PwC: M&A Reached Record Heights In 2021

M&A reached record heights in 2021 and deal momentum is set to continue in 2022 fueled by digital acceleration, according to a PwC analysis.

A spokesperson said, “A strong deals pipeline, the availability of abundant capital, and an ongoing intense demand for digital and data-driven assets all point to another supercharged year for M&A in 2022, according to PwC’s Global M&A Industry Trends: 2022 Outlook. This follows unparalleled growth in deal values and volumes in 2021.

“The analysis examines current global deals activity and incorporates insights from PwC’s deals industry specialists to identify the key trends driving M&A volumes and valuation multiples.

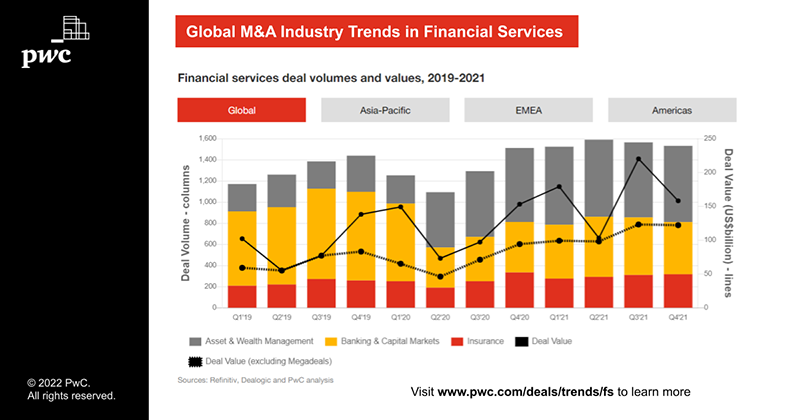

“In the financial services sector: Competition for strategic market advantage continues to fuel M&A, with activity led by deals for technology and innovation.

“Asset and wealth managers are looking to expand into new asset classes, banks are being pushed to modernize by implementing new digital solutions, and insurance companies are looking for opportunities to divest non-core assets or refocus core competencies.

“While activity is still largely defined by the consolidation of a highly fragmented industry, new business models are emerging in sub-sectors, especially among fintechs, insurtechs and regtechs. Although targets in these sub-sectors are often highly attractive opportunities, high multiples raise the stakes for investors, who increasingly need to adopt a value-creation mindset to maximize their return on investment.”

James Ferris, Partner and Advisory leader, PwC Bermuda, said, “An attractive market, with many potential investors is continuing to lead to divestiture activity, along with capability-driven deals as organizations seek to leverage technology, buy into niche markets and drive business efficiencies. Optimizing capital structures will result in further deal activity in the insurance and reinsurance sectors.”

The spokesperson said, “While dealmaking will likely remain robust in 2022, headwinds from higher interest rates, rising inflation, increased taxes and greater regulation could pose structural or financial hurdles for completing deals in 2022.”

Damian Cooper, PwC Bermuda partner, Insurance, said, “In the global insurance and reinsurance market, record levels of deployable capital and continued investor interest in insurance carriers and distributors are boosting M&A activity, especially in the US market.

“We expect private equity firms and asset managers will continue their push into the insurance sector, specifically in the life insurance and annuity space, as large insurance carriers seek to divest non-core assets.”

The spokesperson said, “Increased interest in acquisitions from mutual insurers reflects the desire to acquire blocks of business, as they seek to grow and offer new products.

“Ongoing brokerage consolidation is expected to continue apace. Several specialized PE players are focusing on the insurance brokerage sector, using a roll-up strategy to gain scale.

“Enthusiasm for insurtech IPOs has recently waned due to lower post-IPO performance. While operating profits may have fallen short of expectations which their market cap created, the underlying technology and data-collection opportunities remain attractive. As such, we expect overall investor interest in the insurtech space to remain high, both from PE investors and corporates that are looking to bolster their technology and client offerings.

“2021 saw a record year for M&A in both volume and value – by a long shot. The number of announced deals exceeded 62,000 globally in 2021, up an unprecedented 24% from 2020. Publicly disclosed deal values reached all-time highs of US$5.1 trillion – including 130 megadeals with a deal value of US$5 billion or more – a whopping 57% higher than in 2020 and smashing the previous record of US$4.2 trillion set in 2007.

“Private equity is flexing its fundraising power and increasing its market share of deals activity

“PE continues to capture more, and larger, deals. Almost 40% of deals in 2021 involved a PE fund, up from just over a quarter for the past five years, and PE firms are doing bigger deals, accounting for 45% of total deal value in 2021, compared to 30% over the past five years. Heading into 2022, PE has ramped up its deal capacity, raising record levels of “dry powder” capital.

“Portfolio reviews are driving divestiture and acquisition activity across industries

“On the corporate side, we expect the strategic shift to digital, innovative and new disruptive business models to continue to drive M&A decision-making. With market conditions that demand a greater value creation mindset across global boardrooms, CEOs will also likely focus on divestitures, as they rebalance their portfolios for longer term growth and profitability.

“Environmental, social and governance [ESG] factors will also increasingly influence M&A strategies throughout 2022.

“These trends are playing out across other key industries:

- “Consumer markets: Consumer preferences will continue to serve as a catalyst for M&A activity in 2022 as corporates and PE remake their portfolios to capitalize on trends such as ‘conscious consumerism’ which are creating demand for new products and services and entirely new business models.

- “Energy, utilities and resources [EU&R]: ESG is driving strategies across the industry. M&A will be used to rebalance portfolios and pursue value creation opportunities in ESG growth areas such as renewables, carbon capture, battery storage, hydrogen, transmission infrastructure and other clean technologies.

- “Health industries: Pharma companies are seeking to optimize their portfolios for growth through deals that provide access to new technologies such as mRNA and cell and gene therapy. In healthcare services, speciality care platforms, telehealth, healthtech and data and analytics companies are attracting investor interest.

- “Industrial manufacturing and automotive: Strategic portfolio reviews and ESG are driving M&A activity – in particular, deals that accelerate digital transformation such as electric and autonomous vehicles, batteries and charging technologies, additive manufacturing, next-generation materials, and production with non-fossil energy sources.

- “Technology, media and telecommunications: As traditional industries face high levels of disruption and innovative technologies propel into the mainstream faster than anticipated, the technology sector will continue to see unmatched levels of deals activity—and deal values—as companies from across all industries seek to acquire key technology or digital capabilities.”