Romney: Bermuda Tax Avoidance

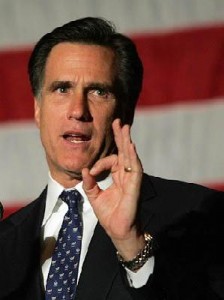

Putative Republican Presidential front-runner Mitt Romney [pictured] used a shell company in Bermuda to help investors in his asset management company avoid paying US taxes, the “Los Angeles Times” reported earlier this month.

Putative Republican Presidential front-runner Mitt Romney [pictured] used a shell company in Bermuda to help investors in his asset management company avoid paying US taxes, the “Los Angeles Times” reported earlier this month.

Federal and state records show the former Massachusetts Governor gained no personal tax benefit from the legal operations in Bermuda or from another fund in the Cayman Islands.

“But aides to the Republican presidential hopeful and former colleagues acknowledged that the tax-friendly jurisdictions helped attract billions of additional investment dollars to Romney’s former company, Bain Capital, and thus boosted profits for Romney and his partners,” reported the newspaper on December 17.

Boston-based Bain Capital is one of the world’s leading private, alternative asset management firms whose affiliates manage approximately $66 billion.

Mr. Romney has based his White House bid, in part, on the skills he learned as co-founder and chief of Bain Capital. While his presidential campaign cites his record while governor of Massachusetts of closing state tax loopholes, his involvement with what the “Los Angeles Times” called “foreign tax havens” had not previously been reported.

“In Bermuda, Romney served as president and sole shareholder for four years of Sankaty High Yield Asset Investors Ltd.,” said the newspaper. “It funneled money into Bain Capital’s Sankaty family of hedge funds, which invest in bonds and other debt issued by corporations, as well as bank loans.

“Like thousands of similar financial entities, Sankaty maintains no office or staff in Bermuda. Its only presence consists of a nameplate at a lawyer’s office in downtown Hamilton, capital of the British island territory. ‘It’s just a mail drop, essentially’, said Marc B. Wolpow, who worked with Romney for nine years at Bain Capital and who set up Sankaty Ltd. in October 1997 without ever visiting Bermuda. ‘There’s no one doing any work down there other than lawyers’.”

Investing through what’s known as a blocker corporation in Bermuda protects tax-exempt American institutions, such as pension plans, hospitals and university endowments, from paying a 35 percent tax on what the Internal Revenue Service calls “unrelated business income” from domestic hedge funds that invest in debt, experts say.

Kevin Madden, Mr. Romney’s campaign spokesman, said there was nothing improper about either the Bermuda arrangement or his investment in the Cayman fund.

“I would disagree that these could be described as tax loopholes,” he said. “These are perfectly normal and perfectly legal arrangements that American companies put together to be successful in the market.”

Mr. Romney is the wealthiest candidate running for president, with a personal fortune of up to $250 million, according to financial disclosure forms he filed in August.

Mr. Romney was elected Governor of Massachusetts in 2002, but did not seek reelection in 2006.

He ran for the Republican nomination in the 2008 US presidential election, winning several primaries and caucuses, but eventually lost the nomination to John McCain.

Earlier this year he announced that he would seek the 2012 Republican Presidential nomination. Political observers and public opinion polls consistently place him among the front-runners in a race which also includes former Speaker of the House of Representatives Newt Gingrich, maverick Congressman Ron Paul and one-time Utah Governor Jon Huntsman.

So Romney’s company did what most people do to protect themselves from taxes if they have the money for it. And this is news why?

this is news because he’s RUNNING FOR PRESIDENT maybe?

Information about Bain Capital came out in 2008. It is not new. There is a transcript from the television show on the Internet. If I recall correctly, it was a discussion about offshore tax shelters and such and Bain Capital and Mitt Romney came up.

There are always going to be more favourable tax jurisdictions than the US. Perhaps they should compete instead of pushing businesses and tax income away…

Why is it ok for the late Ted Kennedy and MANY democRATS to be able to put THEIR money in these vehicles but when a republican does it, all of a sudden it is not too ok or let’s get the proverbial microscope and see if it is ILLEGAL.

you’re kidding, right?

Regarding overseas investments,I have a question regarding the import of US currency..customs forms indicate when entering the US that you must declare on that form if you are bringing in more than $10,000.00 US dollars.My question is,if someone enters the US with 156 US gold dollar coins,is the currency value $156.00 only? Where in actual fact the gold coins are worth just under $250,000.00.Would you consider this a loophole? This question is asked due to a recent court case in Bermuda.

I’ve asked about that before was told by US imigration that its “$10,000 or more or its cash equivalent”…

Do any of you know what is going on in the rest of the world? There are people protesting all over about the rich avoiding taxes! The political mood has changed from tax avoidance being acceptable to closing as many loopholes as possible. WAKE UP BErmuda!

we discussed this a few weeks ago when the academic whose name escapes me brought up the issue…..The fact is the the US tax code allows you to take advantage of it to pay the least amount of tax…..the fact is that Bermuda allows companies to eastablish a name plate with a law firm and use that “loop hole” in the tax code to avoid tax……Bermuda gets little in the way of revenue from the nameplates other than some fees at a law firm or accountant and the US Company legally pays hundreds of millions less in tax….Google save 3 billion and we get $30k and a billion of bad press….thats how it goes…..nothing illegal ……yet

navin, problem is the primary reason that IB is here is tax [I guarantee that of the top ten reasons that companies incorporate in Bermuda at least seven of them relate to tax].

But if you want to stop “name plate” companies (i.e., those with no staff) you’ve got to be willing to shut down the captive industry. Very few of those companies have any staff of their own and rely entirely on management companies so all that Bermuda sees from them is a few thousand dollars in management and government fees every year.

Good Marketing on the West Coast! This should help Tourism. How much did we pay for that article?