 15 provides that the Compliance Committee shall commence remedial action in respect of any weaknesses, deficiencies, and recommendations. Upon commencing remedial action, the member firm is required to submit evidence or otherwise demonstrate that it has remedied matters identified in the report, no later than 12 months after the date of the final report.

Where the member firm fails to adequately address all or any of the weaknesses, deficiencies or recommendations to the satisfaction of the Compliance Committee, the Compliance Committee shall publish its findings.

Investigation Activity

Where the Compliance Committee considers that a violation event has occurred, it may i] issue an order for an investigation under Rule 16 of the Rules; ii] may commence review proceedings; or iii] invoke its powers under Rule 24 where the Committee may give a violation event notice setting out the requirements, restrictions, or penalties the Committee proposes to impose on such PIE public accountant.

Review Proceedings

Review proceedings are a quasi-judicial process that entails empaneling four members of any professional agency or entity of good repute situated locally or international and selected by BPAB. These four independent adjudicators are entitled to determine a firm’s liability for non-compliance.

Section B: 2] Obligations under PATI Act [s5[1]b]

BPAB has the following obligations under PATI Act[s5[1]b]:

- To provide an information statement for the public and promulgate it [s5]

- To provide other information to the public so that the public needs only to have minimum resort to the use of the Act to obtain information [s6]. This includes:

- General information, e.g. activities of the Authority

- Log of all information requests and their outcome

- Quarterly expenditure [upon request] [s6[5]]

- Contracts valued at $50,000 or more.

- To respond to information requests in a timely manner [s12-16]

- To track information requests, and provide this data to the Information Commissioner

- To respond to requests from the Information Commissioner [s9]

- To amend personal information held by the Authority that it is wrong or misleading following a written request by the person to whom the information relates [s19]

- To conduct an internal review if formally requested [part 5]

- To give evidence for review by the Information Commissioner [part 6, 47[4]], or for judicial review [s49], if required

- To provide an annual written report to the Information Commissioner of the status of information requests [s58 [3]].

- To do anything else as required under the PATI Act and subsequent Regulations [s59, 60], including:

- Fees for Requests for information

- Management and maintenance of records

- Procedures for administering the Act

- To train staff and make arrangements so as to facilitate compliance with the Act [s61]

- To designate one of its officers to be the person to whom requests are directed [s62]

Audited financial statements and other financial information may be available upon request if you are Bermudian or a resident of Bermuda, by making a request for information under Public Access to Information [PATI] https://www.gov.bm/public-access-information-pati.

Section C: Services and Programmes [s5[1]c]

Services and Programmes: See Section B above.

Section D: Records and documents held [s5[1]d]

The Bermuda Public Accountability Board prepares and retains financial records at least quarterly as well as audited financial statements, budget, and an annual report annually.

See also Sections A, B and C above.

See also information available on our website at www.bpab.bm or www.bermudapab.com

Section E: Administration [all public access] manuals [s5[1]e]

On November 23, 2020, the Directors of the Bermuda Public Accountability Board adopted its Code of Ethics and updated its Conflict of Interest Policy, which are available upon request.

See also Sections A, B and C above.

See also information available on our website at www.bpab.bm or www.bermudapab.com

Section F: Decision-making documents [s5[1]f]

See response to Section E above.

Government Of Bermuda

Ministry Of Finance

PATI Information Statement

Name of Public Authority: Bermuda Public Accountability Board

Introduction:

Purpose of the Public Access to Information Act 2010: Under section 2 of the Public Access to Information Act 2012, the purpose of the Act is to-

[a] give the public the right to obtain access to information held by public authorities to the greatest extent possible, subject to exceptions that are in the public interest or for the protection of the rights of others;

[b] increase transparency, and eliminate unnecessary secrecy, with regard to information held by public authorities;

[c] increase the accountability of public authorities;

[d] inform the public about the activities of public authorities, including the manner in which they make decisions; and

[e] have more information placed in the public domain as a matter of routine.

Reason that the public authority has an information statement: Under Section 5 of the Public Access to Information Act 2010, every public authority in Bermuda must produce an information statement.

The purposes and aims of the information scheme, and what the public authority hopes to achieve through the information statement: This statement aims to make it easy to access key information about the Bermuda Public Accountability Board’s activities.

Summary of what is in the information statement: Categories of information contained in the information statement, including information provided are as follows:

- Structure, Organization and Legislation – who we are, what we do, our Board of Directors, and applicable legislation;

- Functions, powers and duties of Bermuda Public Accountability Board;

- Obligations under the PATI Act;

- Services and programmes;

- Records and documents held;

- Administration manuals;

- Decision-making documents;

- Name and contact details for the Information Officer; and

- Locations of the information statement.

Section A: Structure, Organization and Legislation [s5[1]a]

The Bermuda Public Accountability Board [BPAB] was established upon enactment of The Bermuda Public Accountability Act of 2011 [the Act] to provide oversight of Bermuda accounting firms that audit Public Interest Entities [PIEs], as defined by the Act and subsequent amendments thereto. The Act provides for a comprehensive, independent and transparent system of oversight by establishing BPAB and granting it powers to carry out the independent supervision of PIE public accountants. The oversight of PIE public accountants provided under The Act is also in accordance with Articles 29, 30, and 32 of the Directive 2006/43/EC of the European Parliament and Council as amended from time to time.

BPAB has engaged an Executive Director to manage the operational, strategic and financial day-to-day operations of BPAB, including the administration, programs, and strategic planning of BPAB. All key decisions of BPAB require approval of the majority of the Board of Directors.

Board of Directors

The Directors of BPAB are responsible for oversight of BPAB’s activities and affairs. The Board has a Chairman, a Secretary and three other non-executive members. Three of the Directors are professional accountants to ensure that the Board maintains accounting expertise. The two remaining members are seasoned financial and investment professionals that help deliver prudent independence and oversight. The Act specifies that a Board member is initially appointed for a three-year term, with extended terms as permitted by the Act.

The Directors of BPAB are as follows:

The Hon. Gerald Simons, OBE, Chairman

Gerald Simons is a retired insurance company executive and a former politician. In 2012 he retired from the Argus Group, a multi-line insurance company, after over 40 years of service, 12 of which were as President and CEO. Argus operates in Bermuda, Gibraltar and Malta. Mr. Simons served in the legislature of Bermuda from 1982 to 1995 and was a member of the Cabinet for 11 years holding various portfolios including education, environment and culture. In 2018 he ended six years as chairman of the board of the Bermuda Monetary Authority, the integrated financial services regulator in Bermuda. Over the course of his career Mr. Simons has served as a member of the board of a number of publicly traded companies including a bank and a public utility. He is the current chairman of the audit committee of the Bermuda Institute of Ocean Sciences. Mr. Simons has served as chairman or president of a number of organizations including the Bermuda Employers’ Council and The Bermuda National Trust. In 1996 Mr. Simons was made an officer of the Most Honourable Order of the British Empire [OBE] for service to Bermuda.

Tony Bibbings, Chairman Compliance Committee

John Anthony [Tony] Bibbings recently retired from the insurance industry in Bermuda. He most recently worked at Artex [Arthur J Gallagher] as an insurance broker into the Bermuda market and oversaw the management of smaller insurance companies mostly owned by their insureds, that is, captive insurance companies. Prior to nine years at Artex, he worked for six years for Beecher Carlson Bermuda in the same capacity. Prior to that, he worked as an underwriter at Swiss Re New Markets in Atlanta, Georgia and Scandinavian Re in Bermuda. In 1987 Tony moved to Bermuda from Canada where he had just earned his Chartered Accountant designation in Ontario. He has remained a member in good standing of CPA Ontario since 1987.

Andrew M. Marsh

Andrew M. Marsh is managing partner of an independent investment consulting and advisory firm in Bermuda. He also serves as an independent director for private investment companies. Andrew brings over 25 years of in-depth capital markets and asset management experience working for top global investment firms including Goldman Sachs [J. Aron & Company], Dai-Ichi Kango, and Alfred Berg in London, Stockholm, and Hong Kong. Since Andrew’s move back to Bermuda in 2001, he has spent time working in senior positions for hedge funds and asset management companies as chief economist, proprietary trader and equity analyst.

Wanda Mwaura, Secretary, Executive Director

Wanda Mwaura has served as the Executive Director of BPAB since January 2020. She also serves as non-executive director on various boards and chair of a risk and insurance committee and chair of audit committees for various entities. Wanda was formerly the Chief Accounting Officer of PartnerRe Ltd. and a Partner of Ernst & Young Ltd. [EY]. During her 17- year career at EY, Wanda served on various boards and committees including the Institute of Chartered Accountants of Bermuda [now known as CPA Bermuda], the Bermuda Insurance Institute, and the former Atlantic School of Chartered Accountants. Wanda is a CPA, CA and a member of the Chartered Professional Accountants of Bermuda.

Michelle Seymour Smith, Treasurer

Michelle Seymour Smith is an accomplished leader with over 20 years of international experience in public companies in the insurance and reinsurance industry. She most recently served as the Chief Transformation Officer of Arch Capital Group having previously held roles as Chief Financial Officer and Chief Operating Officer of Arch Reinsurance Ltd. Michelle has been recognized as one of 100 Influential Women in Insurance and Reinsurance by Intelligent Insurer and was named as a Fellow of the International Women’s Forum Leadership Foundation Program in 2017. Michelle is a CPA, CA and a member of the Chartered Professional Accountants of Bermuda.

Legislation

BPAB is constituted by the Bermuda Public Accountability Act 2011 [the “Act”]. The Act was amended in 2015, 2017 and 2020 to make certain conforming changes to clarify BPAB’s ability to impose civil penalties and to revise the definition of a Public Interest Entity [PIE].

The procedures of BPAB are further set out in subordinate legislation made pursuant to the Act.

See links on the Legislation page of our website at www.bpab.bm for the legislation contained in the Act, Amendments thereto, Rules and Regulations as follows:

- Bermuda Public Accountability Act 2011

- Bermuda Public Accountability Act 2011 Commencement Day Notice 2012

- Bermuda Public Accountability Amendment Act 2015

- Bermuda Public Accountability [General] Rules 2015

- Bermuda Public Accountability Act 2011 Commencement Day Notice 2015

- Bermuda Public Accountability [General] Regulations 2015

- Bermuda Public Accountability [Review Proceedings] Regulations 2015

- Bermuda Public Accountability [General] Amendment Rules 2016

- Bermuda Public Accountability Amendment Act 2017

- EU Withdrawal [consequential Amendments] Act 2020 [bermudalaws.bm]

Section B: 1] Functions, powers, duties of the Authority [s5[1]b]

BPAB is responsible for the oversight and registration of public accountants in Bermuda that conduct audits of Public Interest Entities [“PIEs”].

Registration

Every audit firm in Bermuda that audits a PIE must be registered with BPAB. Registration is for a one-year period and must be renewed annually. At present, BPAB oversees four audit firms in Bermuda [the Big 4] that are registered as “PIE public accountants” as follows:

- Deloitte Ltd.

- Hamilton, Bermuda

- Date of Registration – November 1, 2021 to 2022

- Ernst & Young Ltd.

- Hamilton, Bermuda

- Date of Registration — March 1, 2021 to 2022

- KPMG Audit Limited

- Hamilton, Bermuda

- Date of Registration — March 1, 2021 to 2022

- PricewaterhouseCoopers Ltd.

- Hamilton, Bermuda

- Date of Registration — March 1, 2021 to 2022

Inspection and Investigation Activities

BPAB is constituted by the Bermuda Public Accountability Act 2011 [the “Act”], including subsequent amendments thereto in 2015 and 2017.

The procedures of BPAB are further set out in subordinate legislation made pursuant to the Act containing Rules and Regulations.

Section 32 of the Act and Rule 13 in Part 4 of the Bermuda Public Accountability [General] Rules 2015 [the “Rules”] specifically covers “Inspections and Investigations” providing for the inspections at least once in every three-year period for each of the registered PIE public accountants. Under the Act and Rules, BPAB may at any time determine that a special inspection is required, or where applicable, an investigation.

Inspection Activity

Inspections are assessments of the compliance of each PIE public accountant with the provisions of the Act and Regulations, the professional standards and rules, and the quality control policies of the PIE public accountant, in connection with the issuance of audit reports on the financial statement of PIEs.

Under the Rules, either the Compliance Committee, or any person or entity authorized by BPAB to participate in the inspection, may take such steps and perform such procedures as BPAB determines to be necessary or appropriate. These include document requests and oral interviews.

Rule 12 of the Rules provides that each member firm [and its professionals, partners and employees] are obliged to cooperate with inspections and comply with all BPAB demands and requests.

Inspection Reporting

Inspections result in the production of inspection reports as per Section 14 of the Rules which is to set out any weaknesses in the PIE public accountant’s system of quality controls, any significant deficiencies in any audit engagement reviewed, and recommendations for improvement with regards to the PIE public accountant’s system of quality controls.

Following an inspection under Rule 13, the Compliance Committee will first produce a draft inspection report containing the findings of the inspection. Within 30 days of receiving the Compliance Committee’s draft report, the member firm shall respond to the recommendations contained in the draft report. Upon considering the member firm’s responses, the Compliance Committee may make such amendments as it thinks fit and/or finalize the draft report.

Remedial Action

Upon finalization of an inspection report, Rule 15 provides that the Compliance Committee shall commence remedial action in respect of any weaknesses, deficiencies, and recommendations. Upon commencing remedial action, the member firm is required to submit evidence or otherwise demonstrate that it has remedied matters identified in the report, no later than 12 months after the date of the final report.

Where the member firm fails to adequately address all or any of the weaknesses, deficiencies or recommendations to the satisfaction of the Compliance Committee, the Compliance Committee shall publish its findings.

Investigation Activity

Where the Compliance Committee considers that a violation event has occurred, it may i] issue an order for an investigation under Rule 16 of the Rules; ii] may commence review proceedings; or iii] invoke its powers under Rule 24 where the Committee may give a violation event notice setting out the requirements, restrictions, or penalties the Committee proposes to impose on such PIE public accountant.

Review Proceedings

Review proceedings are a quasi-judicial process that entails empaneling four members of any professional agency or entity of good repute situated locally or international and selected by BPAB. These four independent adjudicators are entitled to determine a firm’s liability for non-compliance.

Section B: 2] Obligations under PATI Act [s5[1]b]

BPAB has the following obligations under PATI Act[s5[1]b]:

- To provide an information statement for the public and promulgate it [s5]

- To provide other information to the public so that the public needs only to have minimum resort to the use of the Act to obtain information [s6]. This includes:

- General information, e.g. activities of the Authority

- Log of all information requests and their outcome

- Quarterly expenditure [upon request] [s6[5]]

- Contracts valued at $50,000 or more.

- To respond to information requests in a timely manner [s12-16]

- To track information requests, and provide this data to the Information Commissioner

- To respond to requests from the Information Commissioner [s9]

- To amend personal information held by the Authority that it is wrong or misleading following a written request by the person to whom the information relates [s19]

- To conduct an internal review if formally requested [part 5]

- To give evidence for review by the Information Commissioner [part 6, 47[4]], or for judicial review [s49], if required

- To provide an annual written report to the Information Commissioner of the status of information requests [s58 [3]].

- To do anything else as required under the PATI Act and subsequent Regulations [s59, 60], including:

- Fees for Requests for information

- Management and maintenance of records

- Procedures for administering the Act

- To train staff and make arrangements so as to facilitate compliance with the Act [s61]

- To designate one of its officers to be the person to whom requests are directed [s62]

Audited financial statements and other financial information may be available upon request if you are Bermudian or a resident of Bermuda, by making a request for information under Public Access to Information [PATI] https://www.gov.bm/public-access-information-pati.

Section C: Services and Programmes [s5[1]c]

Services and Programmes: See Section B above.

Section D: Records and documents held [s5[1]d]

The Bermuda Public Accountability Board prepares and retains financial records at least quarterly as well as audited financial statements, budget, and an annual report annually.

See also Sections A, B and C above.

See also information available on our website at www.bpab.bm or www.bermudapab.com

Section E: Administration [all public access] manuals [s5[1]e]

On November 23, 2020, the Directors of the Bermuda Public Accountability Board adopted its Code of Ethics and updated its Conflict of Interest Policy, which are available upon request.

See also Sections A, B and C above.

See also information available on our website at www.bpab.bm or www.bermudapab.com

Section F: Decision-making documents [s5[1]f]

See response to Section E above.

Section G: The Information officer [s5[1]g]

Name and contact information:

Gerald Simons, Chairman of Bermuda Public Accountability Board

Email: Gerald@bermudapab.com

Phone: [441] 261-8481

Section H: Any Other Information [s5[1]h]

See Sections A through G above. See also information available on our website at www.bpab.bm

or www.bermudapab.com

Section I: Any Other Information To be Provided? [s5[1]i]

None.

Section J: Information Statement: Copies and Updates [s5[2,3,4,5]]

Every public authority shall update its information statement at least once a year, and make it available for inspection by the public at reasonable times by [s5[1-5], PATI Act]:

Date Information Statement was updated: December 31, 2020

Locations of Information Statement:

Confirm copies of Information Statement are available at the following sites:

- Your principal office: [12 Bermudiana Rd, 2nd Floor, Rosebank Building HM 11] Y/N

- The Bermuda National Library; Y/N

- The Bermuda Archives; Y/N

- Available electronically, Y/N

- Website for public authority [www.bpab.bm or www.bermudapab.com]. Y/N

- Have you published a notice in the Gazette indicating the places where the information statement is available for the public? Y/N

- With the Information Commissioner. Y/N

Sign:

______________________________________________________

Gerald Simons, Chairman of Bermuda Public Accountability Board

Date: December 31, 2021

The official notices above have been republished from the relevant section on the official Government website. If you wish to view ‘hard copies’, the Department of Libraries & Archives prints them and you can visit the main library on Queen Street or the Government Archives in the Government Administration Building on Parliament Street to view them.

Read More About

Category: All