Column: Growth In GDP Is A ‘Dead Cat Bounce”

[Opinion column written by Larry Burchall]

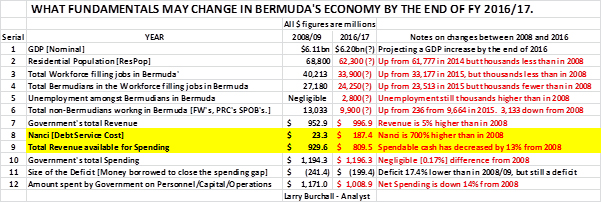

- Nominal Gross Domestic Product [GDP] – Upticking? Possibly rising to and past the $6.11bn level reached at GDP peak in 2008?

- ResPop – 6,500 lower and 9% down from 2008; reflecting a possible slowdown in the loss of Bermudians and the addition of ACBDA sailors and others coming to live and operate businesses from here.

- Workforce – An uptick from the 33,177 reported for 2015? But still over 6,300 lower and 16% down from the 40,213 people filling jobs in 2008.

- Bermudians in the Workforce – For Bermudians working in Bermuda, a 700 uptick from 2015? But still 10% down from 2008.

- Unemployment – Around 700 currently unemployed Bermudians sucked back into employment? But in 2016, Bermudians will still experience exceptionally – for Bermuda – high unemployment, versus negligible [less than 2%?] unemployment in 2008.

- Non-Bermudians employed – An increase in tandem with the increase in Bermudian employment; but over 3,000 fewer than in 2008 and before.

- Government’s total Revenue – Projected at $996.9m. $44m and 4.6% higher than in 2008.

- Nanci – At $187.4m in 2016/17, higher than in 2008 [$23.3m]. Therefore, in 2016, fewer dollars [$164.1m less] are available to spend on Personnel, Operations, and Capital.

- Government’s total planned spending – No significant difference. However, price and cost increases, mean that Government’s buying power is much lower [15% lower?] than in 2008.

- Government’s total spending on Nanci, Personnel, Operations, and Capital – The $2 million dollar increase between 2008 and 2016 is marginal. In those eight years, price and cost changes make the 2016 dollar’s buying power much lower [15% lower] than in 2008.

- The Deficit – The difference between Government’s total revenue and total spending. Lower than in 2008. An absolute improvement.

- Actual Government Spending in Bermuda in 2016/17 on Personnel, Operations, Capital [$1,008.9m] is $162.1m less [14% less] than in 2008 [$1,171.0m]. However, because of price and cost increases since 2008, buying power is even lower [15% lower?].

Those twelve items in that table define what those inelegant but sometimes oh so descriptive Wall Street people, call a ‘dead cat bounce’. Wall Street’ers say that even a dead cat will bounce if you drop it from a great enough height.

After a long six year [2009 – 2014] economic decline, any marginal increase will look like economic growth – a bounce.

The 2015 National Economic Report on Bermuda [NERB2015] reports that Bermuda had GDP of $5.874 billion in 2014. NERB2015 suggests 1.5% – 2.5% GDP growth in 2015. That would see GDP rising to $5.962bn – $6.021bn in 2015.

NERB2015 suggests 2.0% – 3.0% growth in 2016. Three percent growth would take GDP to the $6.14bn – $6.20bn level. This is higher than in 2008 when nominal GDP peaked at $6.11bn. If $6.20bn is reached, overall two year growth would be 5.5%.

Fanfares, champagne, medals all round? That would be premature.

Regaining or surpassing the nominal $6.11bn GDP of 2008 with all those other factors in place means that Bermuda is experiencing a ‘dead cat bounce’. That’s because growth has occurred only in the numeric value of line items that affect the technical economic measurements used to calculate nominal GDP.

The fundamental factors that actually pull Bermuda’s GDP growth down or drive Bermuda’s GDP up are:-

- Increases in Government’s net spending in Bermuda.

- On-Island consumer demand [direct factor of ResPop].

- Business and Tourist spending in Bermuda.

- Increases in the total number of filled jobs.

In 2016, the growth in nominal GDP that might take it up to and perhaps past $6.11bn will be caused, principally, by continued global and local changes in prices [increases] and some lowering of costs for basics [principally fuel and energy].

The table shows and shows clearly, that the fundamentals are not bouncing up. So beware of people trumpeting about growth in GDP. What they are celebrating is a ‘dead cat bounce’.

You really won’t feel much of this nominal GDP growth because the pool of unemployed Bermudians will remain large. Your pay – hit by more increases in Payroll Tax, Health Insurance, and a lot of other just imposed small tax and fee rises – will shrink a tad more. Food prices will continue to creep up, and you’re best off giving up smoking and drinking.

The 2009 – 2014 recession is only over, technically. The aggregated facts show that Bermuda is currently experiencing a ‘dead cat bounce’.

For real GDP growth – a ‘rubber ball bounce’ – Bermuda needs real growth in ResPop; real growth in the workforce; a real increase in net Government spending in Bermuda; and a real and big ramp-up in overall consumer demand.

Otherwise we’re just chucking that poor dead cat.

[I apologize to all cat lovers. I did not invent the phrase. Blame for that goes to the guys on Wall Street.]

- Larry Burchall

20 Most Recent Opinion Columns

- 06 Mar: Column: Addressing Deaths On Bermuda Roads

- 06 Mar: Column: Highlights Of America’s Cup Report

- 04 Mar: Column: “Pathways Is The Right Thing To Do”

- 04 Mar: Column: Chris Famous On Immigration Policy

- 04 Mar: Column: Open Letter From Fubler To MP Brown

- 03 Mar: Column: Shared Vision For Our Community

- 02 Mar: Column: Pull Back Proposal Until Next Election

- 02 Mar: Column: “Our Population Is Shrinking Rapidly”

- 25 Feb: Column: Fundamental Themes Of 2016 Budget

- 25 Feb: Column: Most Important Statements In Budget

- 24 Feb: Lifestyle Column: “The 13 Mile End Goal”

- 24 Feb: Column: Attorney-General On Pathway To Status

- 24 Feb: Column: Decrease Of Bermudians Filling Jobs

- 23 Feb: Column: Benefits Of ‘Pathways to Status’ Initiative

- 23 Feb: Column: Person Holding Opinion Is A “Bigot”?

- 23 Feb: Column: Do Not Set ‘Dangerous’ Precedent

- 23 Feb: Column: Govt Must Engage In Real Consultation

- 21 Feb: Column: Key Is Choosing Growth Going Forward

- 21 Feb: Column: ‘Lay Out The Facts’ On Labour Relations

- 21 Feb: Column: “Looking Under The Hood” At Budget

Opinion columns reflect the views of the writer, and not those of Bernews Ltd. To submit an Opinion Column/Letter to the Editor, please email info@bernews.com. Bernews welcomes submissions, and while there are no length restrictions, all columns must be signed by the writer’s real name.

-

are you seriously suggesting that we need to increase Government spending to revive our economy?

that idiotic crap is what put this Island billions in debt in the first place.

not three weeks ago you were complaining that Govt. overspending has not improved.

Hi George,

Perhaps these further notes will help you.

Three things can push GDP up now. One – real growth in ResPop . Two – real growth in number of filled jobs. Three – real increase in consumer demand. These three will drive GDP up and I make that point very clearly.

Net GovSpen has been declining since 2010. That has been and will continue to be a drag or pull-down on GDP growth, thus acting against the push-up effect of the first three.

Right now, this administration is trying to manage by increasing its uptake from GDP – planning to go from taxes eating up 16% of GDP in 2013 to taxes eating up 18% of GDP in 2018. That tax rate increase is to enable GovSpen to stay where it is without cutting costs. That tax rate increase acts as a pull-down or drag on GDP growth.

The admittedly nasty solution? Hold total GovSpen at a fixed level, cut costs, and do not increase tax rate uptake.

The effect will be that net GovSpen and tax rate uptake stays at 16% of GDP and net GovSpen around $900m in overall GovSpen on Personnel, Operations, and Capital.

Total GovSpen would hold at [$900m GovRev plus Nanci at $190m = $1,090m].

Holding at that level means cutting costs [particularly Personnel] and trying to have minimal impact – certainly no drag – on the private sector’s efforts to ‘grow’ the economy by adding ResPop, adding jobs, and adding to consumer demand.

Complex, I know. But that’s it in simplest terms.

Bermuda needs a rubber ball bounce.

Larry.

Thank you for taking the time to respond to me. I respect that, and appreciate your clarifications.

I could have sworn your article said:

“For real GDP growth – a ‘rubber ball bounce’ – Bermuda needs real growth in ResPop; real growth in the workforce; A REAL INCREASE IN NET GOVERNMENT SPENDING IN BERMUDA; and a real and big ramp-up in overall consumer demand.”

but your clarifications read:

“Three things can push GDP up now. One – real growth in ResPop . Two – real growth in number of filled jobs. Three – real increase in consumer demand. These three will drive GDP up and I make that point very clearly.”

What a relief, as you and I both know that artificially boosting consumer demand by increasing Government spending is not the solution to reviving the economy, shedding our debt, and moving Bermuda forwards from the mess it is in. In fact, I’m glad we agree that:

“The admittedly nasty solution? Hold total GovSpen at a fixed level, cut costs, and do not increase tax rate uptake.”

Many of us think is is even necessary to reduce Government spending in drastic ways, such as trimming dead weight from the workforce. You and I both know that Corporate Bermuda has been trimming the fat for years, laying off those who didn’t pull their weight. That is how corporations survive, and that is how governments survive. I believe we are in agreement on this:

“Holding at that level means CUTTING COSTS [PARTICULARLY PERSONNEL] and trying to have minimal impact – certainly no drag – on the private sector’s efforts to ‘grow’ the economy by adding ResPop, adding jobs, and adding to consumer demand.”

However, you and I also both know that our beloved unions would rather riot and destroy our Island than trim the fat or pull their weight. Complex, I know. But that’s it in simplest terms.

peace.

george