MPs Seek To Legislate For Crown Dependencies

Some British MPs continue to seek to pass legislation in relation to the islands, with a cross party amendment yesterday seeking to order the Crown Dependencies to make their beneficial ownership registers public by the end of next year, with the amendment also seeking to reiterate the order for Overseas Territories to do so.

However the Bill was pulled in British Parliament yesterday, with various British media [1] [2] suggesting that it was pulled as the UK Government wished to avoid defeat.

The matter had been brought up in the recently released report from the British Parliament’s Foreign Affairs Committee inquiry, which cited the law passed in UK Parliament to order Overseas Territories to make their registers public, with the Committee saying they “profoundly regret” that “public registers may not be published before 2023″ and urged the UK Government to lay out a timetable.

In his press conference yesterday, Premier David Burt said some have sought to downplay the Report — which also recommends British citizens get the right to vote in Bermuda — as “only a Committee report that should not be taken as the views or intentions of the UK Government.”

“This is not so,” the Premier said yesterday. “In a move that even the UK Government was not prepared for, a cross party amendment has been introduced into the House of Commons in London and is slated for the report stage under their procedure today.

“The amendment seeks to further force the issue regarding public registers of beneficial ownership and we understand that its support is considerable and growing. It seems that some members within the House of Commons are not waiting for the Government to take a position on the Report’s recommendations; they are moving with haste to force their implementation.”

In reporting on the amendment, the BBC said, “A group of MPs had hoped to amend the bill to force greater tax transparency in Britain’s Crown Dependencies.

“Jersey, Guernsey and the Isle of Man would have to have public registers of beneficial ownership under their plans.The Treasury said as the amendments were only tabled on Thursday, they will be considered at a later date to ensure “sufficient time for proper debate”.

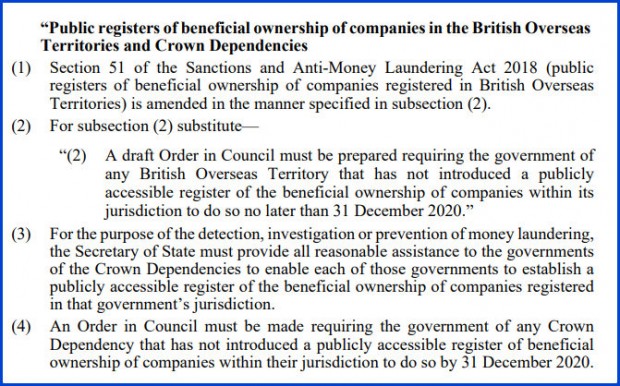

Dozens of UK MPs had signed the amendment to the Financial Services Bill [PDF], which called for a draft Order in Council — which is basically an order from the UK — for any British Overseas Territory or Crown Dependency “that has not introduced a publicly accessible register of beneficial ownership of companies within their jurisdiction to do so by 31 December 2020.”

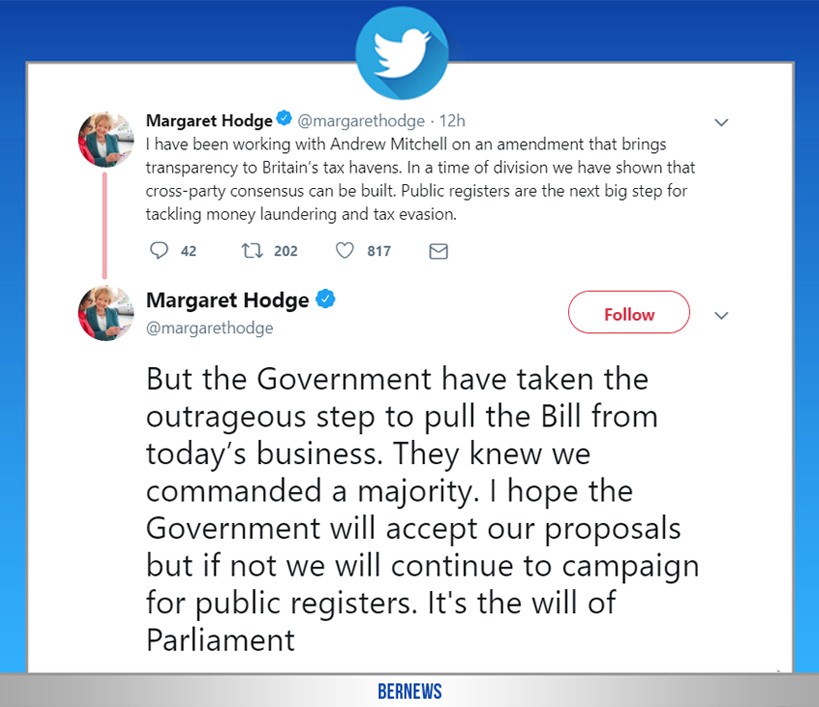

Dame Margaret Hodge MP, one of the key proponents of the Bills legislating for what she calls “Britain’s Tax Havens” said the UK government’s decision to pull the Bill was ‘outrageous’.

Dame Margaret Hodge’s tweet:

Conservative MP Andrew Mitchell and Labour’s Margaret Hodge — who were key in the first bill that legislated for the Overseas Territories — led the group of MPs in the amendment yesterday, and Mr Mitchell told the BBC: “In the face of certain defeat the government have pulled the business for today but the business will return and so will this important amendment”.

“In the Commons, he complained to the Speaker that the government intended “arbitrarily to extend” the 2020 deadline “by no less than three years to the end of 2023 in flagrant breach of what was agreed by this House,” the BBC reported.

The Crown Dependencies have taken a similar position to the Overseas Territories, as a joint statement from the islands said, “The governments of Jersey, Guernsey and the Isle of Man have raised strong objections to several amendments that are being proposed to the UK’s Financial Services [Implementation of Legislation] Bill.

“We are not represented in the UK Parliament, and it is a respected constitutional position that the UK does not legislate for the Crown Dependencies on domestic matters without our consent. The proposed amendments are contrary to the established constitutional relationships that exist between the United Kingdom and each of the Crown Dependencies and, if passed, would produce inoperable legislation.

“The proposed amendments attempt to impose public registers of beneficial ownership for all Crown Dependencies and Overseas Territories. We also consider the legislation to be wholly unnecessary in the context of our robust existing approach to the retention and sharing of beneficial ownership information. All Crown Dependencies are committed to the highest standards of financial services regulation and transparency.”

Screenshot of the relevant amendment in the UK Parliament Bill

In an editorial, the UK’s Guardian newspaper said the Bill “was supposed to begin a process of reining in Britain’s postcolonial possessions, which have become rich and disruptive through their tax-haven status.”

The Foreign Affairs Committee report and the recent legislation pertaining to the Crown Dependencies and Overseas Territories comes as Britain is making their final preparations to exit the European Union, and is seeking to build what they term a “Global Britain.”

So the bill was pulled yesterday.

Once again, David Burt, please politely tell the UK Government to piss off!

From a recent Guardian report, almost 40% of corporate investments channeled away from authorities and into tax havens travel through the UK or the Netherlands. The Netherlands was a conduit for 23% of corporate investments that ended in a tax haven. The UK accounted for 14%, ahead of Switzerland (6%), Singapore (2%) and Ireland (1%).

According to Dr Eelke Heemskerk, who led research in this area, “In the context of Brexit, where you have the UK threatening, unless they get a deal, to change their model to be attractive to companies who want to protect themselves from taxes, well, they are already doing it.”

Good morning, Premier Burt. Kindly tell the UK Government to piss off!

They are one of the largest conduits for offshore tax havens. Until they and the other countries around the world, including the USA, make this a golden standard, we will not meet any of the “required” deadlines they put in place.