Column: ‘At Beginning Of A Digital Revolution’

[Written by Chris Garrod]

“Do you accept crypto?”

I work in the services industry and it was an email from a client. I immediately responded “no, sorry” as I knew my firm didn’t. But we should.

It won’t be very long before the words “Do You Accept Crypto?” will be so common place, they will be as common as, “Do you take cards?”

There are the statements from others: They are speculative investments. Cryptocurrency is dangerous and one should beware of snake oil sales salesmen when buying it. They offer significant risk of loss. Most initial coin offerings fail. It is all one big pyramid scheme and a scam.

Speculation

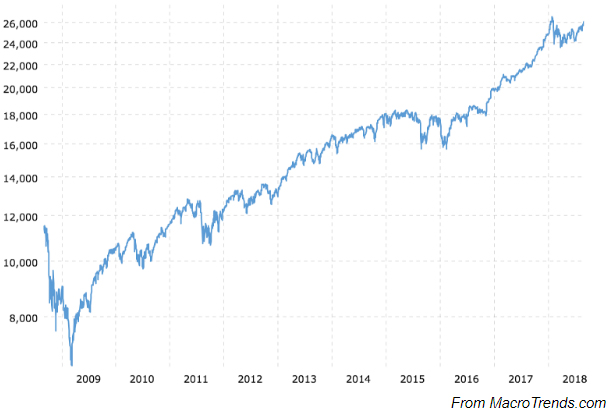

The chart below. The Dow Jones over the past 10 years. The Lehman Brothers scandal and the markets going into a free fall in 2008. A gradual rise over the years with various hiccups along the way since.

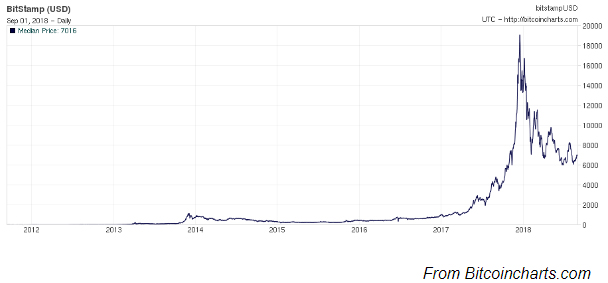

And then there is Bitcoin, the very first blockchain platform. A virtual currency which was only created in 2008 and only started trading in earnest in 2017. It is so nascent, no one can really predict or state with certainty that it is “speculative.” In fact, the crash it experienced in late 2017/early 2018 was in many ways mirrored by the stock markets.

Tulips?

There was a tulip bubble in the Netherlands in the 1630’s which is constantly used as an example of Bitcoin. Jamie Dimon of JP Morgan stating that “Bitcoin is worse than tulip bulbs”. Warren Buffet likening Bitcoin to “rat poison”.

The tulip was a new flower to Europe at the time and due to the fairly small supply being produced by the Dutch Republic at the time, the demand in the tulips led to “surge pricing” – similar to the pricing you may experience when trying to get an Uber and the traffic is busy. Basically, the price of tulips sky rocketed for a period of time. That led to people at the time investing in tulip bulbs, believing they would remain the next “big thing” across Europe. It created an investment bubble which then burst in early 1637. People lost money as a result.

Volatility

Yes, cryptocurrency is volatile. It is a new, digital virtual currency, and if you buy it, whether it is Bitcoin, some other coin or a digital token, you need to know what you are buying and the risk behind it.

Buying fiat is also dangerous. It is subject to crashes, to ups and downs in the market, just as crypto is.

Failure

Why do more ICO’s seem to fail as reported everywhere under the sun?

This is brand new technology. People are buying it because of the hype behind it. It is cool, techie, and sexy. But people also don’t understand what they are buying. And it is incredibly new. There are so many experimental ICO’s or digital token raises currently in progress, as start ups attempt to raise capital to fund their businesses. It goes without saying, the number of failures in this space is going to be high, simply because there are so many ICO’s. If in February 2018, a study by news.bitcoin.com reported that 46 per cent of ICO’s failed in 2017 despite raising over $104 million, then that is not surprising. That figure is going to increase in 2018.

But according to a PwC report, between January and May of 2018, ICO volume is twice as much as it was during the entire year of 2017. According to PwC, between January and May of 2018, ICO volume is twice as much as it was during the entire year of 2017. $6.3 Billion was raised from ICOs in 2017. By June of 2017, $13.7 had been raised. The increase is staggering.

A Pyramid Scheme?

And finally, I am tired of people likening crypto to some kind of “pyramid scheme”.

Per Wikipedia: “A pyramid scheme [commonly known as pyramid scams] is a business model that recruits members via a promise of payments or services for enrolling others into the scheme, rather than supplying investments or sale of products or services. As recruiting multiplies, recruiting becomes quickly impossible, and most members are unable to profit; as such, pyramid schemes are unsustainable and often illegal.”

To try to draw someone into the illusion that crypto is a pyramid scheme is also an illusion. Digital token issuers are raising capital to fund businesses. People who are buying Bitcoin or Ripple are investing in an something which has risk. Whenever you buy any form of investment, it has risk. The fact that ICO’s fail, some have been the subject of fraud [which fiat is also subject to], is something which people have to accept: Bitcoin, the very first cryptocurrency, has only been in existence for 9 years. Ripple, Dash, Ethereum following Bitcoin and others within a far less time span.

Are there dangers? Yes. But this isn’t a Californian gold rush. Digital transformation is turning its world on its head and the acceptance of digital currency over time will …. take time, albeit what appears to be at an increasingly rapid pace. A rush? No. Tulips? No. Dangerous and therefore speculative? Possibly, if you are naïve and invest in something you don’t take the time to research.

So is hitching a ride on the crypto bandwagon worth it? Yes, because we are at the beginning of a digital revolution, of innovation, the rise of blockchain. So long as you are willing to accept and understand the risks involved, prepare yourself for what could be an amazing ride.

[NB: Investing in cryptocurrency or digital tokens is indeed speculative. Anyone considering it should be prepared to lose their entire investment. Note also I don't own any Bitcoin... yet.]

- Chris Garrod is a partner at Conyers Dill & Pearman with opinions on digital transformation including blockchain, crypto, insurtech, AI, legaltech, IoT and fintech.

20 Most Recent Opinion Columns

- 04 Sep: Column: Mathias On Economy, Taxes & Policies

- 02 Sep: Environment Column: Why You Can Smell Rain

- 27 Aug: Column: Cayman Conference, Population, Budget

- 24 Aug: Column: Project Will Create Opportunities

- 24 Aug: Column: Improving Culture Of Education System

- 19 Aug: Column: Govt Revenue Up & Spending Down

- 16 Aug: Column: Credit Card Debt Getting Out Of Control?

- 16 Aug: Column: ‘The Irma Diaries’ Author Interview

- 15 Aug: Column: Progress Towards A Living Wage

- 12 Aug: Column: BPSU Marks UN International Youth Day

- 04 Aug: Column: Build On Foundation Of Past Pioneers

- 27 Jul: Column: Questions, Answers, Arbitrade & More

- 26 Jul: Column: Famous On History & Caribbean Ties

- 20 Jul: Column: Education And Independent Thinking

- 12 Jul: Column: Security Of Our Energy Supply Part III

- 10 Jul: ‘Potential Of Ruining, Rather Than Enhancing’

- 09 Jul: ‘Not Commercialisation, It’s Entrepreneurialism’

- 08 Jul: Carla Seely Column: Halfway Through The Year

- 01 Jul: Column: Impact And Treatment Of Obesity

- 29 Jun: Column: Reflecting On Visit To Cayman Islands

Opinion columns reflect the views of the writer, and not those of Bernews Ltd. To submit an Opinion Column/Letter to the Editor, please email info@bernews.com. Bernews welcomes submissions, and while there are no length restrictions, all columns must be signed by the writer’s real name.

-

Read More About

Category: All, Business, technology

This: It is so nascent, no one can really predict or state with certainty that it is “speculative.

Instead of rushing in therefore, should we not wait?

Lol, if you look at the bottom of the column he says crypto is “ indeed speculative”. Lawyers aren’t very good at propaganda.

I think comparing any digital coin to stocks is misleading . It’s gives the impression that crypto trades on major stock exchanges when it doesn’t . In fact the sec won’t allow bitcoin on to the nyse mainly due to fears of manipulation and general corruption. That says a lot considering all the scams and schemes that have come before.