Column: Pre-Budget Analysis Of Our Economy

[Opinion column written by Larry Burchall]

With the national hysteria over the bad deal at the Airport now died down, it’s wise to re-focus on the real enemy of Debt and Bermuda’s weak economy.

Laid out for laypersons, not professors or high-level business executives, what follows is a clear and honest analysis of Bermuda’s economy as it was in 2008 and as it will likely evolve in 2017. Friday’s upcoming 2017/18 Budget should be examined against this factual national backdrop.

One huge fact stands out. The Bermuda Government’s now fourteen year old pattern of overspending is Bermuda’s ‘enemy within the gates’. Or, as cartoonist Walt Kelly’s Pogo said: “We have met the enemy, and he is us.”

All Bermudians should be fully aware and must understand that they will face many more years of a tight economy before Bermuda gets or can get its “mojo back” and has a Government that no longer deliberately overspends and consequently borrows to pay its day-to-day expenses.

Question? – In 2017, when Bermuda’s GDP regains the numerals 6.1 for its GDP [nominal], will that be from real growth in Bermuda’s economy?

Answer – Reported, by Government, at $5.9bn for 2015, Bermuda’s GDP may soon regain or pass the $6.1bn nominal GDP level of 2008. This may have happened in late 2016, or will happen in early 2017. In 2016/17 Government Revenue will likely exceed GovRev of 2008. [Adjusted for inflation, GDP was $5.6bn/2008 and $4.6bn/2015 [DoS].]

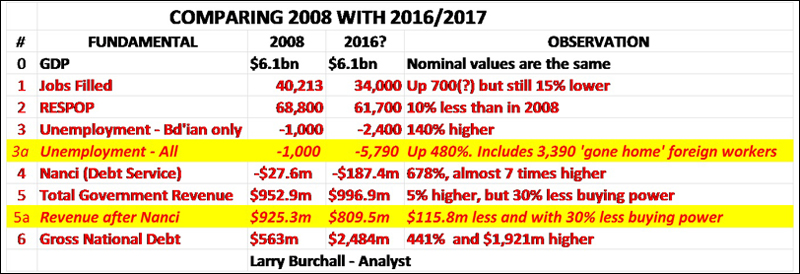

However, GDP and GovRev will be only two of seven key components that, in 2017, are likely to regain or exceed the numeric levels last seen at Bermuda’s economic peak in 2008. Five of these seven key components will remain well below the levels that they reached in 2008. Two will be higher. Gross National Debt will be almost five times higher and Nanci will be almost seven times higher.

This means no real growth in Bermuda’s economy. Instead, Bermuda will experience a ‘dead cat bounce’.

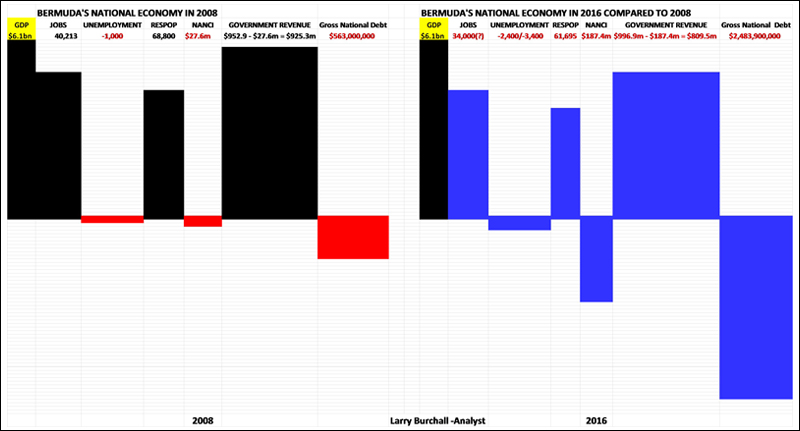

The table that follows displays all of that in words and numbers. The first chart displayed it graphically.

If a return to [nominal] $6.1bn GDP is presented as national ‘economic recovery’, it must be recognized, as the numbers show and confirm, this is simply a textbook ‘recovery’ that is actually a real world ’dead cat bounce’.

In plain language, the recovery to $6.1bn is simply a return to one particular set of digits. A national economic recovery like this will still show strong negative outcomes in six of seven fundamentals. When comparing the two pictures created by the fundamentals, it is immediately and clearly obvious that Bermuda’s 2017 national economy will not and cannot look or feel like 2008.

Bermuda’s Economy. 2008 and 2017. Out of trouble?

1. By mid-2017, Bermuda is likely to regain the 2008 GDP [nominal] figure of $6.1 billion [$6.1bn]. However, six of seven inter-connected fundamentals will not recover or will not have returned to 2008 levels. These six fundamentals are:-

- a. First Fundamental – Jobs filled. In 2008, there were 40,213 jobs filled, with 27,180 Bermudian and 13,033 non-Bermudian Guest Workers. In a 2017 recovery, even with possibly [and optimistically] 481 new jobs added, filled jobs total might just rise to 34,000. This is still 6,200 jobs and 15% lower than the 40,213 jobs filled at economic peak in 2008. For Bermudians, even at a slightly improved filled jobs total of 24,000, [+424 jobs], Bermudian employment will still be stuck at a level LOWER than 36 years ago [in 1981] when the Department of Statistics [DoS] reported 24,191 Bermudians filling jobs – with some Bermudians filling second and even third jobs. As far as total filled jobs, at 34,000 possible in 2017, this is lower than 22 years ago, in 1994, when total filled jobs were reported by DoS as 34,143. Clearly, no return to 2008 job levels.

- b. Second Fundamental – Residential Population [ResPop]. In 2008, at economic peak, Bermuda had between 68,000/69,000 residents – of whom 40,213 [59%/58% of calculated ResPop] were filling jobs. For 2016, Government reported ResPop of 61,695. Filled jobs might have grown to 34,000. In 2026 or 2017, even at 34,000, filled jobs would still be a materially lower 55% of Government’s reported smaller ResPop of 61,695. So ResPop loss remains negative and significant with ResPop 10% lower than in 2008.

- c. Third Fundamental – Unemployment. With real unemployment amongst Bermudians of 1% – 3% in 2008, statistically, for Bermudians, there was full employment; with 97% to 99% of all working age Bermudians filling jobs. In 2016, unemployment for Bermudians was reckoned to be between 2,400 and 3,400. This gave a Government reported and ‘textbook friendly’ unemployment rate – Bermudian only – between 7% and 9%. However, when 3,391 `‘gone home’ Guest Workers are considered, Bermuda’s ‘total national’ unemployment is a more realistic, very high, and ‘real world’ 17% – 18%. In 2017, unemployment for Bermudians will not return to the 1% – 3% level of 2008. Regaining 1% – 3% requires adding about 2,000 jobs for Bermudians. Overall, Bermuda’s economy will not have re-grown to where it re-employs over 5,000 workers.

- d. Fourth Fundamental – Nanci [Annual total Debt Service Cost]. In FY 2008/09, Nanci was $27.6m a year/$75,707 a day. In FY 2016/17, the Government forecast Nanci at $187.4m a year/$513,356 a day. This is almost seven times [678%] higher than in 2008/09. With the $665m loan just taken up, at $2,483.9 million [$2.49 billion], gross Debt is now a much higher 249% of Government’s projected GovRev of $996.9m for 2016/17. That’s two and a half times projected GovRev. This deeply worsens the already toxic relationship between the three fundamentals of GovRev, Gross Debt, and Nanci. Nanci is the ‘killer’. [Note:- From 11th November 2016, Gross Debt will be almost four and a half times higher than in 2008. However, the daily expense of carrying that heavy Debt burden will be over seven times [700%] higher. Since 2008, GovRev has grown only 5%. This big difference in the rate of increase in the daily expense of carrying gross Debt – the daily cost of feeding Nanci – is the silent evil driver for this ‘killer trio’.

- e. Fifth Fundamental – Government Revenue. GovRev was projected to be $996.9m in FY 2016/17. However, after priority feeding Nanci in FY 2016/17, ‘spendable’ GovRev plummeted to $810 million [$997m minus [Nanci] $187m = $810m]. This FY 2016/17 $810m spendable GovRev should be compared to, and is LESS than the spendable GovRev of $925m [$953m minus [Nanci] $28m = $925m] in FY 2008/09. [To clearly illustrate the enormity of the difference, note that in 2008, a loaf of bread sold for $4.50 {DoS}. So the $925 of 2008 would have paid for 205 loaves of bread. However, in 2016, bread sold for $6.35 a loaf. So the spendable $810 of 2016 could only pay for 128 loaves. In 2016, the buying power of a Government dollar was about 38% less than its 2008 power. Put another way, Government spending in 2017 will purchase only about 62% of what it could buy or pay for nine years ago in 2008/09. Only 128 loaves, not 205. So Government either exists on 128 loaves or borrows so it can purchase more loaves.] Therefore there will not and cannot be any material change in this fifth fundamental.

- f. Sixth fundamental – After the $665m Debt shuffle, national Debt costs are higher. The overall impact of the style of taking up of this $665m of new and additional debt is:

- i. Clears the $200m Loan Facility from BNTB due for repayment in Jul 2017.

- ii. Repays $90m due for repayment in May and November 2016.

- iii. Early pay-off $276.1m of the $500m Bond issue due for repayment in July 2020.

- iv. Getting this $665m tranche of ten year bonds at 3.717%.

- v. Reducing the overall average rate of interest from 5.09% to 4.66%.

- vi. Adding new Debt of $98.9m which takes 2017 Gross Debt to $2,483.9m.

- vii. Increases the annual cost of feeding Nanci by $1,964,667

Bermuda’s Debt ceiling is currently set at $2,500m. There is now only $16,100,000 left that can be borrowed before the Debt Ceiling must rise – again.

2. A return to the [nominal] figure of $6.1bn GDP will not and cannot end Bermuda’s recession. For Bermuda, that recession started in 2009. In 2016, Bermudians did not see substantial increases in jobs filled, real growth in ResPop, or a decrease in Gross Debt or Nanci. Nor was there any real increase in Government’s real ability to spend in Bermuda on Bermudians; that is, no real increase in net or spendable GovRev. The same will apply for 2017.

3. However, citing generally accepted textbook definitions, Government spokespersons will likely proclaim that Bermuda’s ‘recession’ is over. But, still affected by these six fundamentals, the consequences and outcomes of all these factors is that, like the stopped hands of a broken clock, Bermuda’s national economy will merely regain a number – $6.1bn – that had been reached once before.

4. What, exactly, has happened? Driven by global price changes, the on-Island impacts of those global price changes, and the passage of time, nominal GDP will grow. However, Bermuda will remain in recession – but just might have flattened out, possibly ready to begin a sluggish ascent from the deep dark economic dungeon into which Bermuda began sliding in FY 2010/11.

5. Starting in 2017 and beyond, Government needs to prevent Nanci from growing any bigger, and simultaneously increase revenue [that’s net revenue after feeding Nanci]. This can only be done with massive increases in existing taxes, or a massive addition of brand new taxes – all imposed on Bermuda’s existing weak and struggling economy; or by extracting additional tax revenues from an economy whose real and nominal GDP is growing by leaps and bounds – that is, by 5% or more annually as happened in the decade leading up to 2008. The only alternatives to massive tax increases are cutting expenditure or continued large scale borrowing – or a combination of both. In 2017, Government will still have a desperate need for revenue.

6. The necessary five percent [5%] annual growth in gross revenue from steadily rising GDP should be set against Government’s February 2016 projection of seven percent [7%] average annual growth in Government revenue out to 2020 [7.0%/2016/17 … 7.1%/2017/18 … 7.3%/2018/19]. This Government projection of a 7% revenue growth rate is much higher than the growth rate projection in Moody’s report on 3rd June 2016. In this report, Moody’s reported: “… we forecast that Bermuda will grow on average 1.8% annually in 2016 – 2020, lower than the 3% median forecast for A-rated peers.” Further into their report, Moody’s also wrote: “…“Positive economic momentum should carry into 2016 and 2017 supported by increased tourism activity related to the 2017 America’s Cup, as well as by increased investment on tourism-related and public infrastructure projects. Moody’s expects that the economy will accelerate to 2.3% on average in 2016-17 and will grow 1.0-2.0% during the following three years.” In this June 2016 report, Moody’s dropped Bermuda’s Sovereign Credit Rating from “A1” to “A2” – just one step [“A3”] separating from Moody’s “Baa1”.

7. In its February 2016 Budget Statement, Government projected a 7% increase in revenue in 2017/18. However, in the aftermath of its surrender of over 3% of its annual revenue to Bermuda Skyport Corporation in order to fund Government’s planned Airport Development scheme; Government now needs an 11% revenue increase to maintain or regain that 2017/18 projected revenue increase. Considering all six fundamentals, as well as Moody’s growth forecast, Government’s revenue growth is likely to be slower than Government projections. It is entirely possible that actual revenue may not rise materially or rise at all. It could even fall.

8. All Bermudians should be fully aware and must understand that they will face many more years of a tight economy before Bermuda gets or can get its “mojo back” and has a Government that no longer deliberately overspends and consequently borrows to pay its day-to-day expenses.

- Larry Burchall

20 Most Recent Opinion Columns

- 17 Feb: Column: Why Did You Get Involved In Politics?

- 13 Feb: Column: Reasonable Degree Of Mutual Respect

- 12 Feb: Column: Dealing With & Rolling Over Pensions

- 09 Feb: Column: Encouraging Peaceful Demonstrations

- 08 Feb: Column: Marking Cancer Awareness Month

- 08 Feb: Column: We’re Bermudians, We Are Not Animals

- 04 Feb: Column: Rabain On Cannabis Decriminalisation

- 01 Feb: Column: ‘Our Advantages Worth Underscoring’

- 31 Jan: Column: “Thank You For Saving My Life’

- 30 Jan: Column: I’m An Airport Convert & Here’s Why

- 25 Jan: Column: Questions About Actions On Dec 2nd

- 20 Jan: Column: ‘My Top Five Tips For Lustrous Locks’

- 19 Jan: Column: What Happened Between 2006 – 2016?

- 13 Jan: Column: ‘A Healthy Democracy Needs All Of Us’

- 12 Jan: Column: ‘Year Of Monumental Change In West’

- 10 Jan: Column: ‘Time Of Risks, But Also Opportunity’

- 10 Jan: Column: Deliver While You Continue To Develop

- 09 Jan: Column: Social And Economic Empowerment

- 09 Jan: Column: ‘Our Island’s Future Is In All Our Hands’

- 08 Jan: Column: Differences Resolved Through Dialogue

Opinion columns reflect the views of the writer, and not those of Bernews Ltd. To submit an Opinion Column/Letter to the Editor, please email info@bernews.com. Bernews welcomes submissions, and while there are no length restrictions, all columns must be signed by the writer’s real name.

-

Thank you Mr Larry Burchall for an analysis of our economy. We need a national debate and a strategic plan developed on a way forward to get us out of this hole.

Why isn’t 2016 compared to 2012? Mr Burchall has cherrypicked the top of the economy.

That is what I said about the last opinion article he wrote about numbers! He picks where he can to make it seem like the “best” argument when in fact it’s not the full picture of year over year and what has happened in between. There is much more to it than just 2008 and 2016/17, it’s extremely misleading.

Why 2008?

Because GDP will soon return to the nominal level reached in 2008. Hence the comparison with 2008.

Larry Burchall.

This is good, but might be good to provide a TLDR version:

1. Things are better than they were, but it’s still bad.

2. We borrowed way too much under the PLP, and haven’t been able to course-correct under the OBA, so NANCI is still our main enemy.

3. With our current policies and structure, we can’t increase revenue enough to dig ourselves out, without cutting expenditures – and likely even with that.

4. Larry is great about highlighting the fact we just have significantly fewer people here than in 2008. That’s a bad thing because generally speaking you don’t get much growth without people.

The bad news is that this basically puts the OBA in an untenable position. What the OBA *should* do, is increase taxes on companies – but that is incredibly sensitive because companies are happy to relocate if it’s too big an increase – at the same time as cutting the civil service and other expenditures. The latter is just political suicide, even though it needs doing.

So it’s a serious tightrope walk. Companies must be willing to cede some increasing percentage of profits to the local government – but not so much that the marginal benefits of being here are eroded. And remember this is a time when the US President is rather keen on punishing US companies doing operations abroad. The biggest risk to Bermuda is actually Trump deciding some radical change to tax policy (let’s turn on today’s news shall we?)

Personally I’d love to see Larry/someone do a thought piece on the share of revenue derived from international business in Bermuda. I find a good share of Bermudians seem to believe that IB is just some giant piggy bank that needs shaking for the good of us any our tiny island. Those companies are only here because it benefits them to be so – the second that ceases to be the case, Bermuda’s future is basically bleak. A smarter Bermudian would be doing everything they can to attract foreigners and their investment, rather than antagonizing them.

Mr. Burchall has been consistently warning everyone about the dangerous borrowing levels for years. He showed with simple math that not even a full economic rebound would pay for all of the government spending. No one listened.

And now the government has delayed cuts to for another year. Hopefully they will start next year, to avoid even more pain.

It amazes me how people are so concerned about the level of national debt now that the hole is as big as it is.

What would all these ‘commentating experts’ do with their time if the governments finances were in the black?

How quickly they forget.

Larry I have been keenly following your economic and island social analysis since they first appeared in print. Your forecast have been borne out almost to the letter.

We live in a world where many suffer from varying degrees of conceptual blindness. Others just suffer from that dreadful metal illness where they cannot see past their noses – surely a stumble will follow.

The taste of fake news might be tantalizing – but please do not swallow.

Thanks, as ever, Mr. Burchall, for keeping these important if unpleasant facts in the public eye.

Larry , Bob was able to raise the additional $45 .4 million to cover the airport cost .So Bermuda we will get a new airport without too much stress placed on the average citizen. The goal is to eliminate the $135 million deficit over the next two years. This is very possible .Since 2013/14 it has come down from $331 million .Additionally , the civil service must be cut more . It is hoped as the economy expands , many of these highly paid professionals will be push out of government into the private sector. Let’s push to increase the resident population . Jobs are coming on line, Morgan’s Point, the airport , and the new hotel in St. George’s .Looks like I see green shoots. Spring must be on it’s way. Again, without money, the government must speak to the needs of the people at the lower end, the man in the street. There is at least $90 million dollars of waste in the government’s budget (10% ) ,but Bob dare not touch that. The civil servants and the BIU would eat him alive. PROVE ME WRONG ? Nanci has not been very kind to us. Those PS’s will not hold the line. They do not believe in zero sum budgeting .Even when Bob tells them not to spend, they in fact spend more. BUT BOB WILL NOT FIRE THEM. WHY!! Those powerful unions again.

Now can some financial GURU put all of this yadda yadda into every day terms for the average not so educated Bermudian please!

Larry who should we vote for in the next election who will be able to sort this mess out?